You may be wondering how the current economic trends like high inflation might affect oil prices over the next couple of years. If we could look through the crystal ball to figure out what commodity prices will do it would certainly help us have a better understanding of the value of our producing royalties. As prices go up, it tends to counteract the ever-declining production and helps our royalty checks stay stable or even increase. In fact, we saw this last year as Henry Hub natural gas spot prices hovered in the $5 range in the latter part of 2021. We were getting paid close to double the price for gas as compared to the average price just two years ago.

We hear a lot about high inflation and oil prices in the news lately as the economic recovery seems to have gotten away from the Federal Reserve and their lagging monetary policy. One thing is clear, interest rates are going to rise but if you’re like me you may be wondering how this is going to affect our mineral rights and royalties. And, more importantly, you may be wondering if there are ways to protect your hard earned savings against the damaging effects of inflation.

To break this down, we took a look at a few of the economic measures and how commodities like crude oil were correlated to things like the relative strength of the US Dollar and inflation to see what these factors might due to future oil and gas prices. Plus, we talk about a technology innovation that may help our royalty checks and act as a long term store of value in the process.

Be sure to also subscribe on Apple Podcasts via the link above and please leave us an honest rating and review. We read every one of them and sincerely appreciate any feedback you have. To ask us a question to be featured on an upcoming episode, please leave a comment below or send an email to feedback@mineralrightspodcast.com.

Current Economic Environment

The pandemic was hard on every country as many elected to lockdown to prevent the spread of the virus. So it would be easy to place the blame on the pandemic. To take a step back at some of the economic factors that impact the price of oil and gas, we took a look at the relative strength of the U.S. Dollar, which is the currency that oil and gas are priced in. As the U.S. Dollar weakens, the price of oil goes up because that same dollar has less purchasing power. On the flip side, a stronger dollar generally causes the relative price of commodities like crude oil to fall as the relative strength of the dollar increases.

U.S. Dollar Index (DXY)

This index tracks the strength of the dollar against a basket of major currencies. It was created by the U.S. Federal Reserve in 1973 to help understand the value of the U.S. dollar against global currencies. There are six currencies that make up the index – Euro, Japanese Yen, Pound Sterling (GBP), Canadian dollar, Swedish krona, and Swiss Franc. As of right now, the DXY sits at around 95.4. When you look at the historical data, we actually aren’t all that bad when compared to a few low points like the 2008 financial crisis where the index was around 72. Before the pandemic we were at around 98 so this doesn’t appear to be a major contributor on oil prices (it is probably having an impact but doesn’t appear to be the reason that un-adjusted Energy commodity prices are up 48.9% over the past 12-months.

How Bad is Inflation?

The advertised inflation rate for 2021 was 7% or 5.5% excluding food and energy. The US Bureau of Labor Statistics shows the basket of goods and services that make up the CPI including the weightings and price year-over-year price changes. Some areas with unusual supply and demand effects due to the supply chain issues caused by the pandemic like used cars, are well above this number but even when you look at areas without these unusual issues, prices are up. Again the area seeing the biggest price changes is Energy commodities which are up 48.9% over the past year like we mentioned.

The Impact of High Inflation on Oil Prices

Now you would think that high inflation is what is causing most of the increase in commodity prices but that is just part of the theory of how inflation affects commodity prices. It is true that commodities such as gold, agricultural goods, and energy like oil and natural gas have historically been viewed as a hedge against inflation.

That said, the price of oil & gas have generally moved as a result of the dollar’s relative strength or weakness internationally since these commodities are priced in the U.S. Dollar. At least this has been the case in the past where that has been a bigger factor than domestic inflation.

But what if the entire global economy is facing similar inflationary pressures as we are seeing today due to most major economies shutting things down during the pandemic and increasing the monetary supply to help keep things moving during those shutdowns?

Now that things have reopened and demand for goods and services have recovered we are using more energy. Increases in demand without a corresponding increase in the supply of oil causes prices to go up. When you couple this with the fact that oil and gas is the feedstock required by every industry, whether for power generation, as an actual feedstock in the manufacturing process (e.g. plastics), for transporting goods, or for all of the above, an increase in costs causes suppliers to pass-through these increased costs to consumers in order to maintain a profit. In fact, “economists generally agree that oil prices can drive some variation in inflation” and the fact that “international inflation rates move together” means that oil and gas prices may indeed drive a big part of inflation.

