Before we dive in, just remember that the value of your mineral rights to you is what is most important. Many of us have a connection with our mineral rights since they have been handed down within our families for generations. They may have sentimental value and may provide a connection to relatives that have passed.

That said, there are reasons that we may need to consider selling some or all of our minerals or royalties to meet immediate financial needs. In that case, it is helpful to know the things that might affect the value of your mineral rights or royalties.

Using the embedded player above, you can download the episode to your computer or listen to it here!

Be sure to also subscribe on Apple Podcasts via the link above (or wherever you get your podcasts) and please leave us an honest rating and review. We read every one of them and sincerely appreciate any feedback you have. To ask us a question to be featured on an upcoming episode, please leave a comment below or send an email to feedback@mineralrightspodcast.com.

Be sure to also download our FREE Mineral Rights Valuation Resource Guide for 5 resources that will help you understand the value of your Mineral Rights Royalty Interests.

Click here for our FREE Mineral Rights Valuation Resource Guide.

How Mineral Rights Are Valued

First, we’ll do a quick refresher on the ways that mineral rights and royalties are valued. If you want to learn more about these methods, you can go back and listen to MRP 4: How Mineral Rights are Valued.

There are three main approaches that we’ll talk about

Market Approach (Comparable Sales)

Arms-length transaction between willing buyer & seller. Residential real estate example “pulling comps”

Where you can find this information?

Energy Net, other auction sites

County clerk & recorder. In some states like OK, mineral rights transactions are subject to Documentary stamp fees. You can use this to back calculate how much was paid for the mineral rights and then if you know the number of net mineral acres that were conveyed, you can divide the total price paid by the number of NMA to get $/NMA.

Income Approach (Discounted Cash Flow Analysis)

The “Income Approach” refers to the calculation of future cash-flows which are discounted at a certain interest rate and then added together in order to determine the Net Present Value in today’s dollars. This is also called a “Discounted Cash Flow Analysis“.

The way this is done is if you are receiving royalties, the wells are forecasted using what is called decline curve analysis. Then you input various assumptions like future commodity prices, the decimal interest in the well, tax rates, the effective date of the valuation, and the discount rate that you are basing the valuation on.

Let’s talk about the discount rate to help explain what I’m talking about. First, future royalty checks are worth less in the future than they are today because of the time value of money. Any money you receive today can be invested and receive interest or dividends and thus would have grown over time vs. the same amount of money received in the future. Money received further out in the future will have less value than the same amount of money received today because of this. What this means is if you were to invest the lump sum of cash (the Net Present Value) at that interest rate, it would be equivalent in value of your future royalty checks over the entire life of the well(s) from today’s standpoint. The undiscounted sum of all your royalty checks over the life of that well will be higher than this lump sum value today due to this time effect on the value of money. The higher the discount rate or in other words the interest rate used to discount those future cash flows back to today, the bigger the difference between these two amounts.

Rules of thumb

- Very rough estimate at best.

- Cash Flow Multiple:

The Cash Flow Multiple method takes the amount of recent royalty checks and multiplies it by a multiple of between 50 and 70 to determine total value. This methodology may have been used originally to approximate value of royalties in mature fields where there was no expectation of future development and where well declines were well understood. This method doesn’t consider any un-developed acreage you may have and as such gives little or no value to non-producing properties. This method can be a bit more accurate than the lease bonus multiple method in determining the low end of the fair market value for a fully developed tract in a stable commodity price environment but it depends entirely on the multiple you use and if it is consistent with actual sales in your area. Again, this method should only be used as a rough approximation at best.

- Multiple of Lease Bonus Amount

Now that we know the main ways that minerals and royalties are valued, what are some of the things that affect the value?

- The type of property

- Fee minerals – worth the most, executive rights, future upside

- Wellbore only Royalty Interest

- Non-participating Royalty Interest (worth less since you don’t have the executive rights)

- ORRI – dependant on lease staying in effect. Risk of washout

- Non-operated working interest. Royalties – operating expenses

- Commodity prices

- One of the biggest levers on the value. $40 oil vs $80 oil, you would think value would double but actually magnified due to the time value of money. For example $50 to $60/bbl oil, $2.50 vs. $3 gas increases value by almost 40% in one model.

