This is the third episode in our series about the major producing oil and gas basins and plays in the US. The goal is to provide you an overview of the key facts and things you should know if you own minerals or royalties in the area. Please let us know if this is useful and if you have any requests on a particular area that you would like us to cover.

Using the embedded player above, you can download the episode to your computer or listen to it here! Be sure to also subscribe on iTunes or wherever you get your podcasts and please leave us an honest rating and review. We read every one of them and sincerely appreciate any feedback you have. To ask us a question to be featured on an upcoming episode, please leave a comment below or send an email to feedback@mineralrightspodcast.com.

Now, let’s dive into our overview of the Powder River Basin

The Powder River Basin is located in Southeast Montana and Northeast Wyoming. It is about 120 miles East to West and 200 miles North to South.

Fun fact: the Powder River Basin is originally known for its coal deposits. In fact, the basin supplies about 40 percent of the coal in the US according to the US Energy Information Administration. In fact, it has become the single largest source of coal mined in the US, and one of the largets coal deposits in the world.

Since most of the coal in the Powder River basin is on federal lands, we’re not going to talk about it in detail. Instead, we’ll focus on the oil and gas deposits today. In fact it was one of the largest sources of natural gas in the US back around 10 years ago. Most of this gas came from coalbed methane.

The name comes from the fact that this area is drained by the Powder River amongst others. Generally speaking, it is pretty sparsely populated. The major towns in the Powder River include Gillette (pop around 32,000) and Sheridan Wyoming (pop around 18,000) and Miles City Montana (pop around 8,400)

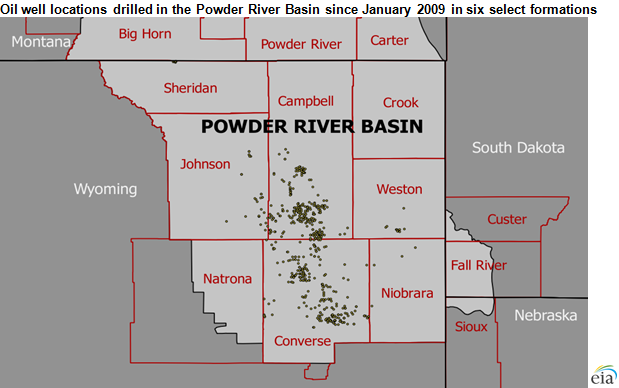

Counties that are part of the Powder River Basin include Campbell, Converse, Johnson, Natrona, Weston, and Niobrara Counties in Wyoming and Big Horn and Powder River counties in Montana.

Geology:

The USGS Published a comprehensive review of their assessment of potentially undiscovered oil and gas in the Powder River Basin. It is quite lengthy but has a ton of detailed information.

Geologic Overview:

- Like we have talked about in the DJ Basin and Permian Basin overview episodes, the Powder river also has stacked oil and gas plays coming from multiple formations.

- Oil and gas is produced from rock that ranges in age from around 300 million years ago to 60 million years ago or more recent than that.

- Most production comes from the Cretaceous period which was 145-66 million years ago.

- Breaking this down we will talk about the upper cretaceous and the lower cretaceous with the Niobrara total petroleum system (TPS) forming the upper and the Mowry shale forming the lower.

- The upper cretaceous has been a target for exploration since the 1950’s when the Dead Horse Creek field was discovered and more recently, several discoveries in the 1970’s were made whereby stratigraphic traps were identified as an important target in order to ensure success

- Within the Niobrara TPS there are several formations of note – list top to bottom:

- Mesaverde – Lewis Sandstones (Parkman sandstone part of the Mesaverde formation primarily in West PRB)

- Sussex-Shannon Sandstones

- The Niobrara carbonate formation which is believed to have been the source rock for these first two conventional targets

- And then finally the Frontier-Turner Sandstones

- Next, we’ll talk about the lower cretaceous which is where the Mowry Total Petroleum System falls. It generally includes:

- The Lower Cretaceous Fall River-Lakota Sandstone (conventional reservoirs).

