These minerals might sound exotic, but they’re increasingly vital to modern life and global geopolitics. As the United States seeks new sources of these critical materials—including a potential deal with Ukraine that’s making headlines—mineral rights owners across America need to understand what the “rare earth boom” could mean for their own properties.

We cover three main themes:

- What rare earth elements are and why they’ve become so valuable in the modern economy.

- The geopolitics of rare earths, including the developing U.S.-Ukraine minerals deal and what it means for domestic mining.

- How mineral rights owners can protect and potentially profit from rare earth deposits on their properties.

Be sure to also subscribe on Apple Podcasts via the link above and please leave us an honest rating and review. We read every one of them and sincerely appreciate any feedback you have. To ask us a question to be featured on an upcoming episode, please leave a comment below or send an email to feedback@mineralrightspodcast.com.

Part 1: Rare Earth Elements – Not So Rare, Incredibly Vital

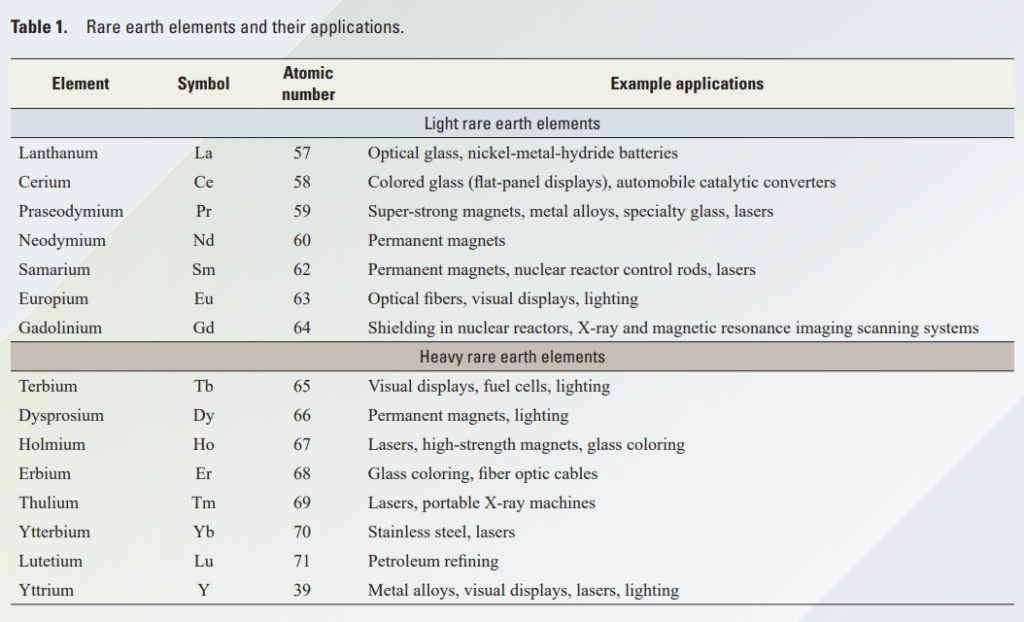

Despite their name, rare earth elements aren’t actually that rare in the Earth’s crust. What makes them “rare” is finding them in concentrations high enough to mine economically. There are 17 elements in this group, including metals with exotic names like neodymium, dysprosium, and yttrium:

What makes these elements special is their unique properties. They’re critical components in technologies that define modern life. Your smartphone contains several rare earth elements. The magnets in electric vehicle motors and wind turbines rely heavily on neodymium. Military defense systems, from guided missiles to radar systems, depend on rare earths. Even the green energy movement we’re witnessing globally relies on these elements for batteries, motors, and generators.

The rare earth market is projected to grow from about $5.3 billion in 2021 to over $9.6 billion by 2026, according to market research. And those figures may be conservative given the push in many countries towards electric vehicles and renewable energy technologies.

