What are Post-Production Costs?

Post-production costs refer to expenses incurred by the oil & gas operator that are passed on to the royalty owner and deducted from the royalty. They are also sometimes referred to as “post-production deductions.” Post-production costs are most commonly related to getting a product to market in a salable form, as in the case with natural gas.

Even if you have a cost-free lease, you may still legally be charged some post-production costs, like severance tax (which is one of the most common post production costs).

As mentioned earlier, natural gas royalties are usually most affected due to the extra costs to transport, compress, dehydrate, or otherwise process gas to get it into saleable form. These additional deductions are what has caused controversy over the past few years with the boom in production of natural gas.

Post-production costs are different than production or operating costs which are born by the lessee (e.g. the operator and working interest owners).

Using the embedded player above, you can download the episode to your computer or listen to it here! Be sure to also subscribe on iTunes!

In case you prefer video, you can watch us discussing this topic on YouTube (fun fact, this was our first video episode so please bear with me as we improve 🙂 ).

Why Post-Production Costs are Important for Royalty Owners

These costs are important for royalty owners to understand because they can result in a significant deduction from your royalty check. This is because many royalty owners may have to share proportionally in the costs of getting the product into a marketable form and to the location where it is actually sold.

The most important thing to understand is that the language in the oil and gas lease dictates what deductions are allowed (or not allowed). This is why it is important to be aware of your lease terms and whether or not post-production costs are allowed. If you have a cost-free oil and gas lease, but you are still getting charged for post production costs (above just severance and ad-valorem taxes), it is time to dig deeper into your specific lease language.

There is a lot of nuance here that varies from state to state so it is critically important to get help from a qualified an attorney to help interpret if you run into issues.

Post-Production Costs Can Severely Impact Your Royalties

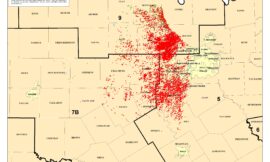

To give you an example of just how significant this impact can be, here are some numbers from a royalty interest that I own in Oklahoma. These minerals are under an older oil and gas lease that has pretty standard lease terms (which in this case are somewhat unfavorable from a royalty owner perspective).

The well in question produces oil, natural gas liquids (NGL’s), and natural gas. In January of this year, the net natural gas royalty (how much I was actually paid) was only 12% of the gross royalty (my share before any deductions).

Here’s the Breakdown of These Deductions:

- Compression: 19.9% of gross royalty

- Oklahoma state tax: 0.7%

- Fuel: 6.8%

- Gathering: 60.6%!

Grand Total: 88% of my natural gas royalty!

This example illustrates why negotiating a cost-free oil and gas lease is so important. You could negotiate the best royalty rate and all the other terms but if the lease allows the operator to deduct unlimited post-production costs, it could be all for naught.

This is an extreme example and I probably ought to be calling Spencer Cox for some help with this property!

Why do Operators Deduct Post-Production Costs From Royalties?

The short answer is because they can (in many cases).

The long answer is that it can be expensive to get gas into a marketable form. It may seem like all of these costs are unnecessary but in actuality, these costs add a lot of value to the price received for the gas. By processing the raw gas that is produced into natural gas and natural gas liquids, the operator will usually receive a larger payment in $/mcf vs. if they didn’t do these things. If they didn’t process the gas, they may not be able to sell the gas at all (e.g. if they just flared it for a well that primarily produces liquids or oil).

The case law in many states allows for operators to deduct reasonable post-production costs incurred from the sales price received for that gas at the point of sale prior to calculating the royalty.

At the end of the day, they are in business to make money and to the extent that it is legal for them to pass on certain costs they will do so.

That said, some post-production costs that are passed on to the royalty owner can be excessive.

Just to reiterate, this is why it is important to either negotiate a cost-free lease or to add language to your lease that caps how much they can deduct from your royalty. This is arguably the most important part of the lease, especially if you are in a state that has a liberal interpretation of lease language that allows lessee to pass on some of the cost associated with making a product marketable.

Legal Considerations with Post-Production Costs

Many articles that analyze royalty case law in many states mention the concept of the royalty being paid “at or near the wellhead” or “market value at the well” as one of the key arguments for the courts ruling in favor of allowing operators to deduct post production costs when calculating royalties.

The argument for this “at the wellhead” rule is that natural gas does not have market value at the well before it is processed so therefore courts often rule in favor of operators deducting these costs.

