This is the first in our series about the major producing oil and gas basins and plays in the US. We provide an overview of the key facts and things you should know if you own minerals in the DJ Basin. Please let us know if this is useful and if you have any requests on a particular area that you would like us to cover!

Using the embedded player above, you can download the episode to your computer or listen to it here! Be sure to also subscribe on iTunes or wherever you get your podcasts and please leave us an honest rating and review. We read every one of them and sincerely appreciate any feedback you have. To ask us a question to be featured on an upcoming episode, please leave a comment below or send an email to feedback@mineralrightspodcast.com.

What is the Denver – Julesburg Basin or DJ Basin?

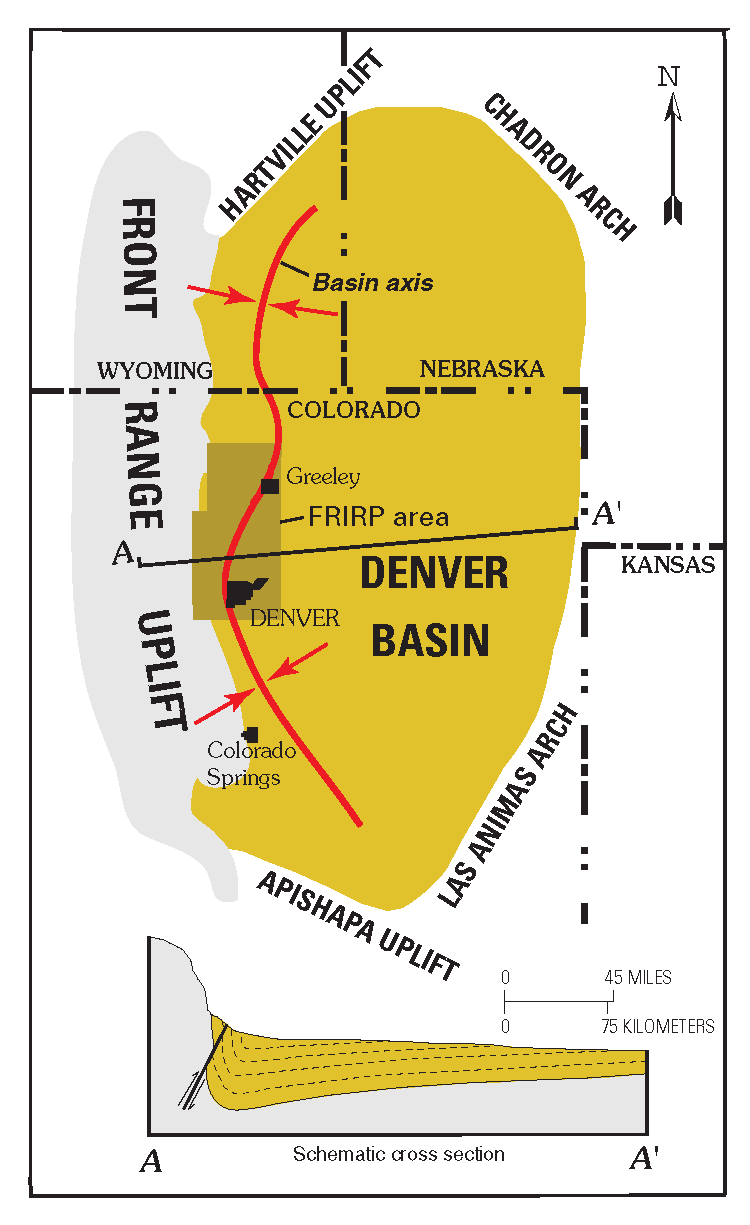

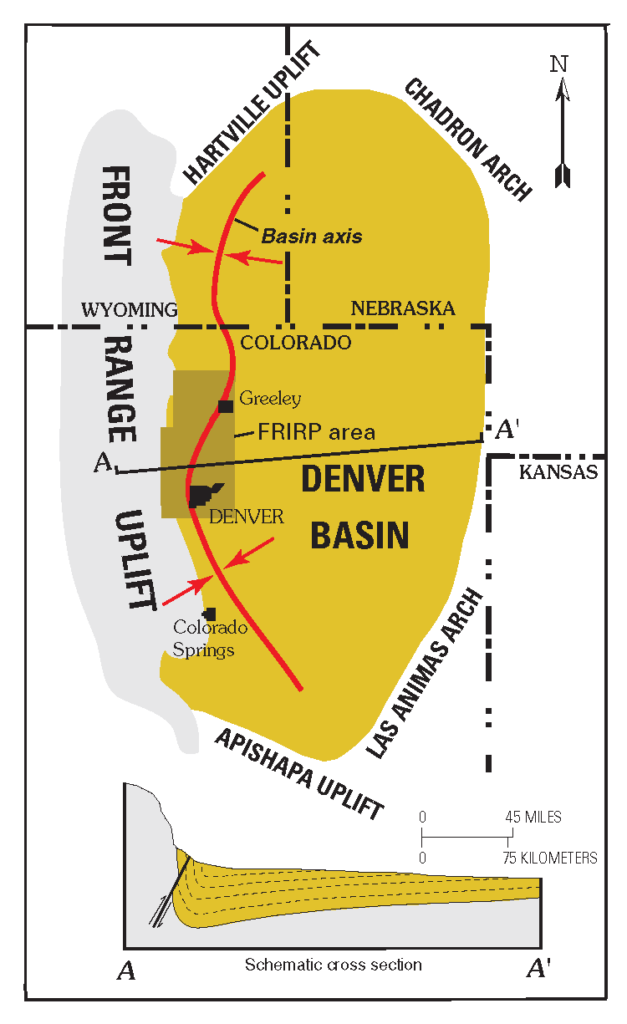

Location of the DJ Basin:

- Northern Colorado, Eastern Wyoming, Parts of Western Kansas and Nebraska. For reference, extends Primarily North to South from North of Cheyenne Wyoming down to Colorado Springs.

- Primary producing field is the Wattenberg gas field in Weld County and Northwestern Adams County in NE Colorado.

