In this episode, we provide an overview of key facts about the SCOOP, STACK, and MERGE Play in the Anadarko Basin in Oklahoma. This is the fifth episode in our series about the major producing oil and gas basins and plays in the US. Please let us know if you have any requests on a particular area that you would like us to cover. We covered the Permian Basin, DJ Basin, Uinta Basin, and Powder River Basin in previous episodes.

Using the embedded player above, you can download the episode to your computer or listen to it here! Be sure to also subscribe on Apple Podcasts or wherever you get your podcasts and please leave us an honest rating and review. We read every one of them and sincerely appreciate any feedback you have. To ask us a question to be featured on an upcoming episode, please leave a comment below or send an email to feedback@mineralrightspodcast.com.

Now, let’s dive into our overview of the SCOOP, STACK, and MERGE Plays.

Location

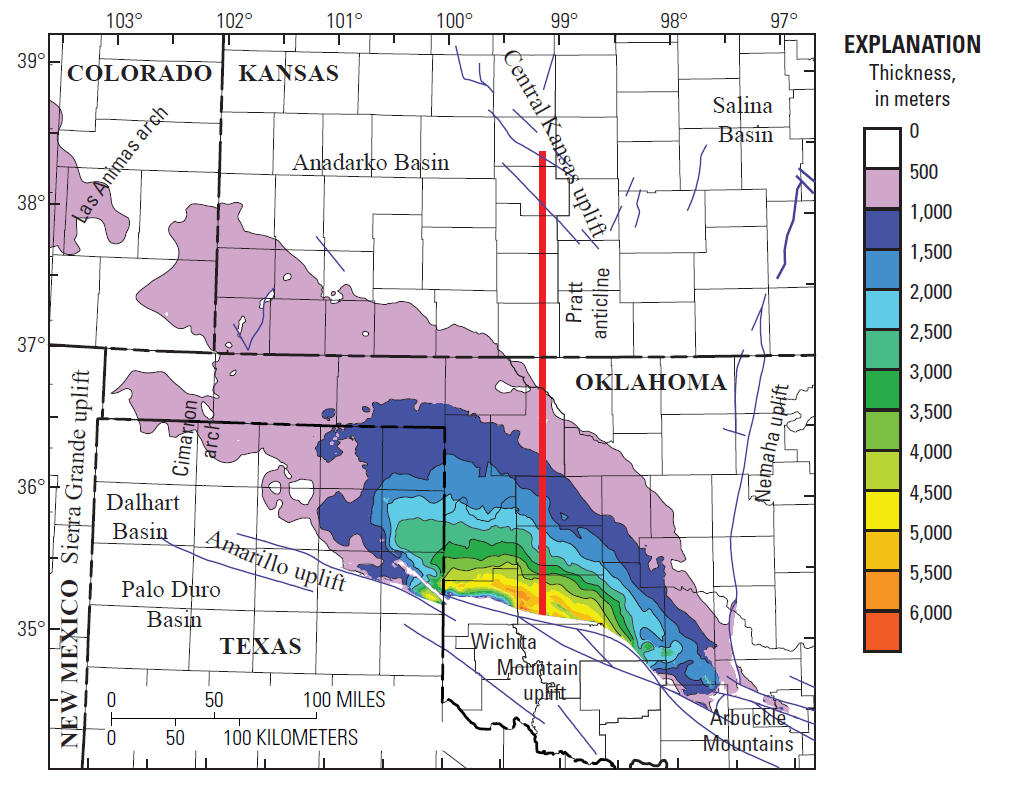

Geologic Map for the Anadarko Basin showing thickness of strata between the Silurian Hunter Group and the Pennsylvanian Desmoinesian

