In this episode, we answer questions related to leasing for a stratigraphic test well, how to establish the cost basis for mineral rights that are sold, saltwater disposal wells, best practices for selling non-producing mineral rights, and more! Thanks to Karl, Kimberly, Cara, and Danielle for submitting your questions!

My upcoming Mineral Management Basics course addresses many of the common questions that I get around the different types of mineral and leasehold interests, how to read a legal description, and how to identify nearby oil and gas activity. Be sure to sign up to be on the wait list to be notified when it launches later this year! In the meantime, if you would like 1-on-1 coaching, you can send me an email at feedback@mineralrightspodcast.com.

There is also an amazing free tool that can help you automate some of the things related to tracking nearby activity and tracking your royalty payments. Which brings me to the sponsor for this episode:

MineraliQ is a free online platform for mineral owners which will automatically connect to your well data – helping to track all your royalty check payments and portfolio value. Discover what your minerals are worth in real-time, view royalty payments, track income trends, and know the exact location of your properties using their interactive map. Activate your free account today by clicking the link here: MineraliQ.com

Thanks again to everyone who left a review or who submitted a listener question! If you have a question about your minerals or royalties, you can send it to feedback@mineralrightspodcast.com and who knows we might just answer it on the air!

If this has been helpful, please take a moment and leave us an honest rating & review on Apple Podcasts. This feedback really helps keep us going and helps make sure that we are putting out content that is tailored to your needs.

Listener Questions

My #1 challenge is to educate my wife and I so we do not make a major mistake that could have over 40 years of consequences.

So far your site seems to have the best most useful information. Your article “Here are our top 10 lease provisions to look out for when negotiating an oil and gas lease:” is one of the shortest most informative and useful articles I have ever read.

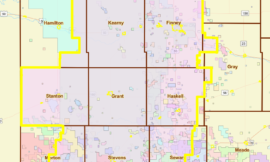

My wife and I are land owners of approx 240 acres. About 6 months ago [a company] was offering leases on land 1 mile north of me a land owner asked me to inform him if we were offered a lease. 2 weeks ago we received a lease offer in the mail so I contacted 2 of my neighbors to the north and they said that they thought the lease was bad and that they thought that the company was deceptive and that they thought their neighbor was purposely deceived to get him to sign a lease to allow drilling. I also assume all companies start negotiations very favorable to themselves. Since then I have found out that this company has 10 or 11 drill sites in a 50 mile radius and it looks like all drilling is 1200′ to 1500′ for Stratigraphic tests. Some drill sites have already been plugged and abandoned some have not been drilled yet.

We declined to sign the lease because neither of us think there is any oil or gas, we thought the terms were unsatisfactory and we do not want a drill site on our land. And now we are trying to educate ourselves in the event there is a profitable amount of minerals under our land.

Some of our questions now are.

- If they find oil what is a fair lease?

- What happens after a Stratigraphic Test?

- Is the lease probably over after a well is plugged and abandoned or is the stratigraphic test just the beginning?

- What are the laws if we don’t sign but we are assigned to a pool?

- Is it beneficial to not sign if lease terms are unsatisfactory.

- Something about a 200 to 300 percent penalty for not signing.

- Also some states allow for best terms by not signing.

The more we learn the more we realize how little we know.

I personally think there is no oil or gas and this event is over for us.

Thank you,

Karl

Question #2

Hi Matt,

My mother just sold a portion of her mineral right on an inherited property. I’m trying to determine if there is a easy way to establish a cost basis at the time of inheritance (2004) so that I don’t have to declare the entire sale as LT capital gains on her taxes. Sale price does not justify paying for research.

I’ve contacted a firm local to where the property is in WV and asked for an estimate to do the look back. Her current excess tax liability due to the sale is roughly $8,500 if I use a $0 basis. Not sure if it is worth the effort but she owns 3 properties with varying percentages of mineral rights and she is in her late 80s.

Kimberly

Question #3

How do you find buyers for non-producing oil and gas mineral rights in Colorado?

Cara

Question #4

Hi Matt,

I can’t express how happy I am to discover this podcast!! Listening to this one episode #83 I learned more about the surface well operation than I have been able to find combing the internet since last September.

I bought 40 acres that is right next door to my current 2nd home and intend to move and live there permanently in the next year. I also bought the mineral rights and about 3 acres has a surface use agreement for a salt water disposal well that is actively being used every day.

This property is located in Northern Michigan. There is a lease agreement that was in affect for 15 years starting in March of 2006 so it I thought it was expired and contacted the operator.

They told me that the lease is not expired because the had a clause in the original lease that states “or as long as operations are ongoing”. So they had been paying the prior owner $1500 per year. They have offered to raise that to $2000 per year.

Since I thought the lease was expired, I had really not thought about the income from this and asked for $5500 per year or I would rather have them cease operations. They have not said no to the amount-and we are still negotiating some other terms. The lease is very vague. He did say this is a vital part of their operation because it connects with 3 other wells in the area.

I had a phone meeting with the owner and a land man that helps him negotiate. The land man was not very willing to make any changes and certainly not in the term of the lease term as far as making it shorter and reviewed annually.

So I guess I would like to know how to deal with this sort of lease that comes along with the property that seems to be never ending.

Any input you have would be much appreciated so I have a bit more knowledge going into the next meeting.

Thanks for any help you might have.

Danielle

Resources Mentioned in this Episode:

Matt’s YouTube Channel

Steps Involved with Drilling a Well / Saltwater Disposal Wells

- MRP 15: They are Going to Drill on my Land – How Long Before I Start Getting Paid Oil & Gas Royalties? (Hint: It Might Be Faster than You Think!)

- MRP 83: Saltwater Disposal Well Agreements

- MRP 23: How to Negotiate a Surface Use Agreement

Taxes

- MRP 20: Taxes on Mineral Rights and Royalties

- MRP 146: How Mineral Rights and Royalties are Taxed in 2022

- MRP 32: Rob Prentice on IRS Mineral Rights Valuation and the National Association of Royalty Owners

Negotiating an Oil & Gas Lease

- For help with negotiating tactics, I really like the book Never Split the Difference by former FBI hostage negotiator Chris Voss.

- MRP 6: How to Negotiate an Oil and Gas Lease

Mineral Rights Education

- MRP 120: Listener Stories – Mineral Owner Barb Rankin (Features Curated List of Resources if you are getting started)

- Mineral Rights Podcast Academy (Coming Soon!)

- 1-on-1 Coaching with Matt

How to Sell Mineral Rights

- MRP 70: 5 Tips if You Are Thinking About Selling Mineral Rights

- MRP 78: How to Sell Your Mineral Rights or Royalties For The Highest Price

Thanks for Listening!

To share your thoughts:

- Leave a comment or listener question below (we read each one and your question may be featured in a future episode)!

- Ask a question or leave us feedback via email.

To help out the show:

- Leave an honest review on Apple Podcasts or wherever you get your podcasts – we read each one and greatly appreciate it. Plus, you can get a shout out on a future episode!

Thanks again – until next time!