If you receive royalty income from oil & gas wells, you probably are familiar with the statement that accompanies your royalty check. This statement contains a lot of useful information that you can use to make sure you are getting paid correctly. From the volumes of oil, natural gas, and natural gas liquids that were sold in a given month to the price that was paid for these products to what post-production costs were deducted from your royalties, if any. These are critically important to keep track of as a royalty owner to ensure that you are getting paid what you deserve.

If you receive royalties on more than a couple of wells then you also have probably realized how difficult it can to track all of this manually with tens or hundreds of pages in each royalty statement. Thankfully there are a few shortcuts and time-saving tips that you can take to streamline this process for you and your family or for your company. That starts with automating the process of keeping track of your royalty check payments and looking on a map to see where new permits or rigs are located relative to your interests. Better yet, how about an automated email notification if a new permit is filed nearby?

Which brings me to the sponsor for this episode:

MineraliQ is a free online platform for mineral owners which will automatically connect to your well data – helping to track all your royalty check payments and portfolio value. Discover what your minerals are worth in real-time, view royalty payments, track income trends, and know the exact location of your properties using their interactive map. Activate your free account today by clicking the link here: MineraliQ.com

Be sure to also subscribe on Apple Podcasts via the link above and please leave us a rating and review. We read every one of them and sincerely appreciate any feedback you have. To ask us a question to be featured on an upcoming episode, please leave a comment below or send an email to feedback@mineralrightspodcast.com.

How Long Should I Keep Royalty Statements?

It depends but it is a best practice to hold on to statements or at least have them accessible for 7 years for income tax purposes. At minimum, your CPA will likely advise you to hold on to the 1099 forms for 7 years for any royalty income. It is not necessary to hold on to them forever but you should consult with your CPA if you have any questions (this should not be construed as tax advice!).

Many mineral owners keep the .PDF statement that you can download from EnergyLink for free and some like to print them out and store them with the other documents related to their minerals and royalties. There is no right or wrong answer in terms of how you store it but the most important thing is that you know where to find them.

What is important is that you double check your 1099 forms against your royalty checks each year to make sure they are correct before you file your taxes. We talk about how to do this in MRP 97: How to Audit Your Oil and Gas Royalty Statements.

It is also useful to periodically perform a royalty audit to make sure you are getting paid correctly.

Is there a statute of limitations for when you can file a claim if you find a discrepancy?

The short answer is that it depends on the state but in general the answer is yes. Disclaimer that we are not attorneys and this should not be construed as legal advice and this information is being shared for informational purposes only.

I believe that Texas has a statute of limitations of 4 years for this type of claim. So the moral of the story is to do something sooner rather than later if you believe you are not being paid correctly. If you wait too long then you could be forfeiting your rights to underpaid or unpaid royalties.

Whatever state you are in if you feel you are being underpaid then it is a good idea to contact an attorney licensed to practice law in the state where your minerals or royalties are located to get advice specific to your situation.

How Should I Track Oil & Gas Royalties?

There are a couple of ways:

Spreadsheet or paper to keep everything organized:

- List of wells and ownership interest

- Gross & net revenues by check date

If you have an interest in more than a couple of wells then this becomes impractical to keep track of everything manually. There are several software solutions that have been developed over the past couple of years to help automate this process.

Some examples are: WellProfits, Royalty Advocate, Mineral Answers and most recently MineraliQ by Enverus (disclaimer: they are a sponsor of the podcast).

If you are receiving royalty statements electronically via EnergyLink, MineraliQ makes it effortless to keep track of your wells and nearby activity. In fact, since EnergyLink is also an Enverus product when you create a MineraliQ account it automatically brings over the well details and royalty statement information into the platform so that you can track all of your wells in one place. The best part is that it is FREE.

Tips on Using Software to Track Royalties

If you decide to use software to keep track of things then make sure you know how to login to the website or application. If you have heirs that will be inheriting the property then it is a great way to share with them what you own. Some platforms allow you to setup view only accounts or you can share your username and login information and walk them through where the interests are located, etc.

Also, the saying “garbage in, garbage out” applies here. So it is important to make sure you spend the time up front to setup correctly or get help with the setup process to save time for yourself and your heirs over the long term.

The software is only useful if you look at it regularly and use the information to make decisions or take action. Many applications will flag for you if you have not received a check for say more than 60 days but you have to investigate further to find out why you didn’t receive a payment. Maybe the well was shut-in for maintenance or maybe the payment dropped below the minimum payment threshold (e.g. $25 and is being rolled over until the balance goes above that amount at which time they will cut a check).

If the system flags something for action, whether it is a missed payment or perhaps new well permits that were recently filed on your interests, you still need to take action. The application will not do that for you.

Keeping track in a mineral management software or spreadsheet makes it easy to share with relatives who might have equal undivided interests in the same wells. This allows you to compare notes each month to make sure everyone’s royalty payments match up.

It also makes it easier for your heirs to keep track of your interests and allows you to have all the information they need to know in one easy to access location. Especially if they are out of state – you can provide the link to a Google sheet or to your mineral management website for them to login to keep track of things and to learn about what the family owns. If you keep all of your royalty statements in a shoebox and never tell your family about it they will be surprised to find out that they inherited mineral or royalty interests and won’t know what to do about it. You want to educate them so they can proactively manage and protect this valuable asset. This is where organizations like the National Association of Royalty Owners (NARO) comes in with educational webinars and in-person presentations at state and national conventions.

Should I Keep Track of Additional Information Beyond my Check Stub?

The short answer is yes. There can be other uses for this information. For example, for mineral appraisal or valuations you also need to know the full legal description of your interests, your lease royalty rate, copies of division orders.