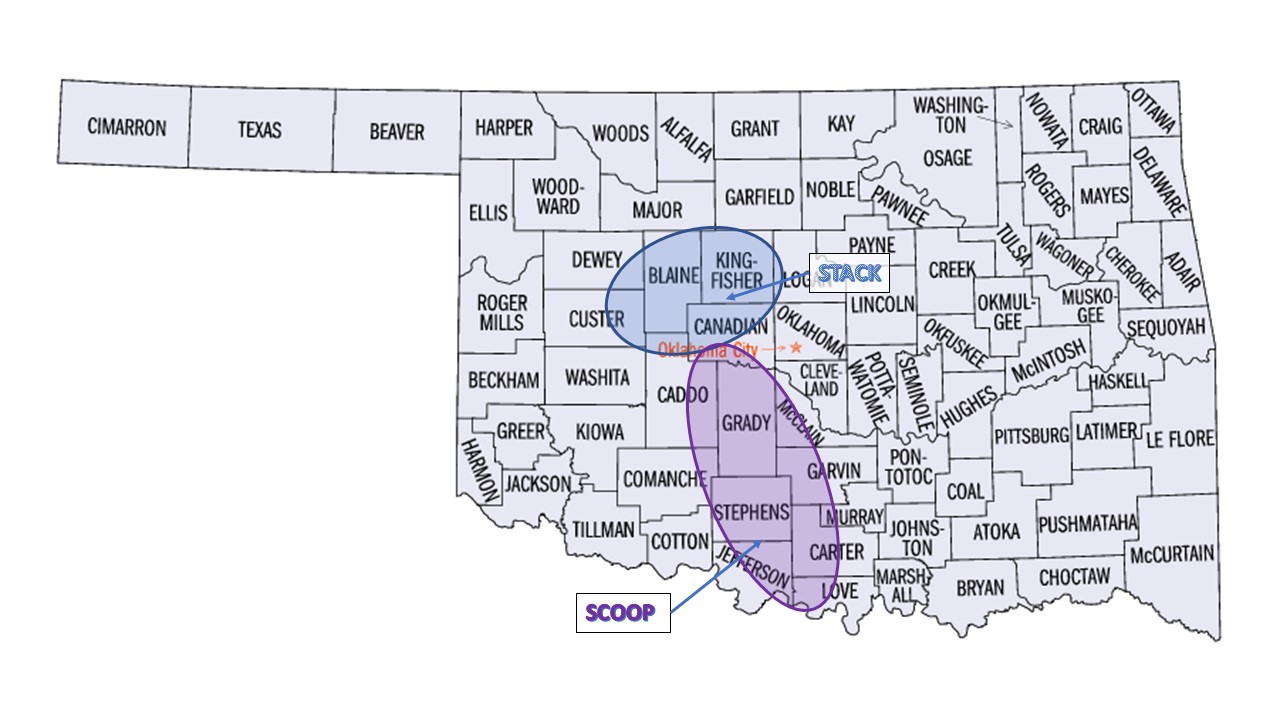

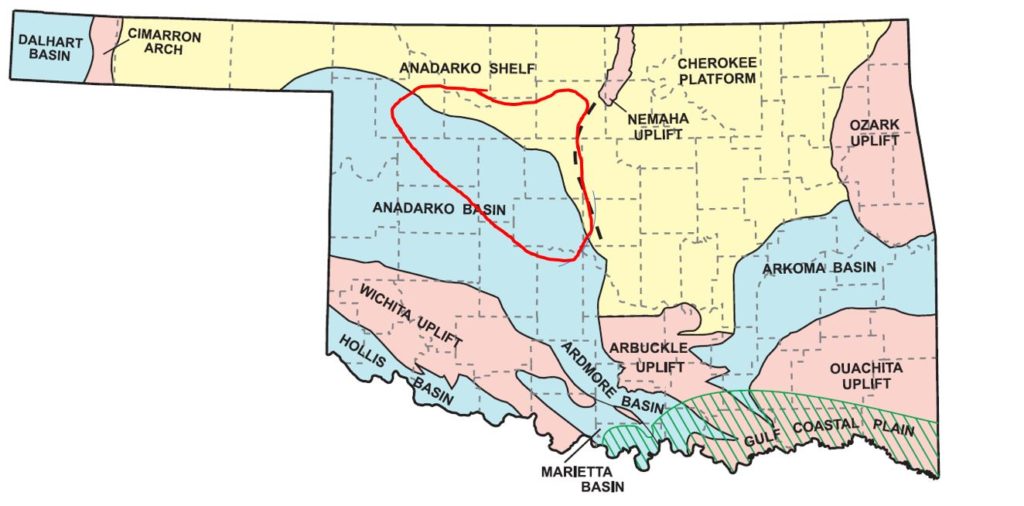

The STACK play is located in the Anadarko Basin area of Oklahoma. STACK is derived from “Sooner Trend (oil field), Anadarko (basin), Canadian and Kingfisher (counties).” The majority of the play is located across (Canadian and Kingfisher as the core counties) and Dewey, Blaine, Major, Garfield counties. Unlike other Plays such as the Eagle Ford, Bakken, Granite Wash, the STACK is not a geological formation, but a geographic area.