- Price differential to WTI. E.g. Uintah basin in UT, utah yellow wax might have differential -$10/bbl

- Uncertainty, commodity price risk often baked into value.

- Resources: EIA Short-Term Energy Outlook, NYMEX strip price (forward months/years expected oil & gas prices)

- Your oil & gas lease

- Whether or not the acreage is open/unleased or leased

- If leased, the negotiated lease terms

- Royalty rate, cost-free provisions?

- 12.5% royalty vs. 25% royalty rate example

- Why are cost-free provisions important: post-production costs

- Pugh clause, depth clause, term

- Held by production?

- Royalty rate, cost-free provisions?

- Producing vs. Non. Producing

- Producing – royalties,

- Age of wells, how long expected to keep producing

- How much are they producing?

- What are they producing, Oil vs. gas, + NGL’s

- Who is the operator?

- Non-producing mineral rights

- Is there the potential for future development?

- If so, what formations, well spacing (how many wells), conventional vs. unconventional

- Producing – royalties,

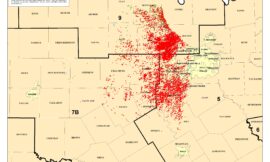

- Location

- Nearby activity level

- If undeveloped, have good wells been drilled nearby? This is referred to as offset activities?

- If you have undeveloped minerals not near any activity

- If you have undeveloped minerals in the heart of a large unconventional oil & gas basin with a lot of activity. E.g. in core wattenberg field in the DJ Basin, in the core of Reeves County, TX in the Delaware Basin

- Why? Multiple stacked formations, impressive well results (e.g. Reeves County wolfcamp with per well reserves (akak EUR) of 500-600k bbls and 2+ BCF gas).

Example to illustrate this:

- $40 oil, undiscounted gross sales $20,000,000, 1% NRI = $200k

- $2 gas, undiscounted gross gas sales = $40k

- Undeveloped minerals in non-core area or area with less impressive well results:

- 100k bbl EUR, $40k undiscounted sum of potential royalties

- Well spacing, akak upside potential. Every PUD well adds value.-

- Development Timing

- Related to location but want to talk about this because it is so important

- If you are in a good area and there are permitted wells or operator is drilling wells on your lease

- Biggest lever on value

- One year later = 63% decline in value at 10% discount rate

- Reason: many unconventional oil & gas wells, 30-40% of oil/gas produced in first year. Time value of money

- One year later = 63% decline in value at 10% discount rate

Summary:

To summarize, these are the 6 things that have the biggest impact on the value of your mineral rights or royalties:

- Type of property

- Oil and Gas Prices

- Your lease

- Producing vs. non-producing minerals

- Location – core vs. non-core, proximity of activity

- Development timing – biggest lever

Resources Mentioned in This Episode:

Be sure to also download our FREE Mineral Rights Valuation Resource Guide for 5 resources that will help you understand the value of your Mineral Rights Royalty Interests.

Click here for our FREE Mineral Rights Valuation Resource Guide.

- An in-depth discussion on the methods for valuing mineral rights and royalties, including some common rules of thumb. MRP 4: How Mineral Rights are Valued

- EIA’s Short-Term Energy Outlook is updated monthly and provides a 12-month look ahead at what oil & gas prices are expected to do. Did you know that the U.S. Energy Information Administration (EIA) expects that Brent crude oil prices will average $49/b in 2021, up from an expected average of $43/b in the fourth quarter of 2020? This is $5/bbl higher than last month’s STEO; hopefully we see this trend continue with actual oil prices.

- NYMEX WTI Crude Oil Strip Price represents the WTI Crude Oil Futures contract prices for forward months. This is commonly used to forecast reserves and economics associated with oil producing properties. Between the EIA STEO and NYMEX strip pricing, you can get a feel for the outlook for future oil prices and how that might impact your future royalties.

- The documents you should give to buyers to get highest offers:

Thanks for Listening!

To share your thoughts:

- Leave a comment or question below (we read each one and your question may be featured in a future episode)!

- Ask a question or leave us feedback via email or voicemail: (720) 580-2088.

To help out the show:

- Leave an honest review on Apple Podcasts or wherever you get your podcasts – we read each one and greatly appreciate it. Plus, you can get a shout out on a future episode!

Thanks again – until next time!