- The Lower Cretaceous Muddy Sandstone which is where a lot of the conventional oil and gas production came from historically. In fact Muddy Sandstone oil production was first established in the late 1800’s in the Fiddlers Creek and Clareton fields on the East side of the basin,

- The Mowry Shale which is the main oil source for the lower cretaceous reservoirs in the basin (e.g. this is the source rock).

- Now all of these from the Parkman down past the Muddy to the Dakota results in around 4,800′ of stacked pay (of course depending on what part of the basin you are in). So lots of targets that operators are going after.

Conventional Oil and Gas Formations:

- Like I alluded to earlier, most of the historical production came from vertical oil and gas wells drilled into a trap of some kind where an oil and gas reservoir is found. These are what are called “conventional” oil and gas wells. These usually have a very low success rate, think on the order of only 1 out of 3 wells are successful with conventional oil and gas exploration.

- In addition to the Muddy Sandstone, another conventional formations that has been targeted since around the 1950’s is the Minnelusa formation.

Unconventional Oil and Gas Formations:

- Now some of what was historically considered source rock is being targeted with horizontal drilling and hydraulic fracturing. So these are what are considered the more unconventional plays, the shale and tight sands like the Niobrara formation and the Mowry shale. But pretty much all of the formations I mentioned are currently targets of horizontal drilling, especially across the southern part of the Powder River Basin.

- We’ll talk about geologic risk later but generally the unconventional plays are lower geologic risk than the conventional plays, but it can depend greatly on how much we know about the play and the geologic attributes that dictate whether or not a well will be successful.

Why is Powder River Basin a relatively hot area right now?

- Like we mentioned in our episode about the DJ Basin and the Greater Permian Basin, it is because of the combination of the use of horizontal drilling and hydraulic fracturing to open up these rocks to allow oil & gas to be produced from what had historically been considered a seal (not porous or permeable enough to flow on its own).

- Like other unconventional plays, operators drill down to the target formation which generally is over a mile deep and then go horizontally for one or two miles.

- Then they fracture the rock using hydraulic (water) at high pressure along with proppant (like sand) to keep fractures open.

- These two technologies have been around for a long time but it is more recently that they were combined to allow oil and gas to be produced from unconventional plays (e.g. shales).

TRIVIA CONTEST (OCTOBER 2019)!!!

A piece of trivia I mentioned in DJ Basin episode (Episode 28): What year was the first “frac” was performed? (Hint, it was in Kansas). If you know the answer, email me at feedback@mineralrightspodcast.com before the end of October 2019. I’ll pick one of the emails with the correct answer to get a free mineral rights consultation (valuation, help with reviewing a lease, whatever you need). Remember, the contest ends at 11:59 pm October 31, 2019!!

Major Operators in the Powder River Basin:

Here is some interesting information about a few of the major oil and gas operators with significant acreage in the Powder River Basin:

- Anschutz (privately held) has the largest position at around 460,000 acres

- Anadarko (Oxy) has around 445,000. With Oxy’s recent acquisition of Anadarko there is some speculation that there is a good chance that their position in the Powder River Could be sold to help pay for the acquisition. The big issue right now is the publicly traded oil and gas operators across the board are having a hard time getting support for any acquisitions not part of the permian basin. Plus, one of the downsides with the Powder River is it is still relatively early days in terms of proving up the acreage and proving to investors that wells can be drilled economically there. Some really promising results but will have to wait and see if they can get well costs down.

- Then EOG with around 400,000

- Devon Energy with around 330,000 acres

- And Chesapeake with around 213,000 acres

Here are a few highlights from a couple of these operators and shows they are bullish on the potential of the Powder River Basin:

- Chesapeake (CHK) – Q2 2019 Investor Presentation:

- CHK has around 213,000 net acres in Powder and they expect to drill and complete (bring online) 68 wells in 2019. They are currently running 5 rigs and 2 frac crews and are planning to spend around $500 million there this year.

