In this episode we explore an exciting development that could potentially boost demand for natural gas. Let’s dive into how converting natural gas to liquid fuels might create new demand and opportunities. Currently, the United States is experiencing a natural gas boom. We have so much gas that in some areas, prices have even gone negative. This oversupply has led to natural gas trading at a price that is much lower than its energy content would suggest. In fact, This price disparity could revolutionize the way we traditionally use natural gas and has started to create opportunities for innovative solutions.

Be sure to also subscribe on Apple Podcasts via the link above and please leave us an honest rating and review. We read every one of them and sincerely appreciate any feedback you have. To ask us a question to be featured on an upcoming episode, please leave a comment below or send an email to feedback@mineralrightspodcast.com.

The Peak Oil Myth

For decades, the “peak oil” hypothesis has loomed over the energy industry, warning of shortages and skyrocketing prices as the world’s finite oil reserves are depleted. However, these dire predictions have consistently underestimated the relentless pace of technological innovation in the sector. Time and again, methods and resources once deemed too costly or impractical have been transformed into economically viable reserves through human ingenuity.

The shale revolution in the United States serves as a prime example of this phenomenon. A little over a decade ago, the combination of hydraulic fracturing and horizontal drilling techniques unlocked vast reserves of oil and natural gas trapped in shale formations, upending conventional wisdom about dwindling supplies. What was once considered an expensive novelty has now become a major contributor to global energy markets, allowing the U.S. to smash production records year after year.

In fact, we talk about this in MRP 245: The Role of Oil & Gas in Our Energy Future – The Mineral Rights Podcast and how the oil and gas reserves estimates have more than doubled since 1980 as we discover new reservoirs, including our ability to unlock the oil & gas in shale formations.

That said, even if we top out our oil reserves, our plentiful natural gas reserves can actually fill in the gap due to chemical processes discovered more than 100 years ago.

The Power of Chemical Engineering

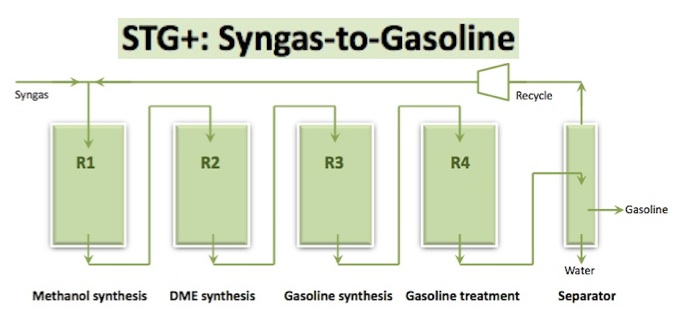

At the core of the natural gas revolution lies the ingenuity of chemists and chemical engineers, who have developed sophisticated processes to transform this abundant resource into a versatile replacement for traditional crude oil products. Through a technology called Fischer-Tropsch synthesis, natural gas can be converted into a wide range of refined hydrocarbons, including diesel, jet fuel, and even gasoline.

Fischer-Tropsch (FT) synthesis is a process that can turn syngas into fuels and other chemical products. This method was invented by Franz Fischer and Hans Tropsch in the 1920s. During the Second World War, it helped Germany produce fuel. Later, South Africa used this process to meet its fuel needs during its isolation in the apartheid era.

Since then, the technology has been improved, including changes to the catalyst and reactor design. Depending on what the syngas comes from, people might refer to the technology as coal-to-liquids (CTL) or gas-to-liquids (GTL).

At facilities like Shell’s Pearl Gas-to-Liquids (GTL) plant in Qatar, natural gas is first reformed into synthesis gas (a mixture of carbon monoxide and hydrogen), which is then passed over a specialized catalyst to produce long-chain hydrocarbons. These hydrocarbons can then be finished into various products using traditional refinery technology.

And, this process can also be used to convert coal to hydrocarbon liquids. We mentioned South Africa using this process to convert its plentiful coal reserves into gasoline and other refined products to make up for the fact that they lack oil & gas reserves and were isolated due to international sanctions and embargoes impressed against that country due to their apartheid racial and ethnic segregation policies which kept the white minority in power.

Well-known examples of CTL plants include Sasol’s Sasolburg I and II plants. We visited one of their plants outside of Johannesburg South Africa on a trip that we took in college as part of an honors program I was in at the Colorado School of Mines.

Molecular Flexibility: The New Norm

As chemists continue to blur the lines between different hydrocarbon molecules, a paradigm shift is underway: the traditional distinction between “oil” and “natural gas” is becoming increasingly blurred. Through processes like Fischer-Tropsch synthesis, natural gas can be transformed into molecular equivalents of traditional refined products, effectively expanding the definition of “oil” to include any hydrocarbon that finds its way into a refinery.

The theory is that over time this should mean that natural gas trades at roughly the same price from an energy content standpoint. Once natural gas and crude oil become more interchangeable in terms of being able to produce refined products, this molecular flexibility should act as a powerful deflationary force in the energy markets. As natural gas becomes a viable substitute for crude oil products, the two resources will inevitably trade at roughly the same price, correcting for energy content and transportation costs.