The caveat is that it depends on the state where the well is located. For example, in Colorado the interpretation of this language seems to be more favorable to royalty owners – Colorado Supreme Court said in Rogers v. Westerman Farm Co. that:

“Absent express lease provisions addressing allocation of costs, the lessee’s duty to market requires that the lessee bear the expenses incurred in obtaining a marketable product. Thus, the expense of getting the product to a marketable condition and location are borne by the lessee. Once a product is marketable, however, additional costs incurred to either improve the product, or transport the product, are to be shared proportionately by the lessor and lessee. All costs must be reasonable.”

How to Limit Post-Production Costs

It all starts with your Oil & Gas Lease!

When negotiating an oil and gas lease, negotiate for either cost-free provisions OR a maximum amount that the lessee may deduct for any reasonable post-production costs.

The post-production costs that are allowed to be deducted from your royalties greatly depends on the state where the minerals or royalties are located and court decisions on the subject.

Other Steps You Can Take:

If you are stuck with an existing lease that allows post-production costs to be deducted, that you either negotiated or inherited from someone else:

- Understand what is allowed to be deducted

- Research the operator to understand how they are handling natural gas for your wells, is it being sold to a subsidiary?

- Contact the owner relations department to ask for more information about the wells and who the gas is being sold to. They may or may not tell you. You may be able to find out this information by doing research on your own.

- Get help from a qualified attorney to get an interpretation of your specific oil and gas lease and what the lessee may or may not be able to deduct from your royalty checks

- Periodically audit your royalty check statements to see what is being deducted and that what they are deducting is allowed and appears reasonable.

If You Are Wrongly Charged Post-Production Costs

After you take the steps shown above and you think you may have found a discrepancy, contact your attorney to understand your options under the law. They can provide insight as to what deductions might be considered “reasonable” and how your situation compares with other royalty owners and operators in that basin or play.

Keep in mind that good intentioned people can make mistakes and a mistake may have been made with regards to the interpretation of your oil & gas lease or in the data entry process for your property.

Another possible scenario is that their attorneys may have taken a more liberal interpretation of what deductions are allowed and your attorney may be able to help you negotiate lower deductions.

It also never hurts to contact the operator’s owner relations department to ask questions as to why they are deducting certain costs.

If you feel that you may have some post-production costs that are incorrectly being deducted from your royalty check, your attorney can advise you of your options.

You can listen to Episode 13 with attorney Spencer Cox with Burns Charest on royalty audits and when litigation may be necessary.

Also, if you get charged negative royalties for natural gas for a particular month, listen to Episode 53 on Negative royalties also with Spencer. Again, a qualified attorney licensed to practice in the state where you own royalties can help.

Red flags to Look for On Your Royalty Statement:

Here are some possible scenarios that may affect your post-production costs:

- If the operator has a subsidiary that performs majority of the steps in making natural gas marketable. For example, if they have a midstream subsidiary that they sell the gas to and that subsidiary charges the operating company for gathering, compression, dehydration, transportation, marketing, etc. Your lease may have language that provides for any royalties (or costs) to be equivalent to what would have occurred in an arms-length transaction. If so, then it is important to look at the costs closely to make sure they are reasonable. Again, you may have to do some research to find this out. If they are a publicly traded company, they may list this in an investor presentation.

- If you get charged negative royalties. You would expect that you should receive a positive amount for any natural gas (or other product) that was sold in a given month. It is possible that post-production costs can add up to more than what the natural gas was eventually sold for. In this case, you are being “charged” negative royalties. This most commonly occurs with natural gas because of all the previously mentioned expenses that go into making it saleable. This is a scenario where it is a good idea to go over the statement and your oil and gas lease with a fine-toothed comb to make sure it is allowable.

Helpful Resources:

- Deducting Post-Production Costs From Fee Royalty

- Texas Supreme Court allows producers paying royalties to deduct post-production costs

- White paper on Negative Prices & Royalty Calculations by Burns Charest, LLP presented to the State Bar of Texas. They’ve graciously made it available to listeners of the Mineral Rights Podcast to download for free.

Thanks for Listening!

To share your thoughts:

- Leave a comment or question below (we read each one and your question may be featured in a future episode)!

- Ask a question or leave us feedback via email or voicemail: (720) 580-2088.

To help out the show:

Subscribe and leave a review on iTunes or wherever you get your podcasts – we read each one and greatly appreciate it. Plus, you can get a shout out on a future episode!

Thanks again – until next time!

Disclaimer: The information contained on this website and in the Mineral Rights Podcast episodes should not be construed as legal advice on any subject matter. All information, content, and references on this site are for general informational purposes only. This website links to other third-party websites. These links are provided as a convenience to our listeners/readers and the Mineral Rights Podcast and the hosts do not recommend or endorse the contents of the third-party sites. You should not act or refrain from acting on the basis of any content included in this episode without seeking legal advice from counsel in the relevant jurisdiction.