In this episode we talk about the current oil and gas market outlook, where prices might be headed, and what this all means for mineral and royalty owners.

Be sure to also subscribe on Apple Podcasts via the link above and please leave us an honest rating and review. We read every one of them and sincerely appreciate any feedback you have. To ask us a question to be featured on an upcoming episode, please leave a comment below or send an email to feedback@mineralrightspodcast.com.

Oil & Gas Market Update

To understand where oil and natural gas prices might be headed, it is useful to take a look at the current supply & demand situation. The latest EIA Short Term Energy Outlook breaks down where we are now compared to where we were before and during the pandemic. Specifically, they had an interesting observation about the current OPEC surplus crude oil capacity situation:

“Even with increased OPEC crude oil production, remaining surplus production capacity will be more than sufficient to meet additional demand should consumption exceed our expectations. We expect that OPEC surplus crude oil production capacity, which averaged 6.2 million b/d in 2020, will average 6.7 million b/d in 2021 and 4.8 million b/d in 2022, compared with average surplus capacity of 2.2 million b/d from 2010–19. These estimates do not include additional capacity that may be available in Iran that is offline because of U.S. sanctions on Iran’s oil sales. All else equal, elevated levels of OPEC surplus production capacity tend to have a moderating effect on crude oil price increases.”

EIA Short term energy outlook dated july 1, 2021

Hopefully, the economic recovery will continue and global supply and demand for crude oil will remain somewhat balanced over the next several years. As you can see from the next figure, global liquid fuels demand aren’t likely to fully recover from the pandemic levels until 2022.

Ultimately, OPEC+ remains the relief valve on global demand as the cartel holds an estimated 6.7 million barrels per day of surplus crude oil production capacity in 2021. So, while the US was the swing producer during the previous shale boom, this has shifted back to OPEC.

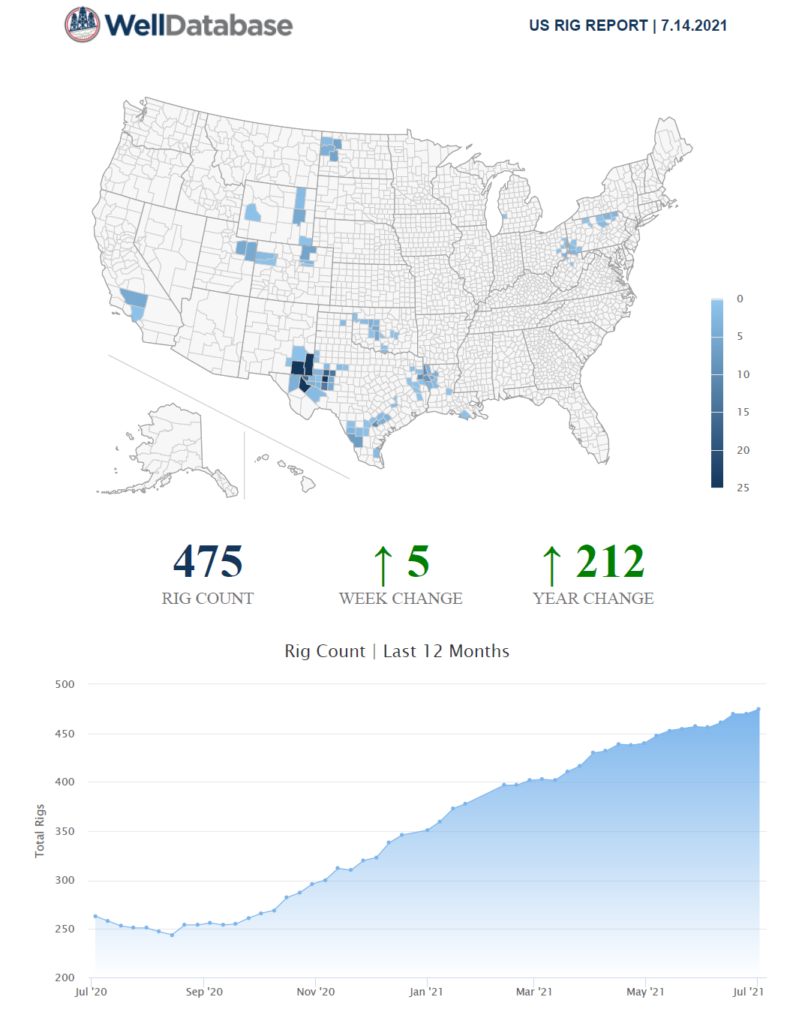

North American Rig Count

Activity levels in the US remain well below the pre-pandemic highs. Thankfully, activity has picked up significantly since the 2020 lows but we are still less than half than the rig count seen at the end of 2019 before COVID.

The majority of U.S. drilling activity is still centered around the greater Permian Basin in West Texas and Southern New Mexico. The Williston Basin (Bakken), Haynesville, Eagle Ford, Marcellus, Woodford, and DJ Basin (Niobrara) are also seeing steady level of activity albeit at much lower levels than the Permian.

Impact on Mineral Rights and Royalties

The good story around minerals and royalties is tied to the recovery in oil and natural gas prices in 2021. Since our royalties are directly tied to oil and gas prices, we have seen a steady increase in royalty checks.

That said, the lower level of drilling activity in the US means it will take longer before that well is drilled on your property. Since the biggest lever on the value of undeveloped acreage is development timing (timing of when a new well is drilled), we can expect to see lower offers than were being made prior to the pandemic. Acreage in the core areas of the major basins and plays with permitted wells are still demanding top dollar but undeveloped acreage with no line of sight to drilling is not likely to demand high speculative offers like we saw from 2016-2019.

The reason for this is the market fundamentals have changed and the days of endless cheap capital for operators to drill wells to grow production are gone.

You’ll Also Learn

Listen to the full episode to learn about:

- The impact that renewables will have on the future of the oil and gas industry and where we will still need petroleum products.

- What is likely to happen to the domestic oil & gas producer landscape due to these changing market dynamics.

- What will prices for mineral rights and royalties do in the near term and longer term as the oil and gas market evolves.

- What will the prices for mineral rights and royalties look like in the future.

- What role the US is likely to play in the global crude oil market going forward.

Resources Mentioned in This Episode

Articles / Reports

- Biden continues his anti-U.S. oil and gas push while crude demand rises

- EIA Short-Term Energy Outlook

- Baker Hughes North American Rig Count

Episodes

- MRP 52: How Crude Oil Prices Work

- MRP 84: The Top 6 Things That Affect The Value of Mineral Rights and Royalties

Thanks for Listening!

To share your thoughts:

- Leave a comment or question below (we read each one and your question may be featured in a future episode)!

- Ask a question or leave us feedback via email or voicemail: (720) 580-2088.

To help out the show:

Click the Apple Podcasts Logo Above to leave us a rating & review. It really helps us reach those that need to hear this information and only takes a minute. We greatly appreciate it! Plus, you can get a shout out on a future episode!

Thanks again – until next time!