The SCOOP play otherwise called the South Central Oklahoma Oil Province play is principally located in the state’s Anadarko Basin. The SCOOP play is generally located in Garvin, Stephens, Murray, and Carter counties

You may also read about the MERGE play. The MERGE is the area between the SCOOP and STACK plays and generally covers Caddo Cato, Grady, and McClain counties.

Geology

Taking a step back, the SCOOP and STACK plays are located in the Anadarko Basin. The Anadarko Basin is a large geologic depositional and structural basin located in Western Oklahoma and the Texas Panhandle and all the way up into parts of Southwestern Kansas and extreme Southeastern Colorado. It is around 70,000 square miles in area. Sedimentary rocks from the Cambrian period (in the Paleozoic Era) around 540-485 million years ago through Permian age (around 300-250 million years ago) make up the basin.

STACK Play

Talking about the STACK play first, it is also aptly named since there are multiple stacked formations that are being targeted by operators. This allows an operator to target multiple formations from a single location. The core area of the STACK is around 1,000 square miles in area so makes up a small portion of the overall Anadarko Basin but is the focus of a large part of the activity in the basin.

STACK play was first drilled by Newfield Exploration in 2011. and two of the main producing reservoirs include the Mississippian Meramec and Osage formations as well as several other potential targets including the Morrow, Oswego, and Red Fork.

SCOOP Play

SCOOP play mainly targets the Devonian to Mississippian aged Woodford Shale. The Woodford Shale is a silica and highly organic rich black shale that was deposited about 320 million to 370 million years ago.

The Woodford shale is seen as the major source rock for certain plays in the basin as it provides hydrocarbons to the Hunton group, Viola group, Simpson group, and the Arbuckle group. Similar to other unconventional oil and gas plays, this source rock formation is now the target of horizontal drilling activity.

Major Operators in the SCOOP/STACK

Some of the Key Operators in the STACK/SCOOP include:

- Continental Resources – One of the major players. They have Project Springboard in the SCOOP where they have 73-miles of contiguous leasehold and are using what they call row development to maximize efficiencies. 3 reservoirs being targeted: Springer, Sycamore, and the Woodford with 70-85% of production being oil. Basically this is a full-field development scenario for their acreage which is in the sweet spot of the over-pressured oil window of the SCOOP.

- Devon Energy – has one of the largest STACK positions. They recently announced an agreement with Dow to jointly develop a portion of their acreage. In 2017, Devon held the initial production rate record in the over-pressured oil window of the STACK play. The peak 24-hour rate of production was 6,000 oil-equivalent barrels per day (50% oil). At the time this was the highest initial production rate of any well in the play.

- Ovintiv (formerly Encana) – approximately 365,000 acres with 265 of that in the STACK and the rest in the SCOOP.

- Marathon Oil – Approximately 300,000 net surface acres in the STACK/SCOOP

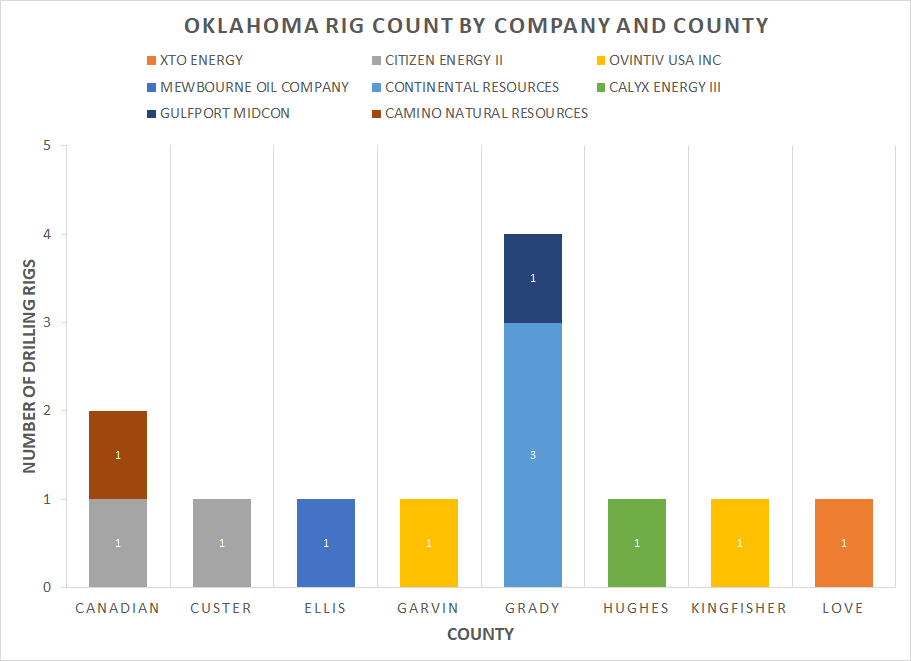

As you can see in the rig count chart below, smaller operators like Gulfport and Citizen Energy are currently active in the play.