So, from doing research on this, economists don’t fully understand the dynamic relationship between short-term changes in oil prices and inflation but one possible explanation of this relationship is that oil prices may heavily influence inflation.

This makes sense to me given the dependence of every industry on energy prices and when energy prices go up, the price of goods and services have to go up as well.

What about Supply & Demand for Oil?

Of course, these things aren’t the only impacts on oil and gas prices. One of the biggest factors impacting oil and gas prices is the balance of supply and demand (or lack thereof). When we get into an oversupply situation like we saw in 2020 when economies shut down, prices drop quickly to try to bring things back into balance.

Conversely, when we get into a situation where demand exceeds supply, oil prices rise until there is again a balance. Where we are at today (as of the end of 2021), Global oil demand has outpaced supply. Global oil demand is currently 99.73 million barrels per day whereas current global supply is 99 million barrels per day, according to the U.S. Energy Information Administration (EIA) and the consulting group ERCE. So we have a very tight supply situation right now which is causing prices to go up. In fact, as we record this in early January 2022, Brent and WTI crude oil prices hit their highest levels since October 2014 following an attack in Abu Dhabi near state owned petroleum tankers. This price spike was as a result of concerns over supply disruptions which I think will be short lived but the fundamental issue remains that we are in a supply crunch and that is being exacerbated by the lack of new investment in oil and gas projects due to greenwashing within the public markets.

Why Record Oil Prices are Bad

My hope is that oil stays below $90 because if it goes higher than that or certainly higher than $100 per barrel, we are likely going to see customers reacting by cutting back, call it a demand shock but basically if oil reaches a level where companies are losing money by continuing to buy at those levels they will just shut down manufacturing or whatever their business is until prices drop back down. More worrisome would be the political response that $100+ oil prices would likely solicit. You start to get into windfall profits conversations and other nonsensical arguments against producers. Too high oil prices are not good for anyone.

The US Government has traditionally shown a high level of incompetence when it comes to understanding supply & demand so they would likely foolishly call on OPEC to increase production instead of spurring additional investment in growing production domestically. Ironically, OPEC is already at their limit and can’t really produce any more oil then they currently are, with the possible exception of Saudi Arabia which may have some surplus capacity. But again, our political climate and the heavy push to invest heavily in green projects while simultaneously cutting off funding for oil and gas companies is starting to rear its ugly head in terms of oil prices.

We are seeing this play out in Europe where Germany has made poor decisions around their investment in energy to where natural gas prices on an oil equivalent basis are greater than $200/bbl and this is forcing factories to shut down and people can’t afford to heat their homes.

Despite the political headwinds the industry is facing both at home and abroad, the silver lining to higher oil prices is that companies will have more cash to re-invest in drilling new wells to help production stay level or at least slow the decline in production as wells get depleted. Eventually this will help supply and demand get back in balance but it may take some time.

The Damaging Impacts of High Inflation

One of the questions that all of this brings to mind is how much our policy decisions both here in the U.S. and abroad in terms of underinvestment in oil and gas over the past several years are actually contributing to higher inflation. In other words, would we be seeing inflation at 7% if we didn’t stifle investment in growing oil and gas supply over the past two years? I suspect that if we were in an environment of lower oil prices that our inflation wouldn’t be running as hot as it is.

in terms of the overall impact on mineral and royalty owners is concerned, I think it would be good if the price of oil stayed below $80/bbl. AT these prices, oil and gas producers can make money and continue a measured pace of investment in new drilling and energy prices would allow companies to make money without having to pass larger cost increases on to the consumer if Oil stays at $85/bbl vs. drops back down to $70 or $75/bbl.

Impacts of Higher Energy Prices

In either scenario, robust oil and gas prices will continue to spur an interest in mineral rights and royalties as an asset class that delivers a good return on investment. It will also mean that our royalty checks stay consistent despite declining production (assuming you don’t have new wells coming online, just status quo), higher prices help offset lower production. It will mean a healthy market for leasing your minerals as well as companies have additional cash to reinvest in maintaining or slightly growing production (while still staying within cash flow).

Monetary Policy Fail?

