Potash and other “critical minerals” have been in the news lately. On September 30th, 2020, President Trump signed an executive order “declaring a National Emergency to expand the domestic mining industry, support mining jobs, alleviate unnecessary permitting delays, and reduce our Nation’s dependence on China for critical minerals.”

Under the Executive Order, a “critical mineral” is a mineral identified to be a non-fuel mineral or mineral material essential to the economic and national security of the United States, the supply chain of which is vulnerable to disruption, and that serves an essential function in the manufacturing of a product, the absence of which would have significant consequences for the economy or national security.

In 2018, a draft list of 35 minerals deemed critical to US National Security and Economy was published by the department of Interior and Potash is one of the minerals listed.

When you read about the coming transition to renewable energy, critical minerals may not be the first thing that comes to mind. That said, these minerals are critical (pun intended) for the “renewable” energy infrastructure being touted by some politicians. From solar panels and wind turbines to electric vehicles and the large quantities of batteries that make these technologies usable, minerals like lithium and cobalt are required. In fact, the World Bank predicts a 500% increase in the production of these critical minerals by 2050 to meet growing demand.

Growing the food required to feed the growing global population uses a lot of fertilizer, and potash is a naturally occurring ingredient in fertilizer.

Like oil & gas, for a company to be able to mine for potash or other critical minerals on privately owned land, they must obtain a lease from the mineral owner beforehand.

In this episode we talk about what Potash is, where it is located, things to think about before signing a mining lease to allow the mining of potash or other critical minerals that go into wind turbines, solar panels, and electric vehicles.

Using the embedded player above, you can download the episode to your computer or listen to it here! Be sure to also subscribe on Apple Podcasts or wherever you get your podcasts and please leave us an honest rating and review. We read every one of them and sincerely appreciate any feedback you have. To ask us a question to be featured on an upcoming episode, please leave a comment below or send an email to feedback@mineralrightspodcast.com.

What Does this Mean for the Mineral Owner?

The expected growth in mining these critical minerals may present an opportunity to generate royalties from the production of minerals other than oil & natural gas. Potash is just one of the many critical minerals that may exist in commercial quantities on private land in the United States.

- In fact, some areas of the US have plentiful potash deposits like in the Permian basin near Carlsbad, NM, in the Paradox Basin near Moab, UT, and also in Michigan where a company is pursuing one of the largest potash deposits in the world.

- Some of existing potash mines sit on federal land but a lot of potential potash resource is on private land.

- Like oil & gas, for a company to be able to mine for potash on privately owned (or otherwise known as fee) minerals, they must obtain a lease from the mineral owner beforehand.

Before we dive into things to know about mining leases, let’s take a step back and do a deeper dive into Potash.

What is Potash?

Potash includes various mined and manufactured salts that contain potassium in water-soluble form. For example, potassium chloride is one of these salts.

The name Potash is derived from “pot ash”, which refers to plant ashes or wood ash soaked in water in a pot, which was the primary means of manufacturing the product before the Industrial Era. The word “potassium” is derived from “potash”.

Potash is produced worldwide in amounts exceeding 90 million tonnes (40 million tonnes K2O equivalent) per year, mostly for fertilizer. Various kinds of potash fertilizer constitute the single greatest industrial use of the element potassium in the world.

Random fact: Potassium was first derived in 1807 by electrolysis of caustic potash (potassium hydroxide).

Where is Potash Found in the US?

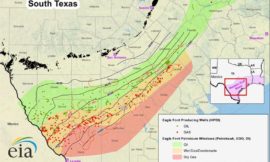

Various mines located around the world but we will focus on the mines in the united states. There are two main areas where potash is mined. One is in the Paradox Basin where there are potash mines near Moab and Wendover, Utah. According to the USGS, the Paradox contains up to around 1.6 billion tons.

The other primary area where potash is actively mined is in the Permian Basin near Carlsbad, New Mexico, not far from the Texas border.

The largest potash mining company in the US is Intrepid Potash. They operate the mines in Utah.

Another company is pursuing large potash deposits in Osceola and Mecosta counties in Michigan. This deposit is reported to be the highest-grade potash in the world, 600% higher than what is being produced in the Permian and twice the grade of deposits found in Canada and Russia. This deposit was estimated to be worth $65 billion in 2017 so even with potash prices coming down it still may be a big opportunity.

How is Potash Mined?

There are two primary ways that potash is mined. The first is what you would picture when thinking about a mine. Large boring machines dig out the ore underground and it is transported to the surface to a processing mill. The ore is refined and crushed and compacted to a uniform size where it is prepared for sale.

The other way they mine for potash is by using what is called solution mining. This is where they drill wells down to the salt deposits and then they pump water or brine downhole to dissolve these water soluble minerals. This solution is then pumped to the surface and the minerals are recovered through recrystallization. They do this through large evaporation ponds at the surface and then the recrystallized potash is collected and then milled like with the underground mine.

