Natural gas currently trades at a massive discount to crude oil on an energy equivalence basis. While oil sits at around $70 per barrel, natural gas trades at around $3 per thousand cubic feet (mcf) – yet based on energy content alone, it should be closer to $12.50/mcf. This pricing disconnect is creating opportunities as two major new demand sources emerge: AI data centers requiring reliable power and innovative gas-to-liquid technologies that can convert natural gas directly into gasoline and other fuels. Listen to hear if $12.50/mcf natural gas might be right around the corner.

Be sure to also subscribe on Apple Podcasts via the link above and please leave us an honest rating and review. We read every one of them and sincerely appreciate any feedback you have. To ask us a question to be featured on an upcoming episode, please leave a comment below or send an email to feedback@mineralrightspodcast.com.

Why Natural Gas Could Be Severely Undervalued: The Case for $12.50/mcf

Natural gas prices have remained surprisingly low, hovering around $2.50 per thousand cubic feet (mcf) for most of 2024 despite growing demand and new use cases. However, when comparing the energy content of natural gas to crude oil, there’s a compelling argument that natural gas should be trading much higher – around $12.50 per mcf. Here’s why this price disparity exists and what factors could drive prices higher in the future.

The Energy Content Equation

The math behind the $12.50 price target is straightforward: 6,000 cubic feet of natural gas contains roughly the same energy content as one barrel of oil. With oil trading at around $75 per barrel, this suggests natural gas should be closer to $12.50 per mcf based on energy equivalency alone. This significant gap between current prices and energy-equivalent value represents a potential arbitrage opportunity.

Why Prices Are Currently Depressed

The current low prices can be attributed primarily to a supply glut created by several factors:

- The shale boom, which combined horizontal drilling and hydraulic fracturing to unlock vast new gas reserves

- Significant associated gas production from oil wells in the Permian Basin

- Major production increases from formations like the Marcellus Shale and Haynesville Shale

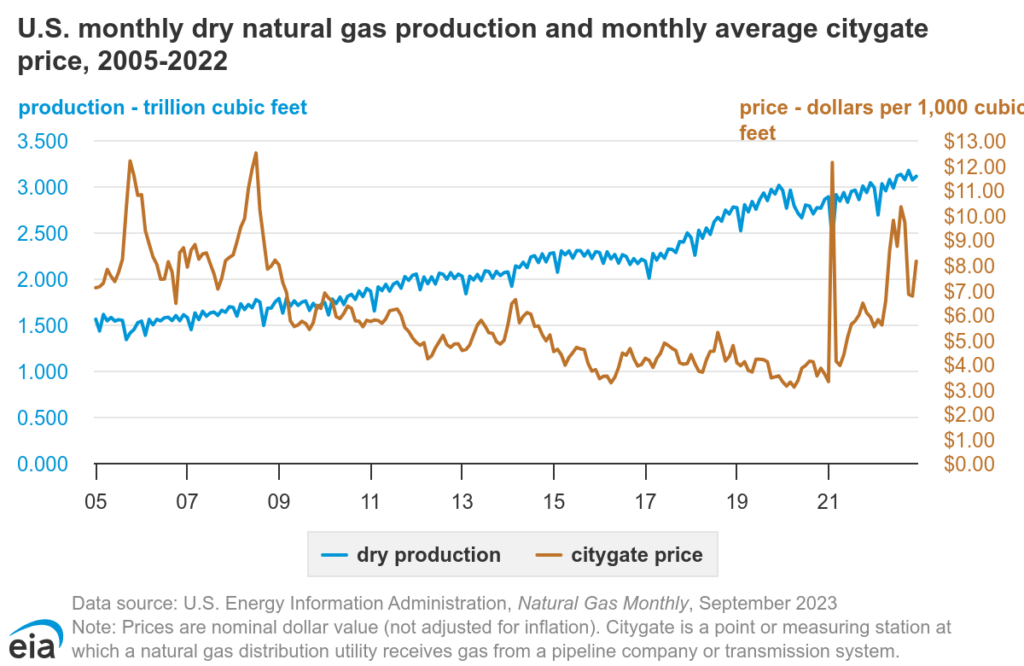

Before the shale revolution, the United States consumed more natural gas than we produced domestically. This started to change in 2006 and in 2017 we became a net gas exporter (natural gas production exceeded consumption).

