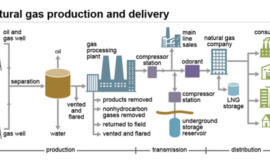

In this episode, Justin and I interview Neil Ray, president of the Colorado Alliance of Mineral and Royalty Owners or CAMRO. We discuss the new Colorado Oil and Gas Financial Assurance regulations that just went into effect. If you’re not familiar with what financial assurance is, it is the process of operators putting up money to ensure that the state isn’t left footing the bill for plugging and abandoning wells in case the company goes out of business. This is just one part of the overarching changes to the way that oil and gas is regulated in the state of Colorado.

This topic is important because even if you don’t have minerals in the state, other progressive states could adopt similar measures. These new financial assurance rules may make it difficult for small producers to meet the requirements which is important because according to the IPAA, there are about 9,000 independent oil and natural gas producers in the US. These are the small mom and pop operators that employ an average of just 12 people. These companies produce 83 percent of America’s oil and 90 percent of America’s natural gas.

Be sure to also subscribe on Apple Podcasts via the link above and please leave us an honest rating and review. We read every one of them and sincerely appreciate any feedback you have. To ask us a question to be featured on an upcoming episode, please leave a comment below or send an email to feedback@mineralrightspodcast.com.

About Neil Ray

As many of you know, I am the current Colorado chapter president of the National Association of Royalty Owners (NARO) which is a volunteer led organization that educates and advocates for mineral and royalty owners. My guest, Neil Ray was the President of the Rockies Chapter of NARO from 2008 to 2011 and the previous Colorado Chapter before splitting off to form the Colorado Alliance of Mineral and Royalty Owners or CAMRO. He’s the current president of CAMRO and his family owns mineral and royalty interests in several states including Colorado, New Mexico, Kansas, and Utah.

Mr. Ray’s family has history in the oil and gas industry starting in Colorado in 1917. He has served as the Chairman of the Colorado State Board of Community Colleges and Occupational Education, and has proudly served as a skills judge for the Vocational Industrial Clubs of America (VICA).

For 23 years, he was employed in the Newspaper industry in various management positions, owned a printing company and was president of R&R Research and Development Company.

We Discuss

Introduction

- Background, experience in minerals and royalties, where do you have interests?

- When did you get involved with your family’s minerals and royalties?

What is Senate Bill 19-181

For our listeners who might not be familiar, can you give a brief summary of what Senate Bill 19-181 is?

In addition to the notice requirements What have been some of the most significant impacts on the industry as a result of the rulemakings that resulted from this bill? If he doesn’t cover this do you want to ask this sounds good

We could spend an entire episode talking about each of the changes that were made but let’s talk now about financial assurance.

Financial Assurance

We’ve covered the subject of orphan wells recently on the show in MRP 144: Solutions to the Orphan Wells Problem and MRP 145: Abandoned and Orphan Wells with Professor Jim Crompton and it is clear that it is a growing problem for the industry. Orphan wells refers to the abandoned non-producing wells without an owner.

- While states have some sort of financial assurance or cash bonding requirement for operators to help fund the eventual cost of plugging & abandonment of these types of wells should the company go out of business. In general, what is the purpose of financial assurance requirements such as operators posting surety bonds and are these requirements usually enough to cover these plugging costs?

- How do different states handle this and how did Colorado previously handle these financial assurance requirements? Do you want to take the next one will do sounds like he’s cover all of it take the next instead no problem will do

Let’s talk about the changes to the way that Colorado addresses financial assurance for oil and gas activities in the state and the potential impact of these changes on oil and gas activity and as a result, on mineral and royalty owners.

- That said, what are the concerning aspects of this rulemaking from a royalty owner point of view and why?

- We mentioned cash bonds but what are other methods that the COGCC will accept as a means of providing financial assurance?

- What are the most significant changes from this recent rulemaking around financial assurance?

- When do these changes go into effect and how do these changes affect operators with existing wells?

These bonding requirements usually come into play before an operator drills a new well but what other types of events trigger increased financial assurance? (I think we can skip to the highlighted question below just before wrap-up)

It seems that some of these changes could be good overall in terms of minimizing the likelihood that new wells that are drilled would ever become orphan wells in the first place or if they do then the plugging cost will be covered.

- These new rules define different types of wells, how operators have to manage each type of well, and the timeframes for when operators must plug and abandon wells that end up on their out of service well list for eventual P&A.

- What types of wells are now designated as requiring to be plugged and abandoned?

- What timeframe does it require an operator to plug these types of wells?

- How will these new requirements affect small operators in Colorado?

One of the most impactful changes in addition to the financial requirements seem to be how what are typically called stripper wells or lower producing wells are handled.

The new rules define a low-producing well as “an oil or gas Well that produces a daily average of less than 2 barrels of oil equivalent (“BOE”) or 10 thousand cubic feet of natural gas equivalent (“MCFE”) of gas over the previous 12 months.”

- What is the significance of this categorization?

- It seems that these lower producing wells require higher financial assurance up to what the COGCC calls single well financial assurance, or basically the full cost that it would take to plug & abandon the well unless the operator has these on their list to plug. What will the consequences of this change be?

Another important change appears that it gives local governments and surface owners more power to request closure of a well. It does require the requesting entity to confer in good faith with the Operator but it does mention that if the well has been low producing for the previous three years and they can provide evidence that the well is no longer “used or useful”, then it is up to the COGCC to decide if the well must be plugged & abandoned.

- What are the benefits to surface owners from this change?

- What are the risks to operators and royalty owners?

The definition of Used or Useful in the new rules:

“USED OR USEFUL means a Well, or an Oil and Gas Location or Oil and Gas Facility with or without associated Wells that is currently being used or has an identified future beneficial use, which may be indicated by, among other things: a. Production trends for the Well; b. Plugging and Abandonment, Remediation, and Reclamation costs in relation to the Well’s gross revenue generation; c. Failure to use or develop a facility; d. Remaining economic viability; or e. Other relevant evidence.”

There are many advancements in technology that could extend the life of these low producing wells, such as using produced gas to generate electricity for bitcoin mining (as discussed in MRP 141: Bitcoin Mining to Monetize Stranded Gas with Jacinda Brown) which can be very profitable even if the well is considered a low producer. It seems like this is still an opportunity for operators but they may have to provide evidence that these wells could have a beneficial use for things like this otherwise they may be required to put the well on their list to plug & abandon.

How do you see this part of the rule developing and what are the potential impacts to royalty owners?

How to Contact Neil

Resources Mentioned in This Episode

- Financial Assurance SB 19-181 Rulemaking Fact Sheet Introduction

- COGCC Full Financial Assurance Rules

- Press Release: Colorado Oil & Gas Conservation Commission Votes Unanimously to Adopt SB 19-181 New Financial Assurance Rules

Thanks for Listening!

To share your thoughts:

- Leave a comment or question below (we read each one and your question may be featured in a future episode)!

- Ask a question or leave us feedback via email or voicemail: (720) 580-2088.

To help out the show:

Click the Apple Podcasts Logo Above to leave us a rating & review. It really helps us reach those that need to hear this information and only takes a minute. We greatly appreciate it! Plus, you can get a shout out on a future episode!

Thanks again – until next time!