The U.S. House of Representatives recently held a hearing titled “Gouged at the Gas Station: Big Oil and America’s Pain at the Pump” where they grilled six oil company CEO’s about the recent increase in gasoline prices. While this hearing was mostly political grandstanding and lacked much substance, we break down the implications of what was said and what might be holding back companies from increasing oil production in 2022.

Be sure to also subscribe on Apple Podcasts via the link above and please leave us an honest rating and review. We read every one of them and sincerely appreciate any feedback you have. To ask us a question to be featured on an upcoming episode, please leave a comment below or send an email to feedback@mineralrightspodcast.com.

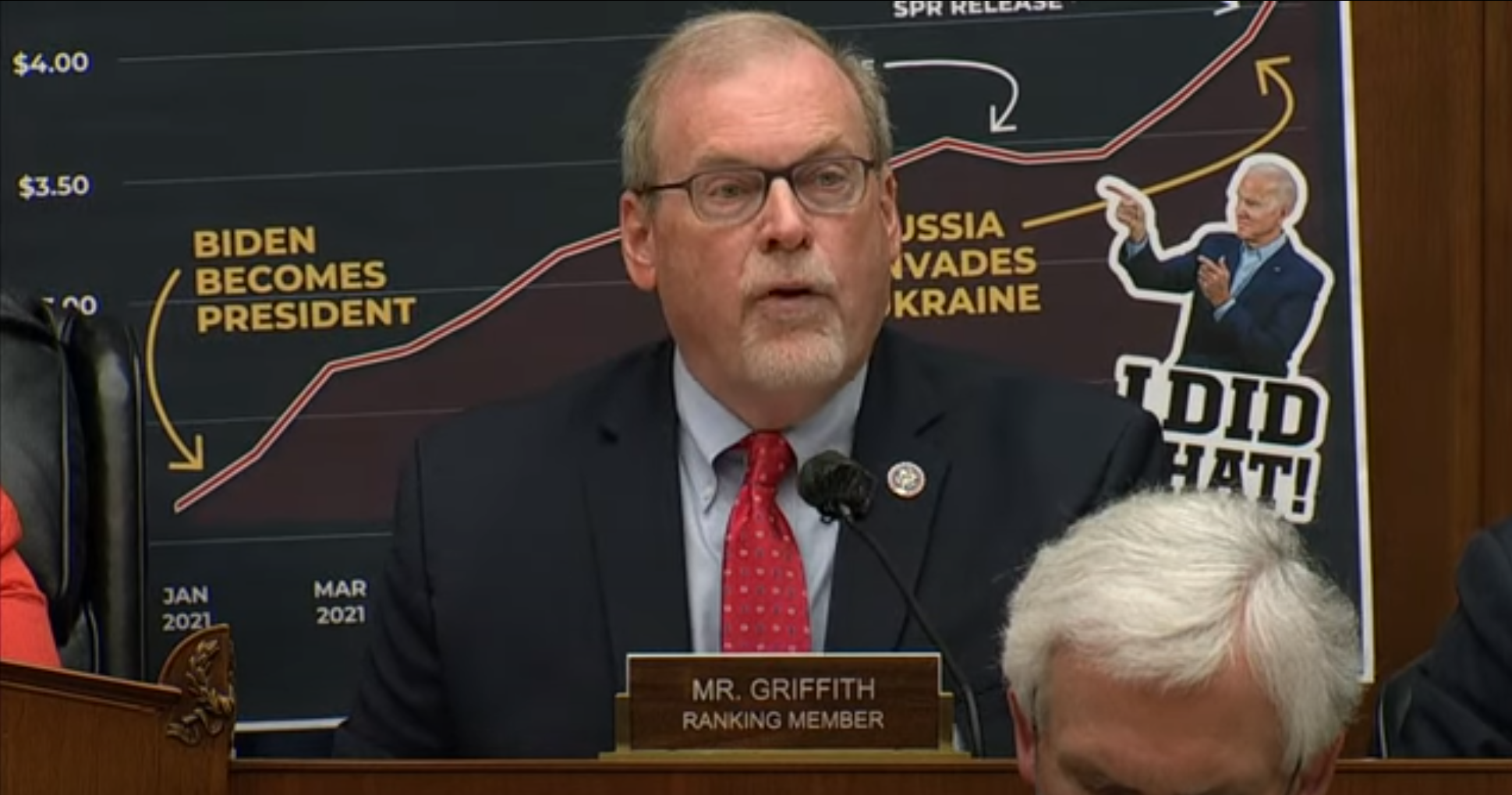

Putin’s Price Hike

The House Energy and Commerce subcommittee has summoned the chief executives of six large U.S. oil companies for a hearing titled “Gouged at the Gas Station: Big Oil and America’s Pain at the Pump.”

CEO’s of Chevron, Devon Energy, Exxon, Pioneer Natural Resources, chairman of BP America, and the head of Shell’s US operations all participated in this hearing.

The hearing was held in response to higher gas prices here in the US and is consistent with the administration’s need to lay blame somewhere. Putin has been in focus and rhetoric like “Putin’s price hike” and big oil profiteering is being used to shift attention away from potentially troublesome policy decisions in a midterm election year.

Refusing to Increase Production?

While the Democrats are accusing “Big Oil” of refusing to increase production and instead focus on returning profits to shareholders in the form of Dividends and share buybacks. First I don’t disagree with respect to buying back stock and as their stock valuations have recovered, now may be a good time to re-evaluate their share repurchase plans for the remainder of the year.