The significant increase in natural gas production (supply) seen since 2006 has resulted in a general downward trend in retail natural gas prices as evidenced by the average citygate price shown in the chart below.

Since 2022, geopolitical forces have eased and natural gas prices have come down significantly. As of the date when this episode was published, the Henry Hub spot price for natural gas trades at around $3.00 per MMBtu, or around 1/23rd of the price of crude oil (West Texas Intermediate Crude is around $70 per barrel).

Emerging Demand Drivers

Several emerging trends could help close the price gap by driving increased natural gas demand:

The AI Data Center Boom

Artificial intelligence and data centers represent a massive new source of energy demand. Industry projections suggest U.S. peak electricity demand could increase by 70 gigawatts by 2030, largely driven by data centers. This could create additional natural gas demand of around 9 billion cubic feet per day – equivalent to an entirely new set of LNG export projects.

Major tech companies are already making moves to secure reliable power sources:

- Oracle is investing $6.5 billion in Malaysia (world’s fifth-largest LNG exporter) for cloud services

- Elon Musk’s AI company is installing natural gas turbines directly at their Memphis data center

- Tech companies are increasingly locating data centers near power sources, including natural gas-rich regions

Alternative Uses for Natural Gas

Beyond power generation, new technologies could create additional demand for natural gas:

- Fischer-Tropsch synthesis: This proven process can convert natural gas into synthetic gasoline. Companies like Verde Clean Fuels and Diamondback Energy are already piloting facilities that could produce 3,000 barrels per day of gasoline from natural gas.

- Industrial applications: Many industrial facilities are capable of switching between fuel sources, and extremely low natural gas prices make it an attractive option.

Why This Matters for Mineral Rights Owners

If natural gas prices move closer to their energy-equivalent value, it could trigger:

- Increased drilling activity in gas-rich formations

- Higher royalty payments for mineral rights owners

- Renewed development in areas where low prices have discouraged production

Environmental and Energy Security Benefits

The potential increased use of natural gas offers several advantages:

- Cleaner burning than coal for power generation

- Enhanced energy security through domestic production

- Flexible fuel source that can support renewable energy transition

- Reliable power source for critical infrastructure like data centers

While current market conditions keep natural gas prices depressed, the combination of growing demand from data centers, industrial users, and new technologies, along with the fundamental energy content disparity with oil, suggests prices could move significantly higher in the future. While nuclear power might be seen as the ultimate solution to reliable low-carbon energy, there is no way that it will be able to satiate the demand for electricity presented by the AI revolution. For mineral rights owners with natural gas interests, patience may prove valuable as these market dynamics play out.

Disclaimer

This content is for informational purposes only and should not be construed as legal, tax, investment, financial, or other advice. Nothing contained on this website constitutes a solicitation, recommendation, endorsement, or offer to buy or sell any securities or other financial instruments. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or content on this website.

Resources Mentioned in this Episode

- Factors affecting natural gas prices – U.S. Energy Information Administration (EIA)

- AI proliferation depends on Permian Basin gas: Chevron CEO | S&P Global Commodity Insights

- CERAWEEK: AI-powered gas demand growth more promising than LNG, says EQT’s Rice | S&P Global Commodity Insights

- 10.2. Fischer-Tropsch Synthesis | netl.doe.gov

- Energy units and calculators explained – U.S. Energy Information Administration (EIA)

- Barrel of Oil Equivalent (BOE): Definition and How to Calculate

- MRP 245: The Role of Oil & Gas in Our Energy Future

- MRP 252: Turning Natural Gas to Gasoline

Thanks for Listening!

To share your thoughts:

- Leave a comment or question below (we read each one and your question may be featured in a future episode)!

- Ask a question or leave us feedback via email.

To help out the show:

Click the Apple Podcasts Logo Above to leave us a rating & review. It really helps us reach those that need to hear this information and only takes a minute. We greatly appreciate it! Plus, you can get a shout out on a future episode!

Thanks again – until next time!