This process provides nearly limitless flexibility to leverage surplus natural gas which currently trades at a discount relative to its energy content and use it as a substitute for crude oil to produce refined products and chemical feedstocks. This should spur development of facilities to utilize natural gas to produce refined products like gasoline. This would mean that all types of hydrocarbons would be priced relative to oil and they should all trade within a narrow range, dictated by the laws of supply and demand.

Specifically, the energy content of 1,000 cubic foot of natural gas is around 1,036,000 Btu’s. Comparing this to crude oil, 1 barrel of crude oil produced in the US averages 5,684,000 Btu’s. Rounding that up to 6 million Btu’s, this means that 6 mcf of natural gas is the equivalent to 1 barrel of crude oil. This is something that is referred to as BOE6 (Barrel of Oil Equivalent).

The Term BOE is used to describe the amount of energy that is equivalent to that of one barrel of crude oil. Many oil & gas operators report production on a BOE basis. In other words, to describe natural gas production and natural gas liquids production in terms of the energy content in a barrel of crude oil.

Based on this, natural gas should trade at roughly 1/6th the price of crude oil. Crude oil is currently trading at around $75 per barrel so based on energy content alone, natural gas should be trading closer to $12.50/mcf!

The Great Arbitrage Opportunity

The current disparity between domestic natural gas prices and crude oil prices in North America presents an unprecedented arbitrage opportunity, one that is already spurring a quiet revolution in the energy industry. With oil trading at multiples of the price of natural gas on an energy-equivalent basis, companies are seizing the chance to transition their operations to take advantage of this imbalance.

Companies like Liberty Energy, an innovative oil field services provider, are leading the charge. Liberty has launched a dedicated division, Liberty Power Innovations, to provide integrated natural gas solutions for remote operations. This includes everything from compressed natural gas (CNG) supply and field gas processing to well site fueling and logistics. The company is actively converting its fleet to run on natural gas, capitalizing on the significant cost savings and reduced emissions.

The Future of Fuel: Gas-to-Gasoline Pioneers

While converting natural gas into traditional refined products like diesel and jet fuel is already a commercial reality, the next frontier lies in the direct production of gasoline from natural gas. There are pilot projects being developed in the Permian Basin where plans are to build facilities capable of producing around 3,000 barrels per day of gasoline. The thought process is that by consuming associated natural gas from operations in the Permian Bas as feedstock, it can leverage the significant arbitrage opportunity there to convert cheap natural gas into valuable products like gasoline while at the same time mitigating flaring of this excess gas. Verde Clean Fuels, a subsidiary of Diamondback Energy, recently announced:

“Verde Clean Fuels, Inc. (NASDAQ: VGAS) (“Verde” or the “Company”) and Cottonmouth Ventures LLC, a subsidiary of Diamondback Energy (NASDAQ: FANG) (“Diamondback”), today announced that the parties have executed a Joint Development Agreement (“JDA”) for the proposed development, construction, and operation of a facility to produce commodity-grade gasoline utilizing associated natural gas feedstock supplied from Diamondback’s operations in the Permian Basin…”

While that particular project is still in the pilot phase, initiatives like these offer a glimpse into a future where natural gas could become a drop-in replacement for crude oil, mitigating supply concerns and price volatility. As the technology matures and more projects come online, the traditional boundaries between hydrocarbons could dissolve entirely, ushering in a new era of energy abundance.

Conclusion

As the world grapples with the dual challenges of energy security and sustainability, natural gas emerges as a game-changing solution. Its abundance, affordability, and versatility, combined with the ingenuity of chemists and engineers, make it the ultimate hydrocarbon equalizer – a resource capable of capping the price of crude oil and ensuring a smooth transition to a more diversified energy future.

While challenges remain, from developing the necessary infrastructure to addressing environmental concerns, the convergence of market forces and technological advancements is paving the way for a world where every hydrocarbon is truly oil, and energy abundance is within reach. As the boundaries between different hydrocarbon molecules continue to blur, the era of peak cheap oil may well be a myth consigned to the annals of history.

Resources Mentioned in this Episode

- 10.2. Fischer-Tropsch Synthesis | netl.doe.gov

- Sasol’s Sasolburg I and II plants

- Energy units and calculators explained – U.S. Energy Information Administration (EIA)

- Barrel of Oil Equivalent (BOE): Definition and How to Calculate

- Verde Clean Fuels, Inc. and Cottonmouth Ventures LLC Announce Joint Development Agreement for a Proposed Natural Gas-to-Gasoline Facility in Permian Basin

- MRP 245: The Role of Oil & Gas in Our Energy Future

Thanks for Listening!

To share your thoughts:

- Leave a comment or question below (we read each one and your question may be featured in a future episode)!

- Ask a question or leave us feedback via email.

To help out the show:

Click the Apple Podcasts Logo Above to leave us a rating & review. It really helps us reach those that need to hear this information and only takes a minute. We greatly appreciate it! Plus, you can get a shout out on a future episode!

Thanks again – until next time!