- They have reported good results in the Turner formation. They reported a single well production record with the RRC 5 well coming online at greater than 4,000 boe/d including gas and 3,000 bo/d. That well has around 160k bbls of oil cumulative production in the first 4 months. They have two wells that they reported which came in with a higher cumulative production than the rest of Chesapeake’s Turner wells (and wells reported by their peers) so it is hard to say if these are outliers or if they are on to something

- EOG Resources:

- According to a map in their Q2 2019 investor presentation, they consider the core area basically the Eastern part of Johnson County, the Southwest part of Campbell County and the North Part of Converse County.

- In a recent investor call, they said: “In 2018, we added more than 1,500 premium net drilling locations and nearly 2 billion barrels of oil equivalent of net resource potential through the addition of Mowry and Niobrara shale plays and new locations identified in the Turner sand,” said Billy Helms, chief operating officer. Read more about EOG’s plans in the Powder River Basin.

- In their 2nd quarter investor presentation from August 2019 this is up to 1630 net undrilled premium locations with 875 in the Mowry, 555 in the Niobrara, and 200 in the Turner.

- EOG defines “premium locations” as minimum of 30% direct After Tax Rate of Return with flat $40 oil and $2.50 natural gas.

- An interesting table that EOG included in their investor presentation shows how their acreage in the Powder stacks up against their other “premium plays” which include the Eagle Ford, Bakken, Wyoming DJ basin, and Woodford Oil Window (Oklahoma). The Mowry/Niobrara wells in the Powder have the highest reserves (Estimated Ultimate Recovery) of 1,700 Mboe gross (Mowry) and 1,400 Mboe Gross (Niobrara) but also the highest total well costs of around $6MM (normalized). EOG’s Wyoming DJ basin wells have a reported total cost target of $4MM per well but also around 1/2 the EUR per well (695 Mboe gross).

Across all operators, there are around 21 rigs running in the Powder as of 9/13/19 according to shaleexperts.com.

Now let’s talk about some of the risks associated with oil and gas activity continuing to grow and expand in the Powder River Basin.

Economic Risk:

Economic risk is closely tied to commodity prices. Wells that are currently economic to drill at oil prices around $55-60/bbl oil $2.50/mmbtu natural gas may not be if the prices fall. If prices drop significantly, it could cause a slowdown or stoppage in drilling new wells.

This is part and parcel of doing business in the oil and gas industry and the Powder River is no exception to this. I would put economic risk higher in the Powder River Basin due to a few factors including the fact that the unconventional plays currently target of horizontal drilling are still being delineated as well as other factors that we will touch on later.

Political Risk:

- My sense is that it is pretty low being that the basin includes Wyoming and Montana which have historically been pretty favorable to oil and gas development. A lot of tax revenue is generated from this industry in these states. Plus when you consider it is the least populous state in the US, there aren’t as many conflicts between oil and gas and residential development like you have here in Colorado.

- Talking specifically about Wyoming since it makes up most of the Powder River Basin, When you think about the major industries, extractive industries (mining & oil and gas) are one of the biggest. According to a 2005 analysis by Boston College, 29% of Wyoming’s GDP comes from extractive industries. Since Wyoming doesn’t have income tax, so relies on severance/property tax. Mineral extraction accounts for most of the property taxes paid in the state (includes severance taxes).

- Then you have tourism (Wyoming has Grand Teton National Park, Yellowstone, Jackson Hole, around $2 billion in annual revenues – 12% of WY workforce)

- Agriculture has been a big part of the economy in Wyoming. In fact, my great grandfather homesteaded a ranch in Carbon County Wyoming early 1900’s. Not called the cowboy state for no reason.

- So when you compare it to its neighbor to the South – Colorado , Wyoming is pretty favorable to oil and gas so I would categorize the political risk as being relatively low. In fact, interesting tidbit in EOG’s latest investor presentation they highlighted the fact that 100% of their activity in the DJ Basin is in Wyoming, not Colorado.

