Did you know that for some lands in Texas that were sold between 1895, the state owns the minerals under those lands but the surface owner has the right to lease these lands and in return, they receive ½ of the bonus, royalty and other consideration paid by the lessee in lieu of surface damages?

In this episode, we dust off our Texas History books and talk about how this came to be and a little known resource that all Texas mineral owners can use to find out what others have leased their minerals for in your area.

As always, you can find the show notes with links to articles we mention in the show at mineralrightspodcast.com. Questions or comments on this episode? Email us at feedback@mineralrightspodcast.com.

Be sure to also subscribe on Apple Podcasts via the link above (or wherever you get your podcasts) and please leave us an honest rating and review. We read every one of them and sincerely appreciate any feedback you have. To ask us a question to be featured on an upcoming episode, please leave a comment below or send an email to feedback@mineralrightspodcast.com.

What is the Relinquishment Act?

The short answer goes back to 1919 when the Texas legislature passed what is known as the Relinquishment Act of 1919 which relinquished ownership of the oil and gas mineral rights back to the surface owners of certain lands while retaining a 1/16th royalty interest for the state.

Of course that would be too simple if the story ended there but to paint a complete picture of how this decision came to be, we need to hop into the DeLorean and go back in time to understand the circumstances around Texas becoming a state and who owned what when that happened.

A Texas History Refresher

If you went to school in Texas, you may remember your days learning about Texas History around 7th grade. Justin and I both attended middle school in Texas and can recall days learning about pivotal events like the Alamo and the Battle of San Jacinto.

In case you’ve slept since then (like me), here’s a brief summary of the history of land ownership in Texas as it relates to the Relinquishment Act Lands (RAL).

Spanish Rule

Going back in time, the history of Texas effectively began with the arrival of the Spanish conquistadores around 1519. In the subsequent years, Texas had been claimed by France, Spain, Mexico, The Republic of Texas, and eventually the United States.

Spain was the most active, establishing settlements called presidios from around 1690 to 1821, and was primarily occupied by Spanish settlers, missionaries, and of course soldiers. In the early 1800’s they allowed colonizers from the United States to settle in this territory.

Enter Mexico

Mexico comes into the picture in 1821 when it gained independence from Spain and the Mexican Texas was born. Mexico subsequently allowed organized immigration from the United States and by some Accounts by the mid 1830’s Anglos outnumbered Mexicans by almost 4 to 1. Needless to say eventually Mexico was concerned about the influx of U.S. settlers and the fact that some immigrants brought slaves into Texas. The Mexican president eventually outlawed immigration of U.S. Citizens to Texas in 1830 and in the years that followed the Texas Revolution happened with the Alamo and eventually the Battle of San Jacinto in 1836 where Texas forces beat Santa Anna and treaty was signed that ended the war and the Republic of Texas was formed.

Spanish and Mexican Land Grants

The takeaway here is that many of these early settlers were given land by either the Spanish or Mexican authorities. When Texas became a state in 1845, it retained all of the public land not already sold by Spain or Mexico to private citizens. The state also retained the mineral rights under the lands that had already been sold to private citizens by Spain or Mexico.

The Texas Constitution of 1876 set aside half of Texas’ remaining public lands to establish a Permanent School Fund to help finance public schools. The intent was that if any of this land was sold, the proceeds were to be deposited into the Permanent School Fund. The Permanent School Fund is like an endowment whereby only the interest income could be spent towards public education while the principle would never be touched.

The Texas General Land Office is the entity that manages these lands which total around 13 million acres. The Texas land office is responsible for leasing these lands on behalf of the Permanent School Fund. Uses include both agriculture related activities, other commercial uses, and of course for oil and gas production.

Texas statutes were eventually updated in 1895 whereby the mineral rights were released to the owners of the lands that had been previously sold.

Classifying the Land

In the following years, Texas sold lands classifying the land before the sale as either “grazing land”, “mineral land”, “agricultural land”, or “timber land”.

Most of the lands sold after 1895 were in West Texas classified as “mineral lands” and since they were classified as minerals, state law at the time required that the state retain all mineral rights when the land was sold.

Black Gold

Just a few years later, Texas was in the spotlight with the major discovery in East Texas with the Spindletop dome discovery, with the Lucas Gusher striking oil on January 10th, 1901 at a depth of only 1,139 ft and estimated initial production rate of 100,000 barrels of oil per day.