- Did you know that the DJ basin dates back to an oil discovery made in Boulder County Colorado in 1901?

What is the Geology of the DJ Basin?

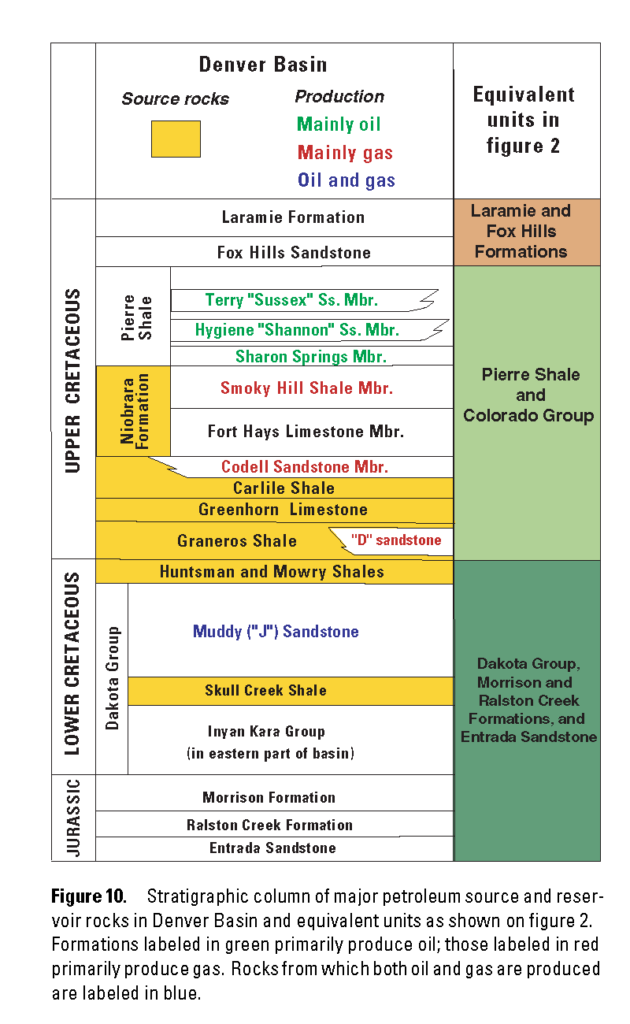

- Stacked plays – like other basins (Anadarko Basin w/ Scoop, STACK, Permian, etc.)

- Production primary from formations that were formed during the Cretaceous period between 145 and 66 million years ago.

- Most of central north america was shallow sea

- Trivia – the cretaceous (along with the Mesozoic) ended with the Cretaceous – Paleogene extinction event which as the large mass extinction event that took out many groups (eg. Non-avian dinosaurs other marine reptiles). Meteor or comet hit the earth.

- Stratigraphic section – top to bottom notable intervals are:

- Sussex

- Shannon

- Niobrara formation (sometimes hear smoky hill shale member) aka Niobrara Chalk.

- Codell Sandstone (does not occur everywhere in DJ Basin)

- Carslile Shale

- Greenhorn Shale

- Graneros Shale – notable formation is the “D” sandstone or “D Sand”.

- Lower – in Dakota Group there is the Muddy J Sandstone or aka “J Sand” which a lot of vertical conventional wells produced from across DJ basin since 60’s and 70’s.