Economic Risk

Like we’ve mentioned before, there is always a level of Economic Risk due to fluctuating commodity prices.

One of the factors that hurts the SCOOP/STACK plays is the lower rates of return as compared to other top tier plays like the Delaware Basin. STACK internal rates of return per well is 17% and the SCOOP is 11% according to Platts Analytics. Oil and gas operators usually target an IRR of 20% or higher so this might shed some light as to why the rig count in both plays dropped significantly in 2019.

While some of the production results reported by operators is impressive, they also have higher drilling and completions costs when compared to other basins. This is because most wells are usually deep.

Another factor that is causing operators to look elsewhere is the lack of improvement in production efficiencies (in other words, the amount of oil and gas that a well produces). Companies are finding more variability in rock quality that has made it hard for them to optimize their completion programs.

Rig Count in Oklahoma

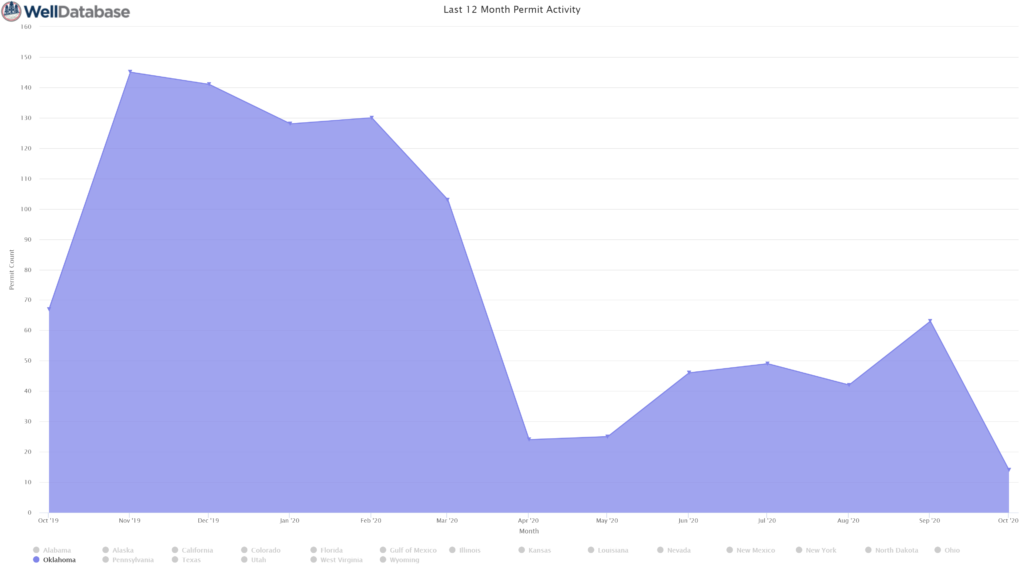

All that said, crude oil production in the SCOOP-STACK recently reached annual highs of 488,000 barrels per day even as the rig count dropped to new lows not seen since 2016, according to data from S&P Global Platts Analytics. In January, operators were running more than 100 rigs and that dropped to 44 rigs in December of 2019. Following the oil price collapse due to the COVID-19 pandemic, the rig count across the entire state of Oklahoma was down to 12 rigs by October of 2020 as seen in the chart below.

