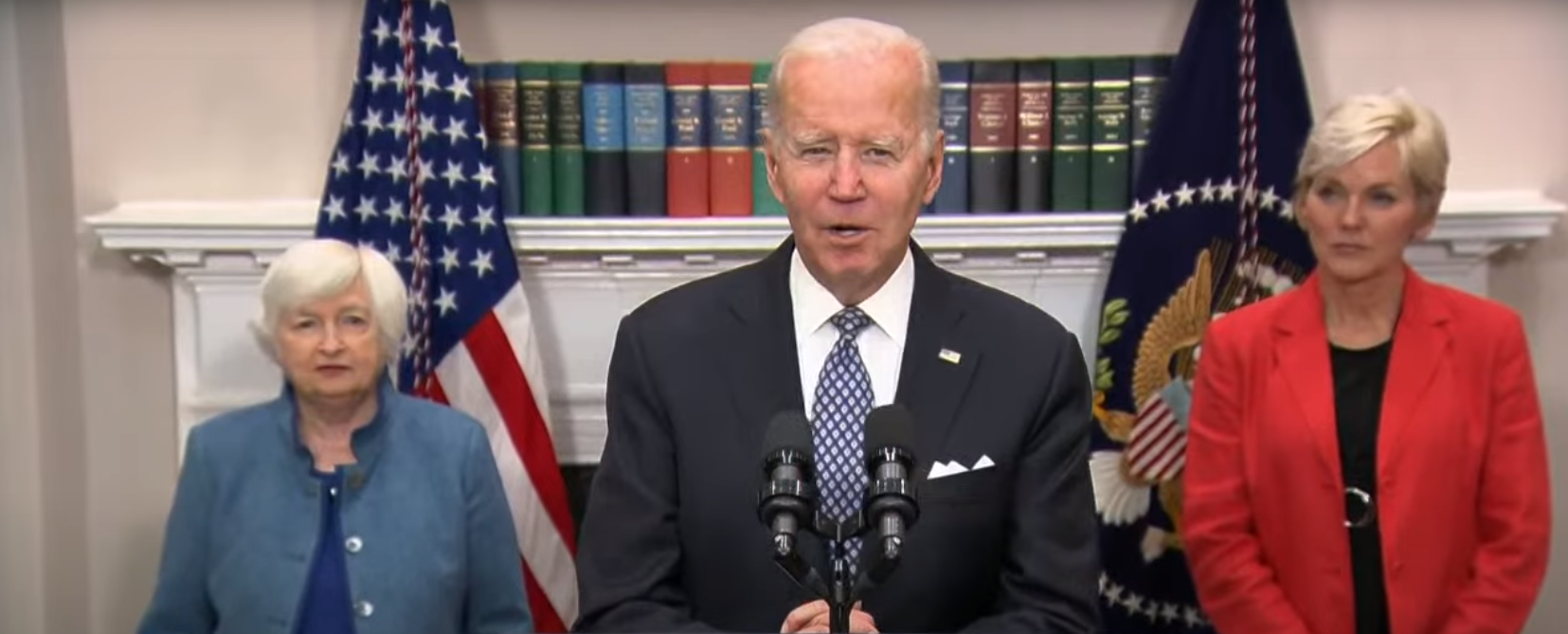

On October 31st, Joe Biden made remarks about gasoline prices and how oil companies reported record profits in the 3rd quarter of this year. His short speech hit on several key points including his tapping the Strategic Petroleum Reserve in an effort to reduce prices at the pump but his main focus was on oil company profits. By returning profits back to shareholders, he claimed that the industry has “not met its commitment to support the American people.” He acknowledged that companies should earn a fair return for innovation and at the same time claimed that current oil company profits are a result of profiteering instead of innovating. In this episode, we react to this claim and provide examples of how oil industry profits are a direct result of innovation and this has resulted in lower energy prices here in the U.S.

Be sure to also subscribe on Apple Podcasts via the link above and please leave us an honest rating and review. We read every one of them and sincerely appreciate any feedback you have. To ask us a question to be featured on an upcoming episode, please leave a comment below or send an email to feedback@mineralrightspodcast.com.

“Record” Oil Company Profits in Crosshairs

On one hand, the President claimed that “companies should earn a fair return for the work they do and innovation they generate”. While on the other hand he keyed in on the fact that Shell reported $9.5 billion in profits in 3rd quarter and Exxon announced $18.7 billion in profits in 3rd quarter – triple what they made last year and a record for the company.

We talked about his claim that Exxon made more money than god last year in our August 2022 News Episode which we recorded live from the National Association of Royalty Owners convention in Denver. In that episode, we discussed how oil company profit margins compare to other industries and they are not the highest. Tech, pharmaceuticals, and financials are the three most profitable industries.