Let’s break down some specific applications:

- Neodymium and praseodymium are essential for making powerful permanent magnets used in electric vehicles and wind turbines

- Lanthanum is used in catalytic converters and hybrid car batteries

- Europium and yttrium provide the red color in televisions and computer screens

- Cerium is used in catalytic converters and for polishing precision glass

These elements often occur together in deposits, but each has its own unique applications. And as technology advances, we keep finding new uses for them.

Part 2: Geopolitics of Rare Earths – U.S., China, and Ukraine

“From the mid-1960s to the early 1990s, the United States was the world’s largest REE-producing country, with production coming entirely from the Mountain Pass mine in southeastern California (figs. 3 and 4). In the late 1980s, China began mining their in-country REE deposits, processing their ore and extracting and separating the individual REEs for use in products, which they also manufactured. China quickly gained control of global REE production, providing 95 percent of the global market of processed REE by 2011 (fig. 5). Between 2011 and 2017, China produced approximately 84 percent of the world’s REEs, followed by Australia with about 8 percent of production (Gambogi, 2019). Within this period, the United States only produced REEs between 2012 and 2015, entirely from the Mountain Pass mine, which contributed only about 4 percent of the world REE supply”

Source: USGS Circular 1454, Rare Earth Element Mineral Deposits in the United States

The rare earth element market has been dominated by China for decades. Currently, China controls approximately 85% of the global rare earth processing capacity and produces about 70% of the world’s rare earth minerals. This dominance has created vulnerability in supply chains for everything from consumer electronics to military equipment.

The United States has recognized this vulnerability as a national security concern. In 2022, the Department of Defense invested in domestic rare earth processing capabilities, and the Inflation Reduction Act includes provisions to support domestic mineral development.

This brings us to Ukraine. Recent reports indicate that Ukraine has agreed to the outline of a major deal that would give the U.S. access to Ukraine’s mineral deposits. Ukraine has significant untapped rare earth reserves, estimated at about 5% of the world’s “critical raw materials,” including lithium, titanium, and graphite.

This deal represents more than just business—it’s geopolitics in action. For the U.S., access to Ukraine’s deposits helps reduce dependence on Chinese rare earths. For Ukraine, it provides much-needed investment in their mining sector and strengthens ties with the U.S. amid ongoing conflict with Russia.

What does this mean for U.S. mineral rights owners? Potentially, a lot:

First, increased interest in domestic rare earth production could spur exploration activities across U.S. properties with rare earth potential. This might mean more opportunities for mineral rights owners to lease or develop their resources.

Second, government initiatives to secure domestic supply chains might include incentives for rare earth development on private lands. This could include tax benefits, exploration subsidies, or streamlined permitting for rare earth projects.

Third, the U.S.-Ukraine deal might establish pricing benchmarks and market structures that could benefit domestic producers and, by extension, mineral rights owners.

However, there are challenges. Rare earth processing has environmental impacts that need careful management. Additionally, developing new mining operations takes time and substantial investment. The economics must make sense for producers to develop new deposits.

Part 3: Mineral Rights and Rare Earths – Protecting Your Assets

If you own mineral rights, particularly in states like California, Colorado, Wyoming, or Alaska, you might be sitting on valuable rare earth deposits without even knowing it. Unlike oil and gas, rare earth deposits aren’t as easily identified without geological surveys, and they haven’t historically been the focus of exploration.

What Mineral Rights Owners Should Consider

First, understand what you actually own. In the United States, unlike most countries, private citizens can own subsurface mineral rights. This is relatively unique globally and creates opportunities for landowners that don’t exist elsewhere. Check your deeds and chain of title to confirm that rare earth elements are included in your ownership. If the deed only mentions oil and gas or coal but not “other minerals”, you may not have rights to them.

Second, take advantage of free public resources to research your property’s potential. The U.S. Geological Survey provides extensive maps and reports on rare earth potential across the country. Their online Mineral Resources Data System is accessible to the public and can help you identify if your property is in an area with known rare earth occurrences. Your state’s geological survey office is another excellent resource—many offer free consultations and have detailed information about local mineral deposits. Check out the resources below for more information.