That said, I disagree that they are refusing to increase production. Companies are looking to increase production this year in response to the increase in oil prices but they are somewhat hamstrung by higher prices as well. Service company costs, steel prices, frac sand prices, all are increasing as well due to inflation and supply chain constraints. In fact, Vicki Hollub, CEO of Occidental Petroleum said at the CERAWeek conference in March of 2022: ““Now, with supply chain challenges, it makes any kind of attempt to grow now — and at a rapid pace — very, very difficult,” she said.

She went on to say “The call for incremental production in the United States, at this point, especially with the supply chain challenges, can’t happen at the level that’s needed not only for our country but for the world. We’re in a significantly challenging scenario today,” she said.

Production in the oil-rich Permian Basin is back around its pre-pandemic peak, according to Hollub, who noted the region faces significant challenges in boosting output. It’s the only shale basin in the U.S. that can increase production, she said.

What’s Holding Them Back?

The elephant in the room that politicians likely will never recognize is that companies are in a very different position today than they were prior to the pandemic. That is, there is a very strong focus on capital discipline and as Hollub said “investors view capital discipline as “essentially no growth.” She even mentioned at the CERAWeek conference that they “do need to return cash to shareholders in the form of dividends or buybacks, especially during the better cycles.” I agree that once you commit to a certain dividend, it becomes very difficult to decrease this and not negatively effect shareholder value.

As mentioned earlier, I do think that some money that is being used on stock buybacks right now could potentially be used to incrementally grow production. However, it is a very nuanced discussion and it depends on the investment opportunities that each company has and what will provide the highest return to shareholders.

So I think these companies could and should do more to reinvest in new production while still living within cashflow. For example, Devon Energy mentioned in their February earnings call that at that time their capital budget was unchanged at $1.9 to 2.2 billion and that they are increasing their share repurchase authorization by 60% to $1.6 billion. At the time of the call, their stock was trading at a multiple of less than 5 times cash flow and that “their business trades at a substantial discount to intrinsic value”. That said, their stock is up 38.5% YTD so as stock gets more fairly priced, I hope these companies will re-evaluate this decision and look to reinvest more into growing production vs. share buybacks.

Who’s Fault is it Anyway?

One of the most valid statements that was made during the hearing was when Representative Rodgers from Washington mentioned that “energy is foundational to life” and that “when energy prices go up. the price of everything else goes up.” In fact, we talk about this in detail in MRP 138: How High Oil Prices and Inflation Will Affect Royalty Owners.

That said, the Republicans lay all of the blame for high gas prices with the Biden Administration. I disagree that this is all necessarily Biden’s fault since policy decisions as a result of the COVID-19 pandemic and the over $4.7 trillion dollars in money printing. This is one of the reasons for the record inflation in 2022.

Of course, the Republicans hit on Biden’s energy policies like cancelling the Keystone XL pipeline, limiting access to leases and permits on federal lands, and anti-fossil fuel rhetoric since he took office. All of this does have some effect on companies ability to grow production and to access the requisite capital necessary for that to happen. I think these policies will result in higher energy prices going forward but I think the Republicans are overly politicizing high prices as Biden’s fault. Now, maybe two or three years from now they would be right but not today.

On the other hand, the Democrats focused on green energy and reducing our dependence on fossil fuels. I do think this is a good idea over several decades, not the timeline they are trying to force. We need an all of the above energy policy including solar, wind, nuclear, and fossil fuels but it is a fallacy to say that more solar and wind would make us less dependent on other countries for our energy. Enabling solar and wind backed up by storage will require critical inputs like cobalt, lithium, and other rare earth minerals to scale to the level needed. We are highly dependent on countries like china for the manufacturing of solar panels and for the critical minerals required to manufacture them. Increasing the amount of nuclear and renewable energy capacity in the U.S. would reduce our dependence on countries like Russia, Saudia Arabia, Iran, and Venezuela for oil imports. It would instead shift this dependence on other countries for their rare earth mineral reserves. The top 5 countries with the largest rare earth mineral reserves, it includes China, Vietnam, Brazil, Russia, India. So we would be just shifting the balance of power to other countries but would be no better off (or worse off since we have limited rare earth reserves in comparison to many other countries). It is six one way a half a dozen the other.

It was apparent that several representatives were clueless as to how much oil the US even produces (as illustrated by Representative Welch from Vermont’s statements around 3:43:27 into the hearing he says “

“On March 6th 2020, just before we had the shutdown as the result of COVID, US crude oil production was 13.1 million . . thousand barrels per day . . . million barrels per, yeah 30,000, thank you.”

Congressman Peter Welch, Representing Vermont

So while Representatives like Mr. Welch may be experts in other areas of commerce, it makes you wonder how they could possibly dictate credible energy policy that would be the best for our country.

Resources Mentioned in This Episode

- MRP 52: How Crude Oil Prices Work

- MRP 143: Special Report – Impact of Russian Invasion on Oil and Gas Prices

- Oil industry execs testify before Congress as gas prices skyrocket nationwide (Full Hearing Video)

- ‘Big Oil’ CEOs testify before Congress amid skyrocketing gas prices – ABC News

- What we learned from the Big Oil hearing – E&E News

- Oil producers in a ‘dire situation’ and unable to ramp up output, says Oxy CEO

- Lawmaker blasts Big Oil CEOs at hearing: ‘You are ripping off the American people’

Thanks for Listening!

To share your thoughts:

- Leave a comment or question below (we read each one and your question may be featured in a future episode)!

- Ask a question or leave us feedback via email.

To help out the show:

Click the Apple Podcasts Logo Above to leave us a rating & review. It really helps us reach those that need to hear this information and only takes a minute. We greatly appreciate it! Plus, you can get a shout out on a future episode!

Thanks again – until next time!

Pingback: MRP 152: Mineral Rights News May 2022 – The Mineral Rights Podcast