Texas became the epicenter of the oil industry after the Spindletop dome discovery and many wildcatters began leasing minerals in West Texas for oil exploration. The statutes at the time provided that “the surface owner would only be paid 10 cents per acre per year during the term of the oil and gas lease as compensation for any surface damages caused as a result of any activity.

Surface Owner FOMO

Affected landowners were pretty unhappy with this situation so they went to the Texas Legislature to change the law. So this is where the Relinquishment Act of 1919 comes into play. Again, the state relinquished ownership of the oil and gas mineral rights back to the surface owners of certain lands while retaining a 1/16th royalty interest for the state.

Some people were unhappy with this decision as they felt the state shouldn’t be giving away the minerals for free as it would be a violation of the State constitution which set aside public lands for the permanent school fund (PSF).

The Permanent School Fund

The Permanent School Fund is an endowment fund established in 1876 for the benefit of Texas public school education. Legislators intended that half of Texas’ remaining public lands at the time be set aside such that the proceeds fo the sale of these lands would be deposited into the PSF. Interest income would only be spent towards public education in the state while allowing the principle to grow over time.

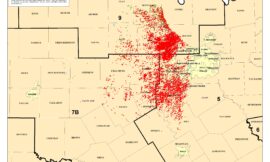

The Texas General Land Office manages over 13 million acres of state lands and mineral rights, including significant acreage in West Texas.

So the Texas supreme court eventually heard the case challenging the Relinquishment Act and whether it was unconstitutional or not. The court came up with a way to interpret the Act in such a way to avoid unconstitutionality by saying that rather than relinquishing the oil and gas mineral rights to the surface landowners outright, it made them an agent for the State for the leasing of these minerals. In other words, it gave the executive rights to the surface owner but kept the mineral ownership with the State.

Some of the affected landowners were still not happy with this arrangement and this resulted in the Relinquishment act of 1931. This new Act provided that any subsequent sale of state lands, the state would retain a 1/16th royalty.

According to the Texas General Land Office “A state Free Royalty interest is similar to a non-participating royalty interest. An oil, gas, or other mineral lease on land in which the state reserves a mineral or royalty interest is not effective until a certified copy of the recorded lease is filed in the General Land Office. Any pooling or communitization of the state’s Free Royalty interest requires School Land Board approval.”

Mineral Classified Lands Sold Between 1895 and 1931

For mineral classified lands that was sold between 1895 and before the Relinquishment Act of 1931 was passed, the state owns the minerals under those lands but the owner of the surface rights(the “owner of the soil”), has the right to lease these lands and in return, they receive ½ of the bonus, royalty and other consideration paid by the lessee in lieu of surface damages.

The oil and gas lease must be on the approved Relinquishment Act Lands Lease form and all terms must be approved by the Texas General Land Office, including bonus consideration, royalty rates, rental amounts, and any other provisions. And as the landowner, while you may agree to the lease terms with the lessee, the lease is not considered effective until it has been approved and a certified copy of the approved lease is accepted for filing in the General Land Office.

If you inherited land that falls into this category, here are the GLO guidelines for leasing relinquishment act lands for oil and gas development.

There is the provision for multiple surface owners that might have inherited an undivided interest in these lands and these RAL leases can cover multiple surface owners or can be handled by separate leases from each surface owner. The GLO says that it prefers that separate leases have the same lease date and terms and the lessee must provide the GLO with a schedule of the percentage ownership of each surface owner under the tract, and indicate whether they are leased or not at the time.

Since this information is public record (because it deals with state lands), you can look up the terms of any leases and some of the supporting documentation around surface ownership. This is a handy reference for all mineral owners in Texas, as there may be RAL lands nearby where you can find out what lease terms were offered other owners.

They have a GIS map viewer and scanned lease files search feature on their website.

Resources Mentioned in this Episode

- Texas General Land Office Overview

- Texas GLO – Scanned Lease Files Search. Search near your minerals to find out what RAL lands were leased for in your area.

Thanks for Listening!

To share your thoughts:

- Leave a comment or question below (we read each one and your question may be featured in a future episode)!

- Ask a question or leave us feedback via email or voicemail: (720) 580-2088.

To help out the show:

Click the Apple Podcasts Logo Above to leave us a rating & review. It really helps us reach those that need to hear this information and only takes a minute. We greatly appreciate it! Plus, you can get a shout out on a future episode!

Thanks again – until next time!