The principles of the Environmental, Social, and Governance movement would seem to be moving the world in the right direction. Who wouldn’t want a cleaner environment, fair treatment of workers, and elimination of corporate bribery and corruption? Under the guise of advancing “responsible corporate citizenship”, the ESG movement has instead turned into a means for forcing an underinvestment in fossil fuel energy which we are now paying the price for.

In this episode, Justin and I talk about the origin and history of the ESG movement and some of the unintended consequences of this seemingly “good” initiative.

Be sure to also subscribe on Apple Podcasts via the link above and please leave us a rating and review. We read every one of them and sincerely appreciate any feedback you have. To ask us a question to be featured on an upcoming episode, please leave a comment below or send an email to feedback@mineralrightspodcast.com.

What is ESG?

The term is widely believed to have originated in the UN “Who Cares Wins” Report in 2004. This report refers to the UN Global Compact. “Launched in July 2000 by United Nations Secretary-General Kofi Annan, the Global Compact is an international initiative bringing companies together with UN agencies, labour and civil society to support ten principles in the areas of human rights, working conditions, the environment, and anti-corruption. Through the power of collective action, the Global Compact seeks to advance responsible corporate citizenship so that business can be part of the solution to the challenges of globalisation. In this way, the private sector — in partnership with other social actors — can help realize the Secretary General’s vision: a more stable and inclusive global economy.”

The 10 Principles Mentioned in the UN Global Compact:

The “Who Cares Wins” report proposed the categorization of these principles under the headings of Environmental, Social, and Governance. Specifically, it mentions:

Environmental issues:

- Climate change and related risks

- The need to reduce toxic releases and waste

- New regulation expanding the boundaries of environmental liability with regard to products and services •

- Increasing pressure by civil society to improve performance, transparency and accountability, leading to reputational risks if not managed properly

- Emerging markets for environmental services and environment-friendly products

Social issues:

- Workplace health and safety

- Community relations

- Human rights issues at company and suppliers’ /contractors’ premises

- Government and community relations in the context of operations in developing countries

- Increasing pressure by civil society to improve performance, transparency and accountability, leading to reputational risks if not managed properly

Corporate governance issues:

- Board structure and accountability

- Accounting and disclosure practices

- Audit committee structure and independence of auditors

- Executive compensation

- Management of corruption and bribery issues

The Evolution of Subjective ESG Reporting

It started out as a small percentage of asset managers and companies subscribing to sustainability to over 2450 signatories representing over $80 trillion in Assets Under Management committing to ESG.

One of the biggest issues with ESG is the lack of consistency and transparency around reporting on ESG metrics. No surprise that the big 4 consulting firms are putting together a set of metrics designed to “create a systematic market-driven” metric system. It makes you wonder how much they are getting paid to put this together, certainly this isn’t being done out of the kindness of their hearts.

The current World Economic Forum framework covers four key areas:

- Principles of Governance

- Environmental

- Human Capital

- Prosperity

The Pros and Cons of the ESG Movement:

Pros:

Incentivizes companies to “do the right thing”. For example, with a focus on ensuring that diverse viewpoints are represented within the management teams of publicly traded companies. This might lead to more opportunities for qualified women to have a voice.

It highlights issues that require attention and can direct companies to change business practices. For example, Apple supplier Foxconn (amongst others) was accused of labor abuses at an iPhone factory. It caused Apple to make adjustments to supplier requirements and relationships.

Cons:

Measurement and reporting is subjective

Incentivizes “greenwashing” (companies to overstate ESG claims). For example, somehow google claims that they are 100% renewable and somehow they changed the definition such that carbon neutrality “still allows for carbon emissions” (at least according to Google’s sustainability lead).

- Allows groups pushing a particular narrative to have too much power over financial decisions. For example, influencing BlackRock to promote ESG – have oversized voting power due to the amount of assets under management. A case could be made that this helped influence the fossil fuels “divestment” movement which resulted in an underinvestment in the energy sector which we are now feeling the consequences of.

- Climate models have been consistently wrong. What if we are headed down the path of more expensive and less reliable energy (solar / wind) when it really won’t make a huge impact. Characterizing all fossil fuels as dirty is subjective. The reality is that energy related CO2 emissions have decreased by almost 2% between 2007 and 2019.

- The hypocrisy of ESG is that it generally favors wind and solar energy over fossil fuels and nuclear. The immorality of this is ironic because it restricts developing countries access to energy which is critical for human flourishing (which would be a Social benefit).