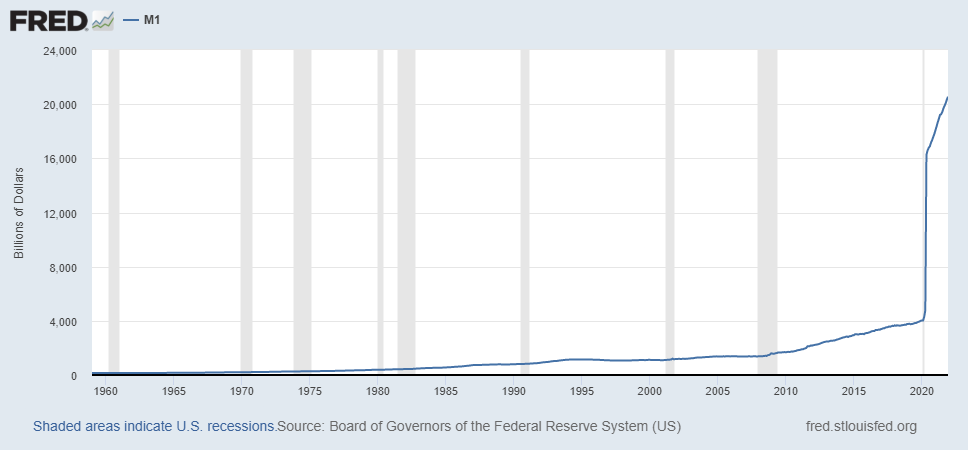

Finally, no talk about inflation would be complete without considering the effects of monetary policy by central banks like the US Federal Reserve. I think we are starting to see the effects of a rapid increase in the money supply caused by central banks printing money to help keep things moving through the pandemic. As some economists have said, “inflation can happen if the money supply grows faster than the economic output under otherwise normal economic conditions”

It would seem that having more money floating around through fiscal stimulus (like the child tax credit and other stimulus checks that were distributed by the US Government during the pandemic), that people are demanding goods at a faster rate than they can be produced that prices go up. An obvious example of that is the price of used cars here in the US. They are actually appreciating in value which is crazy, and this is because of global computer chip shortages that is resulting in automakers being unable to manufacture new cars and keep up with demand. This forces people to look at buying a used car instead which is driving up prices there, for example.

Hedging Against Inflation

When all of this started happening at the beginning of the pandemic I started to look at alternate investments to hedge against what I thought was likely to be high inflation as we are now seeing. I looked at gold but gold and precious metals seemed to not really move like I hoped they would in response to the government buying treasuries and the money supply growth at levels that we have never seen before. Money supply is often seen as an indicator of future inflation and I wanted to find an investment that would withstand high inflation. This is where Bitcoin comes it. I will just say that I never really paid much attention to Bitcoin until 2020 because of the reasons I just mentioned.

Bitcoin to the Rescue?

So I think Bitcoin is going to really gain widespread adoption as an alternate store of value due to the reasons we will cover in our series on Bitcoin and Bitcoin mining using stranded natural gas. This development is poised to benefit royalty owners who previously had to watch operators flare natural gas in locations where there was not a pipeline available just in order to produce the oil that they were after. So stay tuned to that upcoming series as we will break down how this new form of money could change the energy industry and specifically how these developments could affect royalty owners.

Resources Mentioned in This Episode

- The Correlation of Commodities to Inflation

- Crude oil prices increased in 2021 as global crude oil demand outpaced supply

- Gas Prices In Europe Are Now The Equivalent Of $205 Oil

- Visualizing the History of U.S. Inflation Over 100 Years

- How Much Do Oil Prices Affect Inflation?

- Inflation And Interest Rates Rise – Fed Loses Control

- How Does Money Supply Affect Inflation?

- The Current Federal Reserve M1 Money Supply Insanity

- Oil prices surge to a 7-year high on the back of supply disruption fears and surging demand

- MRP 113: Mineral Rights News July 2021

Thanks for Listening!

To share your thoughts:

- Leave a comment or question below (we read each one and your question may be featured in a future episode)!

- Ask a question or leave us feedback via email or voicemail: (720) 580-2088.

To help out the show:

Click the Apple Podcasts Logo Above to leave us a rating & review. It really helps us reach those that need to hear this information and only takes a minute. We greatly appreciate it! Plus, you can get a shout out on a future episode!

Thanks again – until next time!

Pingback: MRP 140: What Royalty Owners Need to Know About Bitcoin Mining With Natural Gas – The Mineral Rights Podcast