Primary reservoirs currently being developed include the Niobrara (Niobrara) and Codell.

- Niobrara formation – is a chalk and is composed of two structural units, the smoky hill chalk member and the fort hays limestone member.

- Codell – fine grained sandstone. Low permeability. Not prospective throughout the entire DJ basin since it thins out to the east. Just below the niobrara formation.

- Hydrocarbons from both Niobrara and Codell units are commingled in many producing wells, so combined interval is often called the Codell-Niobrara Interval or Niobrara-Codell.

- Notable thing about the Wattenberg field is that it is thermally mature (meaning it has been “cooked” more). Core wattenberg has lot of wet gas meaning higher Gas to Oil ratios (gas condensate).

Why is the DJ basin so productive now?

- Combination of horizontal drilling with staged hydraulic fracturing or “fracing”

- Horizontal drilling reaches millions times more reservoir than an old vertical well.

- Drill down to the target formation and then go horizontally for one or two miles.

- Then they fracture the rock using hydraulic (water) at high pressure along with proppant (like sand) to keep fractures open.

- Staged frac’ing refers to fracing along the length of the wellbore in different stages and then plugging and moving back and fracing the next stage. At the end they drill out plugs and flowback the well to remove frac water and sand.

- Two technologies have been around for a long time. Did you know that first frac was performed in 1947 in Kansas?

- 80% of crude oil produced in Colorado comes from DJ basin (per CO Energy Office).

Infrastructure (Pipelines, Gas Takeaway, Refining, etc)

- Current capacity constraints in transporting and processing natural gas that is produced with the crude oil. This causes higher pipeline pressures which acts to back up or curtail production at the wellhead.

- Several companies like DCP Midstream Partners are building new gas processing plants and associated infrastructure to help alleviate the high line pressures.

- The additional gas processing capacity expected to come online by end of 2018 should help.

- Has impacted where companies were drilling (e.g. they drill in lower GOR (gas to oil ratio) parts of basin so they are not as impacted by this).

Geologic Risk

- Refers to the possibility that you won’t get as much oil or gas as expected or to the difficulty for accessing the reserves.

- Geology fairly well understood in DJ basin, they are “exploring” certain parts of the edges of the basin to assess if drilling will be economic there. But not like the “exploration” you might associate with a conventional oil and gas play where you are betting that the source rock migrates to the reservoir rock and is held there by some type of trap or seal. They drill a conventional exploration well to see if they were right and there are much lower success ratios in those cases (e.g. only around 1/3 of exploration wells lead to commercial discoveries). Other wells that don’t produce hydrocarbons are referred to as “dry holes”.

- In DJ basin, Niobrara is fairly uniform throughout, trying to assess whether hydrocarbons can be produced commerically in one area vs. another. In well understood parts of the basin, like the wattenberg field, really no dry holes are drilled. There if the well doesn’t produce it is because the operator probably screwed up and missed the formation while they were geo-steering the well.

- That said, Niobrara/Codell are only economically productive in certain areas of the DJ Basin so while there technically may be oil & gas somewhere, it may not be economic to produce at current oil & gas prices.

- Brings to next item: Economic Risk

Economic Risk

- Commodity prices

- Some wells economic to drill at current oil prices around $60/bbl oil, $3/mcf natural gas

- More become economic to drill at higher oil prices, less at lower oil prices.

- To put in perspective, in August 2018 presentation Extraction Oil & Gas reported their Development Costs at $8.72 / BOE (that is future development costs per proved undeveloped reserves) (development costs includes things like acquiring leases, constructing surface facilities, drilling and completing wells).

- Different than lifting costs or cost to operate and maintain wells (usually lower).

Political Risk

- Colorado has been progressive in setting oil and gas regulations

- Proposition 112 – Setback Requirement for Oil and Gas Development that would have required at least a 2,500 ft setback from any occupied structure and any area designated for additional protection. Fortunately, this ballot initiative was defeated in November 2018

- SB 19-181 – Comprehensive overhaul of oil and gas regulations in Colorado. This bill was introduced in the Colorado Legislature and passed in 2019. Here is a link to the Colorado Revised Statues as amended by SB 19-181. This bill may have significant impacts to the way that oil and gas is developed going forward. If you own minerals in Colorado, you can sign up on the COGCC website to be informed of any rulemakings as they are published.

Thanks for Listening!

To share your thoughts:

- Leave a comment or question below (we read each one and your question may be featured in a future episode)!

- Ask a question or leave us feedback via email or voicemail: (720) 580-2088.

To help out the show:

- Subscribe and leave a review on iTunes or wherever you get your podcasts – we read each one and greatly appreciate it. Plus, you can get a shout out on a future episode!

Thanks again – until next time!