Infrastructure (Pipelines, Gas Plants, Refining)

- Existing pipelines in the Powder River Basin are nearing capacity if they aren’t there already.

- Several new pipelines are being built or will be ready to bring online soon. Read more here.

- There is a lot of existing pipelines in the basin, the issue is going to be how close are the existing pipelines to where the new drilling activity is taking place. It will likely require some investment in connecting pipelines to allow new production to be transported by these existing pipelines.

- That said, as new wells are being drilled, initial production records are being set. If you take Chesapeake’s example RRC 5 well which started producing at 3,000 barrels of oil per day and if a company drills several successful wells that are simiilar in an area, it won’t take long for any pipeline capacity to be filled up. Good news from a capacity standpoint is the new wells have a steep decline rate so it will depend on timing.

- Two issues with transporting oil specifically in the Powder. First is getting oil from the wellhead to the nearest market which is Guernsey and then transporting it from there.

- Two projects are in the works, one to take it to the gulf coast and then another to use existing gas pipeline that runs from North Dakota through the Powder River Basin on to the Midwest and convert it to an oil pipline.

- I see that what will likely happen in the Powder River assuming it continues to progress and successful wells are drilled to help delineate the play, then the speed of development will likely be determined by the speed of the pipeline takeaway capacity being installed.

Geologic Risk:

- Geologic Risk refers to the possibility that you won’t get as much oil or gas as expected or to the difficulty for accessing the reserves.

- Depending on what part of the basin and the target formation, Geologic Risk can vary.

- I would classify the Powder River Basin as having higher geologic risk than say the Geology of the Niobrara and Codell that is fairly well understood in DJ basin.

- Companies are still figuring out the optimal well design, and how certain aspects of the geology affect well productivity in the unconventional reservoirs being targeted like the Niobrara and the Turner..

- There is also other conventional oil and gas exploration going on in the Minnelusa right now and some companies are having some success in the Northern Powder River basin. With that and other conventional oil and gas plays, you are betting that the source rock migrates to the reservoir rock and is held there by some type of trap or seal. They drill a conventional exploration well to see if they were right and there are much lower success ratios in those cases (e.g. only around 1/3 of exploration wells lead to commercial discoveries). The wells that were drilled but don’t produce hydrocarbons are referred to as “dry holes”.

- A study was released in 2019 by the Wyoming State Geological Survey about the horizontal Turner wells that have been drilled. As we mentioned, this is one of the biggest targets that operators are going after in the Powder River Basin.

- The study’s author, Geologist Rachel Toner, said “it appears that the location of a horizontal well in the Wall Cree-Turner, especially in regards to the reservoir depth and temperature, is a better predictor of production success than well design”

- That said, I imagine there will be certain best practices within each formation on the drilling and completions design that will be gleaned as more wells are drilled and this will enable operators to drill more repeatable wells.

- Because of this, the geologic risk will go down as engineers and geo scientists learn more about the basin and these formations.

Hopefully this information was helpful if you own minerals or are looking at investing in the Powder River Basin.

Maps of the Powder River Basin:

The detailed field maps linked below are from the U.S. Energy Information Administration and they reflect the locations, boundaries, names, and either Barrels of Oil Equivalent (BOE) or Liquids (Crude oil plus condensate) or the natural gas reserve size classes of known fields as of the end of 2001. Obviously there have been a lot of significant discoveries since then so it may not show everything that is now known but they can give you a feel for where a lot of the conventional reservoirs are.

| Powder River Basin: | |||

| Northern Part | BOE | Liquids | Gas |

| Southern Part | BOE | Liquids | Gas |

Thanks for Listening!

To share your thoughts:

- Leave a comment or question below (we read each one and your question may be featured in a future episode)!

- Ask a question or leave us feedback via email or voicemail: (720) 580-2088.

To help out the show:

- Subscribe and leave a review on iTunes or wherever you get your podcasts – we read each one and greatly appreciate it. Plus, you can get a shout out on a future episode!

Thanks again – until next time!