According to Alex Epstein of energytalkingpoints.com: “Low-cost, reliable energy enables billions of people to enjoy the miracle of modern machines that make us productive and prosperous. Yet 800M people have no electricity and 2.6B people are still using wood or dung for heating and cooking.2”

- If the ESG movement were truly objective it should be balancing lifting people out of poverty as a positive ESG side effect of fossil fuels and nuclear power.

Nuclear is Low-Carbon

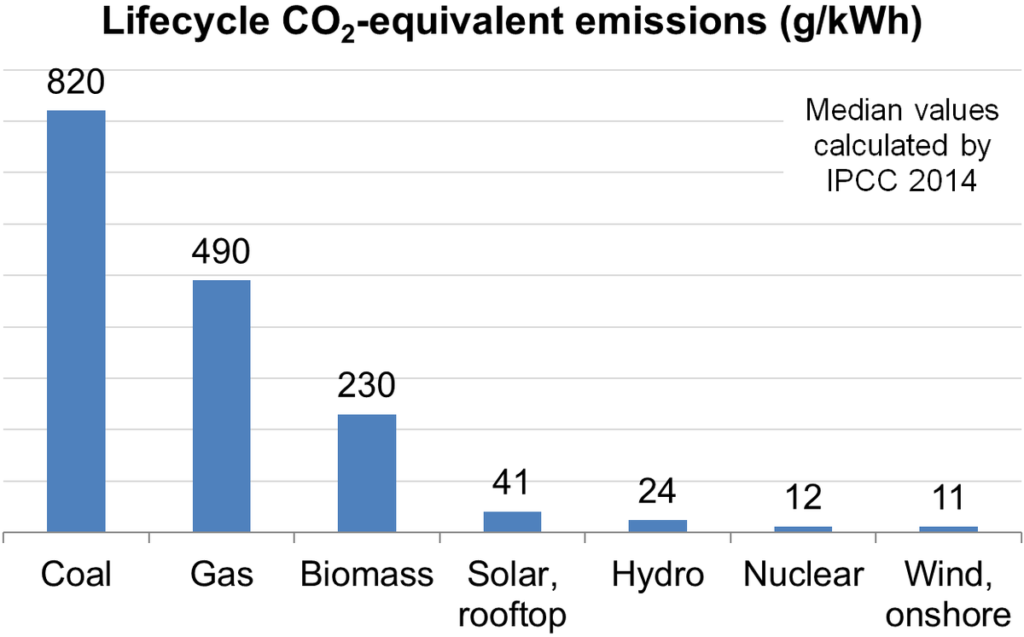

Nuclear power plants produce no greenhouse gas emissions during operation, and over the course of its life-cycle, nuclear produces about the same amount of carbon dioxide-equivalent emissions per unit of electricity as wind, and one-third of the emissions per unit of electricity when compared with solar.

How Does ESG Affect Oil & Gas

- It seems that when we talk about ESG we seem to focus more heavily on the Environmental part and not Social and Governance. In general, it seems that the ESG movement has negatively affected the oil & gas industry by forcing banks to not invest in fossil fuels.

- In another example, Royal Dutch Shell lost a lawsuit by environmentalists in the Netherlands requiring them to decrease emissions. This eventually caused Shell to move its headquarters to London and become UK only registered company. whereas before it was registered in both the Netherlands and the U.K. It could be argued that this move was bad for shareholders.

- The divestment from fossil fuels and resulting increased investment in solar and wind seems to be solely due to the focus on the Environmental part of ESG. Somehow environmentalists overlooked the S and G part of ESG when promoting this transition. Specifically, the use of child labor for Cobalt mining in the Congo and China using Uyghur slave labor to manufacture solar panels.

Resources Mentioned in This Episode

- China uses Uyghur forced labour to make solar panels, says report – BBC News

- Demystifying ESG: Its History & Current Status

- ESG (Environmental, Social and Governance) – Overview and Framework

- Who Cares Wins

- MRP 114: The Dark Side of the Energy Transition and the ESG Movement

- Energy Talking Points | ESG Divestment

- Shell: Netherlands court orders oil giant to cut emissions – BBC News

- How can nuclear combat climate change?

Thanks for Listening!

To share your thoughts:

- Leave a comment or question below (we read each one and your question may be featured in a future episode)!

- Ask a question or leave us feedback via email.

To help out the show:

Click the Apple Podcasts Logo Above to leave us a rating & review. It really helps us reach those that need to hear this information and only takes a minute. We greatly appreciate it! Plus, you can get a shout out on a future episode!

Thanks again – until next time!

Pingback: MRP 174: $1.5 Billion Lithium Deposit Discovered in Maine – The Mineral Rights Podcast