The USGS has identified numerous areas with potential rare earth deposits across the country, including:

- Mountain Pass, California, home to the only active rare earth mine in the United States

- Halleck Creek and the Bear Lodge Mountains in Wyoming

- Bokan Mountain in Alaska

- Various locations in Colorado, Idaho, and Nebraska

- The Iron Hill carbonatite complex in Colorado

- Elk Creek in Nebraska

- Mineral deposits in the Mojave Desert region

The USGS publication “Rare Earth Element Mineral Deposits in the United States” is available online and provides detailed maps showing potential deposit locations throughout the country. Your state’s department of natural resources or mining division may also maintain databases of mineral occurrences that you can access for free.

Leasing for Rare Earth Minerals

Third, be careful with leasing agreements. If companies approach you about exploration, ensure any agreement specifically addresses rare earth elements. The extraction processes for rare earths differ significantly from traditional oil and gas, so standard oil & gas lease language won’t apply. Think of the agreement more akin to other hard rock mineral leases.

Possible considerations with a Rare Earth Mineral Lease agreement:

- Specific royalty rates for rare earth elements, which might be measured based on the gross sales price of the mineral that is mined and sold or a dollar value per “long ton”.

- If you also own the surface rights, understand what environmental protection and restoration requirements might be included, as rare earth processing can involve toxic chemicals.

- As with “continuous operations” clauses in an oil and gas lease, consider minimum exploration and development commitments to prevent companies from sitting on your rights.

- Rare Earth mining opportunities often take much longer to explore and permit so the term of the lease will likely be a lot longer than the 2-5 year primary term we are used to seeing with an oil and gas lease.

Finally, stay informed about market trends and technological developments. The rare earth market is evolving rapidly, with prices fluctuating based on global supply, demand, and geopolitical factors. New extraction technologies might make previously uneconomical deposits viable in the future.

How are Rare Earth Elements Mined?

Rare earth elements aren’t actually rare in the Earth’s crust but are typically found scattered at low concentrations, making economical extraction challenging. The mining process involves:

- Open-pit mining: REEs are extracted by digging vast open pits in the ground, as seen at Mountain Pass mine in California which spans 800 meters across and up to 183 meters deep.

- Ore crushing and grinding: After extraction, the ore is mechanically processed to reduce particle size.

- Concentration: The ground rocks undergo chemical treatment to remove non-rare earth materials, resulting in concentrated rare earth oxide ore.

- Waste management: Some sites use “dry tailings” processes that squeeze water from waste material, forming a paste stored in lined pits on-site with water recycled back into the facility.

Processing and Separation

The challenging part of rare earth production comes after mining, in the separation and processing stages:

- Chemical separation: Due to their similar chemical properties, rare earths must be separated through complex, multi-stage chemical processes.

- Solvent extraction: Various solvents including sodium hydroxide and organic molecules called ligands are used to selectively bind to particular rare earth elements and extract them from the mixture.

- Inefficient process: Current methods require numerous extraction stages to achieve desired separation, making the process complex, expensive, and waste-generating.

- Supply chain challenges: Most separation and magnet manufacturing currently happens overseas, primarily in China. Companies like MP Materials are working to establish complete “mine to magnet” supply chains in the United States.

Environmental Impacts

The environmental consequences of rare earth mining and processing are significant:

- Habitat disruption: Mining operations disturb ecosystems and can lead to deforestation and desertification, as seen at China’s Bayan Obo mine.

- Toxic wastewater: Processing creates wastewater containing acids, heavy metals, and sometimes radioactive materials. At Mountain Pass, historical pipeline ruptures spilled wastewater containing radioactive thorium into the Ivanpah Dry Lake.