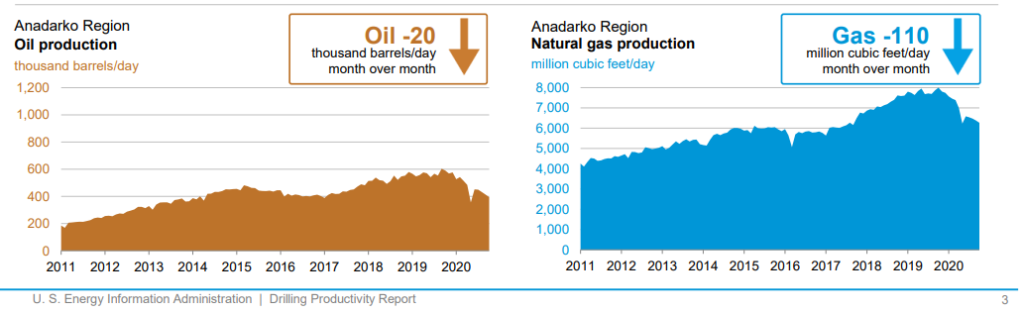

Usually, a drop in rig count would foreshadow a decrease in production but that didn’t happen right away in 2019 in the SCOOP-STACK. In this case, the increase in production despite the drop in rig count was due to the large inventory of DUC’s (Drilled but Uncompleted wells) that were completed in the first half of 2019. This helped production grow even though operators were drilling fewer wells. As you can see from the graphs below, overall production from the Anadarko Basin has dropped since the peak at the end of 2019.

According to the US Energy Information Administration, the Anadarko Basin had 679 DUC wells at the end of 2019 and 700 DUC’s as of August 2020.

Going forward, I would expect oil and natural gas production from the SCOOP-STACK and the Anadarko Basin in general to continue to decline as long as the permit activity and rig count continue to stay depressed. The initial decrease in production may not be extreme as DUC’s are brought online but that will require an improvement in oil prices.

If oil prices do recover significantly, we could again see an uptick in activity but that still remains to be seen.

Political Risk

Oklahoma is generally favorable to the oil and gas industry although there have been issues that the industry has had to manage over the past few years, specifically as a result of earthquakes.

Earthquakes in Oklahoma

You may have heard of this increase in earthquakes in Oklahoma in recent years and it appears to be caused by the amount of water that was being injected deep underground. In 2015, Oklahoma introduced new wastewater disposal rules and after they were implemented, the number of earthquakes dropped dramatically.

The water is being injected deep into the Arbuckle formation and as the wastewater changed to pores in this rock layer they interacted with faults and this is what can trigger an earthquake. In most cases, earthquakes are not caused by Fracking but by water injection deep underground.

That said, the OCC implemented the Well Completion Seismicity Protocol which requires operators to develop and implement a mitigation plan prior to completing any wells and requires that they monitor and take action if any seismic events greater than 2.0 magnitude occur within 5 kilometers of a well.

Because operators have to manage the water injection rates to prevent earthquakes, this could have an impact on production or on the areas that operators choose to drill wells for geologic reasons (further away from faults where earthquakes are occuring).

Geologic Risk

The Anadarko basin has a few geological risks that have affected the production levels in the basin. One of the risks is that some of the reservoirs in the basin are under pressured. Some wells with expected oil production end up producing a lot more gas than expected and this affects the overall oil productivity and the profitability of the affected wells. This becomes a problem in Oklahoma due to higher costs associated with transporting natural gas and the low natural gas prices. This sometimes leads to wells being shut in at very early stages in the well’s life.

Well Spacing

Even if you are in a good part of the SCOOP and STACK, these plays seem to be especially sensitive to well spacing. Interference between wells when spacing is not properly managed can cause a drop in production in the parent well as well as the new children wells which end up causing a lot shorter well life and lower economic returns.

So, Geologic risk is higher than some basins like the DJ Basin and the Permian which we covered in Episode 28 and Episode 30, respectively. It appears that you have to be in the sweet spot in the SCOOP-STACK where there is a good amount of oil and this is where operators are seeing the most success.

Infrastructure Constraints

Because of the large amount of associated natural gas and natural gas liquids produced in the SCOOP-STACK, operators have had to manage gas pipeline and gas processing capacity. As long as this capacity keeps up with new production coming online, things should be ok. For example, the Midship Pipeline owned by Cheniere was supposed to come online at the end of 2019 but they announced would now be put into service in April of 2020. This added ~1.1 Bcf/day of gas takeaway capacity.

Gas transportation and processing capacity will be something to keep an eye on as there could be localized effects on production or activity if wells come online producing more gas than expected or where there is a large amount of gas production in an area that would require an operator to temporarily curtail production due to gas handling constraints.

Thanks for Listening!

To share your thoughts:

- Leave a comment or question below (we read each one and your question may be featured in a future episode)!

- Ask a question or leave us feedback via email or voicemail: (720) 580-2088.

To help out the show:

- Subscribe and leave a review on Apple Podcasts or wherever you get your podcasts – we read each one and greatly appreciate it. Plus, you can get a shout out on a future episode!

Thanks again – until next time!