In this episode of the Mineral Rights Podcast, we provide a comprehensive checklist for mineral owners on handling division orders. From what division orders are, how to verify your decimal interest is correct, when to get professional help, and best practices for documentation. This essential guide helps ensure you get paid correctly from the start so you can protect your interests when a new well begins producing.

Be sure to also subscribe on Apple Podcasts via the link above and please leave us an honest rating and review. We read every one of them and sincerely appreciate any feedback you have. To ask us a question to be featured on an upcoming episode, please leave a comment below or send an email to feedback@mineralrightspodcast.com.

What is a Division Order?

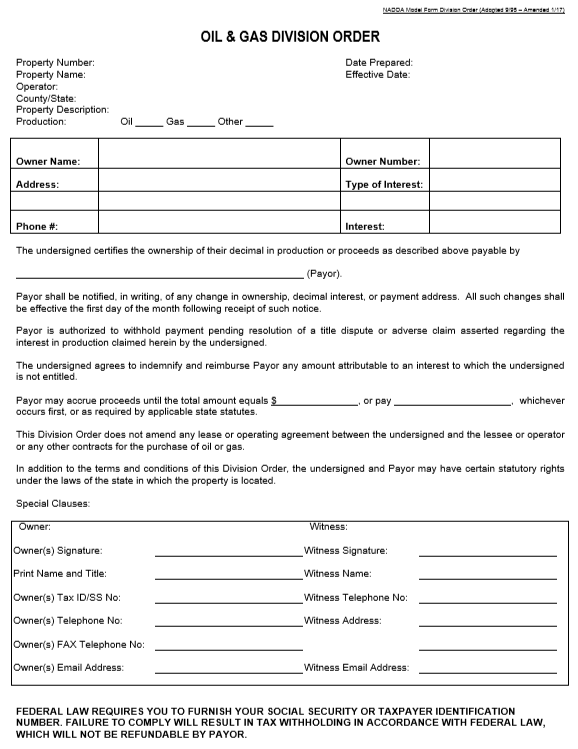

A division order is a legal instrument that documents your interest in a well and allows operators to distribute revenue to interest owners. It confirms your interest before payments begin, outlines your decimal interest (net revenue interest), the effective date of production, payment timing, and minimum payment amounts. Importantly, a division order should not modify your lease terms, so reviewing the language carefully is essential to ensure it doesn’t affect provisions you’ve negotiated in your oil and gas lease.

When You’ll Receive a Division Order

You typically receive a division order when a well begins producing, usually from the operator or first purchaser. It often includes directions and a W9 form for tax purposes. You may also receive a new division order if there’s a change in ownership or operator. Returning the W9 form is important to avoid backup withholding, where they withhold a statutory tax amount from your payments.

Key Components to Review

When reviewing your division order, check these critical elements:

- Owner name and contact information (verify the correct entity is listed)

- Property/well name and legal description (should match your deed and lease)

- Decimal interest or net revenue interest (NRI) – the most critical element

- Type of interest (royalty, overriding royalty, working interest, etc.)

- Payment timing and minimum amount

- Signature requirements

- Tax identification requirements

Calculating Your Net Revenue Interest

To calculate your net revenue interest (NRI) in a standard pooled unit:

- Identify your net mineral acres from your lease documentation

- Find the drilling spacing unit (DSU) size from state records

- Know your royalty rate from your lease

The formula is: (Net mineral acres ÷ Unit size) × Royalty rate = NRI

For example, if you own 160 net mineral acres in a 1,280-acre unit with a 3/16th (18.75%) royalty, your calculation would be: (160 ÷ 1,280) × 18.75% = 0.02343750. This is the decimal (also called your Net Revenue Interest) that should appear on your division order.

Finding the Necessary Documents

To verify your interest, you’ll need:

- State Oil and Gas Commission websites for well information (well plat and permit to drill) and drilling unit details (spacing/pooling orders).

- County clerk records for ownership documentation (deeds, leases)

- Net interest information (from lease offers or title search)

- Calculator or a spreadsheet for NRI calculations

If you’re not comfortable with ownership records or finding these documents, consider seeking professional help from a landman or an attorney specialized in oil and gas. Building foundational knowledge through resources like my Mineral Management Basics course can also be valuable.

Special Cases and Considerations

The standard calculation process works well for typical pooled units, but several special situations require different approaches. Blanchard interests in Oklahoma split royalty payments into the statutory minimum (one-eighth) plus any additional amounts, requiring you to add these components together. In Texas, where there’s no statutory forced pooling, allocation wells and Production Sharing Agreements determine your payment based on the proportion of the well’s lateral length that crosses your tract, making calculations more complex.