- Water pollution: Without proper containment, mine waste can contaminate groundwater and surface water. In Baotou, China, tailings containing radioactive materials, arsenic, and fluorine contaminated farmland and water supplies.

- Air pollution: Mining can produce toxic dust and fumes, causing health problems for nearby residents. In Baotou, residents reported symptoms including nausea, dizziness, and skin lesions.

- Radioactive concerns: While some rare earth deposits contain radioactive elements like thorium, experts note that radiation levels are often relatively low and sometimes exaggerated in public discourse.

Current Developments

The industry is working to address these environmental challenges:

- Research initiatives: The Department of Energy’s Critical Materials Institute is developing more efficient separation techniques and waste reduction methods.

- Alternative approaches: Scientists are exploring recycling rare earths from electronic waste and recovering them from coal waste to reduce the need for new mining.

- Industry improvements: Some companies are implementing more sustainable practices, such as water recycling and better waste containment systems.

Despite these improvements, the growing demand for rare earths in green technologies, smartphones, and other applications means that some level of mining will remain necessary for the foreseeable future, even as recycling efforts increase.

Conclusion and Actionable Takeaways (1 minute)

As we wrap up today’s episode, let’s summarize the key points for mineral rights owners:

Rare earth elements represent a growing opportunity as demand increases for technologies ranging from smartphones to electric vehicles to defense systems. If you own mineral rights, particularly in states with known rare earth potential, take time to understand what you own and explore the free public resources we’ve mentioned to research your property’s potential.

The changing geopolitical landscape, including the U.S.-Ukraine deal and efforts to reduce dependence on Chinese rare earths, creates a favorable environment for domestic rare earth development. This could translate into opportunities for mineral rights owners.

Resources to Research the Rare Earth potential of your mineral rights:

- U.S. Geological Survey (USGS) Maps and Reports on Rare Earth Potential:

- USGS Mineral Resources Data System (MRDS):

- Main Portal: https://mrdata.usgs.gov/

- MRDS Search Interface: https://mrdata.usgs.gov/mrds/

- USGS Publications on Rare Earth Elements:

- “Rare Earth Element Mineral Deposits in the United States”: https://pubs.usgs.gov/circ/1454/circ1454.pdf

- “The Principal Rare Earth Elements Deposits of the United States”: https://pubs.usgs.gov/sir/2010/5220/

- State Geological Survey Offices for States Mentioned in the Script:

- U.S. Bureau of Land Management (BLM) Mining Resources:

- Critical Minerals Institute:

- American Geosciences Institute Resources on Rare Earth Elements:

References

Here are the key statistics mentioned in this episode along with their sources:

- Rare earth market projection (growing from $5.3 billion in 2021 to over $9.6 billion by 2026):

- China controlling approximately 85% of global rare earth processing capacity:

- China producing about 70% of the world’s rare earth minerals:

- Ukraine having approximately 5% of the world’s “critical raw materials”:

- U.S. Department of Defense investments in domestic rare earth processing (2022):

- Location of notable rare earth deposits in the United States:

- Statement about U.S. being unique in allowing private ownership of mineral rights:

- Information on the Mountain Pass mine being the only active rare earth mine in the U.S.:

- USGS Mineral Resources Data System:

- USGS publication “Rare Earth Element Mineral Deposits in the United States”

- Rare earth mining may be key to our renewable energy future. But at what cost?

Thanks for Listening!

To share your thoughts:

- Leave a comment or question below (we read each one and your question may be featured in a future episode)!

- Ask a question or leave us feedback via email.

To help out the show:

Click the Apple Podcasts Logo Above to leave us a rating & review. It really helps us reach those that need to hear this information and only takes a minute. We greatly appreciate it! Plus, you can get a shout out on a future episode!

Thanks again – until next time!

Disclaimer: This episode and accompanying show notes are provided for general information purposes and should not be construed as legal or investment advice. For guidance specific to your situation, please consult with qualified legal and financial professionals.