In this episode we give an update on the current oil market and discuss why leading indicators like the inventory of Drilled but UnCompleted (DUC) wells is important in determining if the U.S. can grow production to meet demand (and in turn cause oil prices to fall). We also talk about the impact of the recent EU embargo on Russian crude oil and the June 2022 OPEC+ meeting and how these things will affect prices for the remainder of 2022.

As a refresher, wWe last talked about the future of the price of crude oil in MRP 143: Special Report – Impact of Russian Invasion on Oil and Gas Prices, where we talked about the impact of Russia’s invasion of Ukraine on Oil and Gas Prices.

A lot has changed since February when we recorded that episode. We’ll talk about the current supply and demand for crude oil, how the recent EU embargo on Russian crude oil could affect the market, and our outlook on crude oil prices for the second half of 2022.

Be sure to also subscribe on Apple Podcasts via the link above and please leave us an honest rating and review. We read every one of them and sincerely appreciate any feedback you have. To ask us a question to be featured on an upcoming episode, please leave a comment below or send an email to feedback@mineralrightspodcast.com.

In this episode we give an update on the current oil market and why things like the record low DUC count could mean prices could go higher before we see any relief.

We last talked about the future of the price of crude oil in March in our Special Report where we talked about the impact of Russia’s invasion of Ukraine on Oil and Gas Prices.

Global Supply and Demand

Current US Crude Oil Production

As seen above, the latest report available from the U.S. Energy Information Administration, U.S. Crude Oil production was 11,655,000 barrels per day. This is below pre-pandemic levels of almost 13 million bpd at the end of 2019. The U.S. is still the top global producer of crude oil and natural gas.

Global supply of crude oil is estimated to be 99.76 million bpd as of February 2022 as seen in the chart below.

High oil prices start to make more sense when you take a look at global demand for crude oil. Currently, global demand is around 101.38 million barrels per day which is just below the peak of 102.13 seen in August of 2019.

This means that we have an estimated crude oil supply gap of around 1.6 million barrels per day. As you can remember from economics class, when demand outpaces supply, prices tend to rise and that is what we see with crude oil.

U.S. Shale to the Rescue (Again)?

Before the pandemic, the US shale industry acted as spare capacity that was able to quickly respond to increases in prices to fill that gap but things are different this time. One way we can measure this is by looking at the number of drilled but uncompleted wells (DUCs). These are wells that have been drilled but not yet hydraulically fractured and brought on production. This is important because this represents an inventory of wellbores that producers can be completed relatively quickly and the additional supply can be brought online.

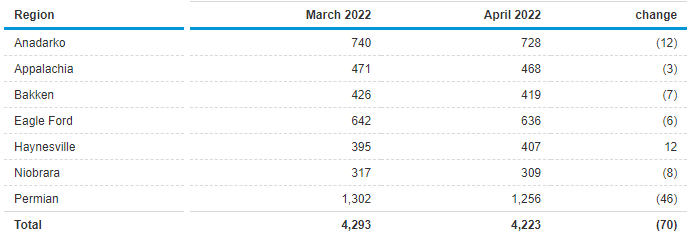

In fact, the US inventory of DUCs is near all-time shale boom lows that weren’t seen since 2014. The inventory of DUC’s sits at 4,223 wells with the majority of these (1200+) in the Permian Basin. To put this in perspective, the high was just under 9,000 in June of 2020 but has been on a sharp decline since then. A year ago (June 2021) the DUC count was around 6,100 wells.

What are some of the reasons behind the decline in DUCs?:

- Increased capital discipline by US oil and gas companies following the wave of bankruptcies seen in 2020 when oil prices went negative.

- Political headwinds from the Biden administration who has pushed the move away from fossil fuels which in turn is making access to capital more difficult.

- Even with increased cash flow, public companies are returning more cash to shareholders through share buybacks and dividend increases instead of drilling additional wells.

- Companies that are looking to increase production are faced with supply chain constraints (lack of labor and materials like pipe and frac sand).

Why is the DUC Count Important?

DUC inventory is widely seen as required to maintain a steady supply of oil and gas this is because it is an indicator of capital investment by operators. In fact, there is an interesting report from Bison Interests (an oil & gas investment fund) that indicated that the global oil market is likely much tighter than we might believe. To wit:

“When capital is abundant producers tend to boost investment and increase drilling relative to completions, and so DUC inventory rises. When capital is scarce producers prioritize well completion over new drilling, allowing them to maintain production levels with less capital – so long as there are DUCs left to be completed. “

2022 Oil Outlook & DUC Dilemma (Bison Interests)

What About OPEC?

OPEC + has typically been seen as a relief valve that has spare capacity that can be brought to market at will. At the time of this episode, there were conflicting messaging about how they are going to handle the Russian embargo. In any case, the cartel ended up raising production rates by 648,000 barrels per day for July and August of 2022. According to Reuters: “OPEC+’s record output-cutting deal, clinched in 2020 at the height of global lockdowns, expires this September by which time the group will have limited spare capacity to increase production further.”

Russian Roulette

Finally, the European Union finally decided to impose sanctions on Russian oil imports. These sanctions are gradual but eventually will impact “75% of Russian oil imports.” That said, the $35 discount to Brent crude that European refineries were enjoying in May are now a thing of the past. As a result, as the price of feedstocks rise, we will eventually see a further increase in energy prices in Europe.

Resources Mentioned in This Episode

- 2022 Oil Outlook & DUC Dilemma (Bison Interests)

- The Myth of OPEC+ Spare Capacity (Bison Interests)

- US Field Production of Crude Oil (Thousand Barrels per Day)

- Drilling Productivity Report – US Energy Information Administration (EIA) (DUC Count can be found under the DUC Wells By Region Tab in the main table)

- It’s Embargo Time – Irina Slav on Energy (I subscribe to her Substack newsletter and you should too if you want to stay on top of the global energy markets)

- Oil group OPEC+ reportedly considering suspending Russia from supply deal

- OPEC+ to stick to oil rise plan despite EU sanctions -sources | Reuters

- OPEC technical committee outcome | Seeking Alpha

- Goldman Sachs predicts $140 oil as gas prices spike near $5 a gallon – CNN

Thanks for Listening!

To share your thoughts:

- Leave a comment or question below (we read each one and your question may be featured in a future episode)!

- Ask a question or leave us feedback via email.

To help out the show:

Click the Apple Podcasts Logo Above to leave us a rating & review. It really helps us reach those that need to hear this information and only takes a minute. We greatly appreciate it! Plus, you can get a shout out on a future episode!

Thanks again – until next time!

Pingback: MRP 161: Mineral Rights News July 2022 – The Mineral Rights Podcast