You might also encounter situations where multiple wells are listed on a single division order, or where your inherited interests span multiple mineral tracts within the same pooled unit. Non-participating royalty interests that burden your mineral rights can reduce your payments, requiring title searches to uncover these previous grants. When calculations don’t match the division order, it’s advisable to request documentation from the operator, including a redacted copy of the title opinion specifically relating to your interest.

When to Get Professional Help

Several situations warrant seeking assistance from an attorney or oil and gas expert. Unclear pooling or unitization language can cause significant headaches, sometimes requiring both legal and engineering expertise to understand why the property was unitized in a particular way. Multiple party ownership or complex inheritance situations may not be immediately apparent but can explain discrepancies in your calculations. When significant potential revenue is at stake, even small decimal discrepancies can translate to substantial money, making professional verification worthwhile.

Division orders containing unusual clauses or requirements, particularly those that appear to modify your lease terms, should be reviewed by an attorney to ensure they’re appropriate and legally binding in your state. Never hesitate to contact the division order analyst listed on your document as they understand the operator’s pay deck system and can explain calculations or unusual situations, providing valuable insight whether you’re working with an attorney or handling things yourself.

Common Mistakes to Avoid

Mineral owners frequently make several errors when handling division orders that can impact their payments. Not verifying the decimal interest is perhaps the most common mistake, potentially leaving money on the table indefinitely. Failing to update contact information or ownership changes, particularly when dealing with trusts that convert after someone passes away, can cause tax complications even when trust names remain similar. Missing deadlines to return division orders can delay payments, as some states allow operators to withhold payment until they receive the executed document. Even minor discrepancies that seem insignificant can accumulate substantial amounts over time, making it worthwhile to question any calculation you can’t reproduce. Assuming all division orders use standardized language is dangerous; always compare against the NADOA model division order form to identify unusual terms. Finally, not keeping your division orders for future reference removes an important baseline document for comparing future payments and identifying changes in your decimal interest over time.

Best Practices for Division Order Management

Creating an organized filing system for all your mineral documents will streamline the process of reviewing division orders. Whether physical or digital, having your lease, deed, and previous division orders readily accessible makes verification quick and simple. Cloud storage solutions like OneDrive or iCloud provide backup protection for these critical documents. Regularly compare division orders with check stubs to ensure consistency in your decimal interest and payment amounts. Track new drilling activity near your property through online platforms like MineralWare or Mineral IQ to anticipate upcoming division orders. Perform annual audits to verify that payments match your 1099 tax form, and periodically check that production reported to the state matches what appears on your revenue statements. These practices help you stay informed and catch discrepancies early, preventing long-term underpayment issues that might otherwise exceed statutes of limitation for corrections.

Future Trends

The division order process is gradually evolving as technology advances. I expect that we will eventually see digitization in this area of mineral management. This might start with electronic signatures and it would make sense to move toward completely online processing, which would streamline the workflow for both operators and mineral owners. While division orders will remain a fundamental part of oil and gas accounting, their format and requirements will likely adapt to accommodate these new technologies in the future.

Resources Mentioned in this Episode

- MRP 3: How to Calculate your Net Revenue Interest in 3 Simple Steps

- Download my Free NRI Calculation Worksheet HERE

- MRP 16: What You Need to Know about Oil & Gas Division Orders

- MRP 179: What Are Blanchard Royalties?

- MRP 274: Protect Your Legacy: Smart Estate Document Storage

- MRP 97: How to Audit Your Oil and Gas Royalty Statements

Mineral Rights Education

- Mineral Management Basics Online Course

- National Association of Royalty Owners (For a limited time, use coupon code “MRPODCAST” for $25 off an Introductory Membership. Good only for first-time members).

- While you are at the NARO website, check out the free letter in lieu of division order template that you can use instead of returning a division order (*depending on the state where your minerals are located).

- 1-on-1 Coaching with Matt

Thanks for Listening!

To share your thoughts:

- Leave a comment or question below (we read each one and your question may be featured in a future episode)!

- Ask a question or leave us feedback via email.

To help out the show:

Click the Apple Podcasts Logo Above to leave us a rating & review. It really helps us reach those that need to hear this information and only takes a minute. We greatly appreciate it! Plus, you can get a shout out on a future episode!

Thanks again – until next time!

Disclaimer: This episode and accompanying show notes are provided for general information purposes and should not be construed as legal or investment advice. For guidance specific to your situation, please consult with qualified legal and financial professionals.