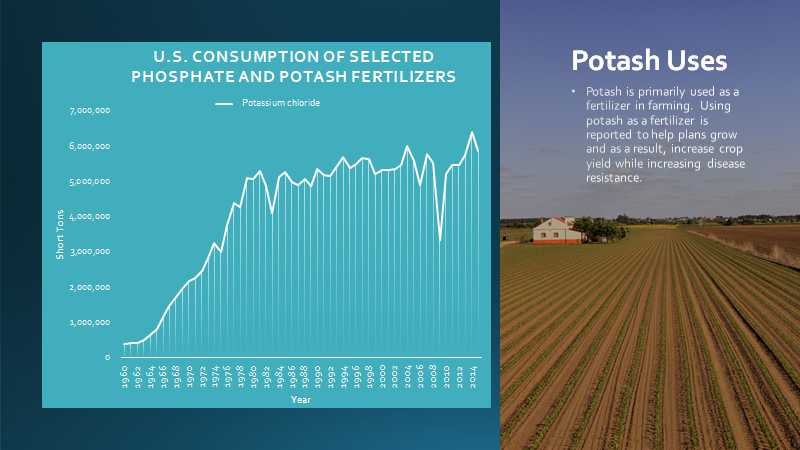

What is Potash Used For?

Potash is primarily used as a fertilizer in farming. Using potash as a fertilizer is reported to help plans grow and as a result, increase crop yield while increasing disease resistance.

A small amount of potash has other uses like the production of detergents and other products.

Why is Potash Important?

Potash is used primarily as an agricultural fertilizer (plant nutrient) because it is a source of soluble potassium, one of the three primary plant nutrients; the others are fixed nitrogen and soluble phosphorus. Potash and phosphorus are mined products, and fixed nitrogen is produced from the atmosphere by using industrial processes.

The US is one of the largest agricultural producers in the world. In fact, the U.S. produces around 34.7% of the world corn exports and 36.5% of the world soybean exports.

Despite this, we only produce around 1.2% of the global potash supply while making up around 13.5% of global demand for this important nutrient:

The average potash price as of 9/30/20 was $338/ton which is down from above $370/ton at the beginning of the year. In fact, the current potash price is down compared to the 5-year average price which was around $370-$380/ton.

Potash Mining Lease

All of this is interesting but the reason we wanted to talk about potash was to talk about other minerals that you could lease with your mineral rights. Especially since we are at the beginning of an energy transition and the big push towards solar and wind and batteries will require a significant amount of rare earth and other “critical minerals”. Potash is just one example of a critical mineral. In any case, it is important to understand if there is a potential for minerals other than oil & gas and this could be another source of income should a company decide to pursue it under your property.

To help understand how this might work we wanted to talk about mining leases and some of the differences when compared to an oil & gas lease. Here are a few highlights.

Mining leases tend to have quite a long term on the order of 10 to 20 years. This is a lot longer than the typical 3-5 years for an oil & gas lease. Some leases have a stated primary term and are extended by mining operations or production, while others have a fixed term and are renewable.

Like an oil & gas lease, there is no standard form of mining lease for fee property, and the terms and conditions of mining leases vary greatly. Provisions of particular importance in negotiation or review of a mining lease include:

- Mineral(s) covered by the lease, those reserved by the lessor, and provisions relating to conflicting development;

- Term of the lease;

- Production royalties payable to lessor;

- Minimum royalties, if any, payable to lessor, and crediting of minimum royalties against production royalties;

- Restrictions on mining methods allowed; and

- Provision that requires the lessor’s consent in connection with assignment or sublease.

To get a feel for the types of royalty rates that you might expect for critical mineral production from your lands, we looked at the Michigan State lease form. They require a 5% production royalty for solution mining of potash. This is a lot lower than the minimum statutory royalty rate for oil & gas across most of the US, of 12.5%.

Like many state and federal leases, it is not a paid up lease but requires annual rental payments. The Michigan lease form has a 10 year primary term.

How to Research Critical Mineral Potential of Your Land

So the moral of the story is to find out what type of activity is going on in your area. Is there a potential for critical minerals to be mined from your mineral rights? You can find out more by looking at the USGS website, searching for the state geological survey where you own minerals.

For example, I looked at the Colorado Geological Survey website and this is what it had to say about the potential for these critical minerals in Colorado:

Among the minerals needed for alternative energy technologies, some have been identified in Colorado and more show promise for successful exploration. . .Perhaps the most promising are the metals used for photovoltaics—gallium, germanium, and indium. These three elements often occur in the mineral sphalerite, the primary ore mineral of zinc. Colorado has many zinc deposits and the possibility is strong that one or more of these can be found in the zinc ore. Germanium is commonly found in coal deposits, so the abundant coals of Colorado, including those under the eastern Plains, are a potential source of this valuable material. Lithium is found in oil shale deposits, including Colorado’s oil shale, as well as in geothermal waters. [Rare Earth Elements] have been found in Moffat and Gunnison Counties and in the Wet Mountains of Custer County.

So do your research and see if you might be in an area where there is potential for other mineral development. If you are approached to lease your minerals for a mining lease, as always consult with an attorney who is familiar with mining law and is licensed to practice in the state where your minerals are located.

Thanks for Listening!

To share your thoughts:

- Leave a comment or question below (we read each one and your question may be featured in a future episode)!

- Ask a question or leave us feedback via email or voicemail: (720) 580-2088.

To help out the show:

- Subscribe and leave a review on Apple Podcasts or wherever you get your podcasts – we read each one and greatly appreciate it. Plus, you can get a shout out on a future episode!

Thanks again – until next time!