For the 3rd quarter, Exxon’s $18.7 billion in earnings that President Biden referred to, resulted in a 16.7% net profit margin. If we compare to Apple – they reported net income of $20.7 billion for the third quarter which results in a 22.9% net profit margin.

In his speech, the President also suggested that if these oil companies invested profits in the US to increase production, it would help bring prices down. Instead he mentioned that they are returning money to Shareholders by buying back shares and increasing dividends. In the bigger picture, investors are demanding this because of the years of mismanagement of capital by the industry and resulting losses as companies invested more than they brought in during the shale revolution.

There were no talks of bailing out the oil companies when oil prices went negative in 2020 which resulted in significant losses for these same companies.

Record Oil Profits Are Due to Innovation

On October 31st, 2022 President Biden made remarks about the recent announcement of record profits by several oil and gas companies. One thing that President Biden said in his remarks that is misleading and simply not true: “Record profits today are not because they are doing something new or innovative, their profits are a windfall of war.”

I saw an excellent post on LinkedIn recently that commented on this statement. The post highlighted some of the amazing innovations in the oil & gas industry that resulted in our ability to unlock the puzzle of extracting oil and gas from shale formations which has lower porosity and permeability than the sidewalk in front of your house. Porosity and permeability are the measures of the ability for oil and gas to flow through a formation. In fact, due to their extremely low porosity an permeability, most shale formations were previously seen as an impenetrable seal to oil and gas.

By marrying horizontal drilling and hydraulic fracturing, engineers were able to economically extract large quantities of oil and gas from these formations. We refer to this often on this show as the “shale revolution”. Today, we are able to drill a well one to two miles below the Earth’s surface and then two to three miles horizontally all while staying within a narrow window where the target formation exists. This is the definition of innovation.

U.S. Now the Leading Oil Producer

The United States went from producing around 5 million barrels per day in 2007 to over 13 million barrels per day before the pandemic as a direct result of this innovation. Prices at the pump today would likely be closer to the prices in Europe if it weren’t for this advancement in technology.

The author of the LinkedIn post rightly claims (in my opinion) that the profits the oil & gas industry are reporting today are as a direct result of the innovations made over the past 15 years. In addition to the major advancement of horizontal drilling and hydraulic fracturing, companies have continually improved their operations. Where it may have taken more than three weeks to drill a well in 2007, now it can be done in 5 days. Companies are using electric powered drilling rigs and frac spreads as compared to burning diesel, they have changed from natural gas operated valves to pneumatic or electrically actuated valves, all resulting in decreased CO2 and methane emissions.

The hard working men and women in the oil & gas industry in the United States deserve to be celebrated instead of singled out and ridiculed. They are already serving their country by producing the critical natural resources we need to continue our current standard of living.

Windfall Profits Tax – Not Again!

To close out the speech the President again hinted at windfall profits taxes when Congress is back in session and that he would be exploring this. This would have the exact opposite effect of what he claims to want, reinvestment in the US oil and gas industry to increase production. Instead, it would result in a further decline in investment and as a result lower oil production.

It would be interesting to see how much outrage would ensue if the president called for a windfall profits tax on every company making more than some arbitrary amount of net profit in a given quarter. What would happen if he called for a windfall profits tax on big pharma or tech or the financial industry. Surely he would face opposition from the politicians who are profiting from their investments in these industries over the past several years. What would Americans think about this socialist policy?

How Do U.S. Energy Prices Compare?

The oil & gas industry in the United States, should be recognized for their contributions in allowing Americans to have some of the lowest energy costs of any country in the world. For example, U.S. Henry Hub natural gas prices were $6.63 per million British thermal units (MMBtu) on September 30, 2022. In Europe, Dutch TTF gas futures were 123.35 euros per megawatt hour on October 31, 2022 (this is around 36 euros per MMBtu). Dutch TTF is seen as a Europe-wide natural gas price benchmark. In Japan, LNG prices were nearly $22 per million Btu’s, more than 3x the price in the US.

Resources Mentioned in This Episode

- ExxonMobil announces third-quarter 2022 results

- Apple 4th Quarter 2022 Results

- Biden to American Oil & Gas Workers: Drop Dead (LinkedIn Post)

- MRP 165: Live from NARO Convention! Mineral Rights News August 2022

- ‘Big Oil’ & The Fallacy Of A Windfall Profits Tax | ZeroHedge

- Democrats blame oil companies for high fuel prices. But the facts don’t back them up.

- Big Oil isn’t as rich as everybody thinks

Thanks for Listening!

To share your thoughts:

- Leave a comment or question below (we read each one and your question may be featured in a future episode)!

- Ask a question or leave us feedback via email.

To help out the show:

Click the Apple Podcasts Logo Above to leave us a rating & review. It really helps us reach those that need to hear this information and only takes a minute. We greatly appreciate it! Plus, you can get a shout out on a future episode!

Thanks again – until next time!