- Also by learning how to use your state oil & gas commission website, you can learn more about your wells, download copies of the drilling permits, plats or other maps showing the well location, and other identifiers like state lease ID or API # for the wells.

- In some cases it may take some time for them to setup the lease ID for a brand new well and to report production at the lease level but sometimes you can access production data at the well level if you know the API # for the well. The API # is a unique identifier that every well in the US gets and a fun fact about the API # is a unique and permanent ID that is one of many industry standards set by the American Petroleum Institute or API (hence the name).

- The format of the API number is a two digit state code, followed by a three digit County Code, and then a five digit well number. Each well gets a unique well number and the number is sequential by the order in which the drilling permit is issued. The smaller then number, the older the well.

Interestingly, some states like Texas drop the state code so when you search for an API number on the Texas Railroad Commission website you start with the three digit county code. For example, to search for the Katherine Brown Unit 3H well in Dimmit County Texas, you would use the number 12738013 with no hyphen between the county code and well #. The full API number for this well includes the state code for Texas which is 42 so the full API number is 42-127-38013.

My Operator Doesn’t use EnergyLink For My Royalty Statements, Where Else Can I Find this Information?

Most state oil and gas commission websites (for example, Texas RRC website, Colorado Oil gas conservation commission, Oklahoma Corporation Commission website, or you have interests in multiple states and want to go to one place, you can use Welldatabase.com‘s free plan. These websites allow you to look up well information such as the operator name, the formations, spacing or pooling orders, and production data for starters.

Tracking revenues:

- Using software or spreadsheet, want to keep track of:

- Check date, owner gross, owner severance, owner deducts, owner other value, owner net value, check amount

- Keep track by calendar year so you can compare against the 1099 that you receive at the end of the year

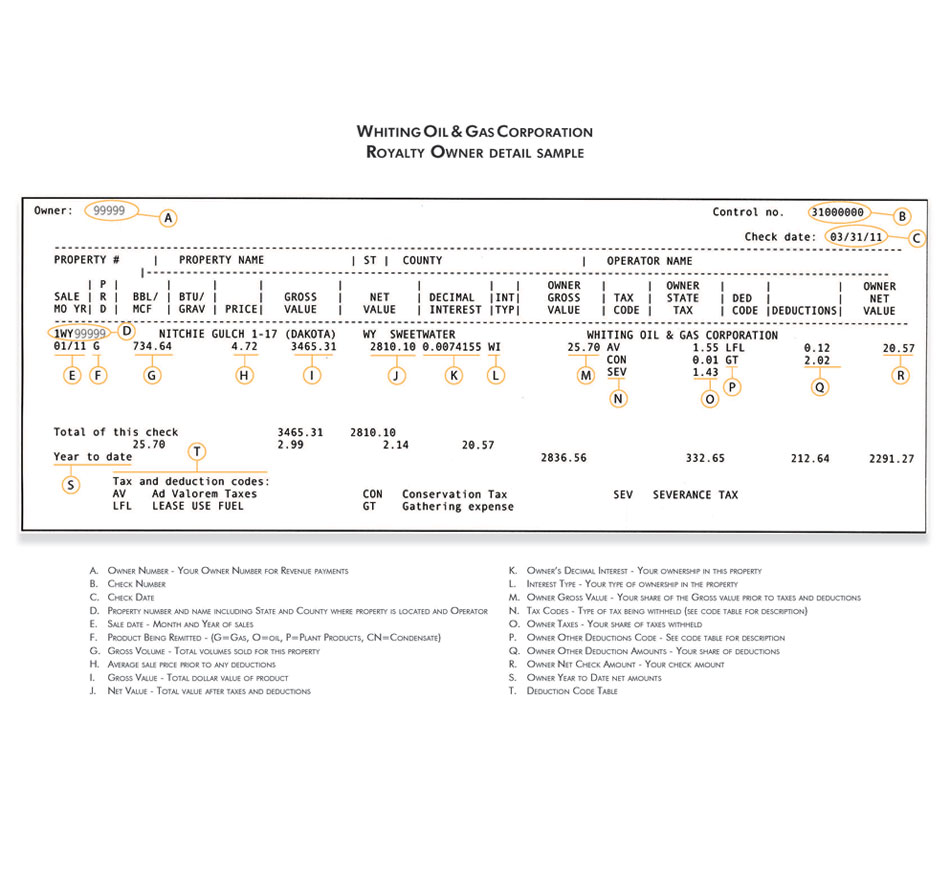

Reading Your Royalty Statements:

Why aren’t royalty statements consistent across operators?

Unfortunately there doesn’t appear to be an industry standard when it comes to reporting royalty income so the format of the check statement depends on the accounting software the operator uses as well as legacy practices. Many operators provide additional information on how to read their specific check statement. Check out this example from Ovintiv which walks through what everything means on their check statements.

How to read basic information:

- The top row usually includes the well name and usually a property ID # within that operator’s accounting system, it may also list the county and state.

- Below that on the left hand side it may list the product code or type (e.g. oil, gas, plant products or NGL) or the first column might list the production date (or month).

- After the date it will list things like the volume sold by product along with the units (typically barrels (bbls) for oil, thousand cubic feet (mcf) for gas, and gallons (gal) for NGL’s or plant products.

- Then the unit price which is the sales price per unit. For example $/bbl, for oil, $/mcf for gas, and $/gallon for plant products or NGL’s, sometimes the BTU factor for gas or the API gravity for oil, then a sub total of the gross value for the product that was sold and then your decimal interest and your owner share or Net amount.

- Below the gross and net volumes and $ amounts, will be the deductions will be listed like backup withholding, severance tax, ad valorem tax, any other deductions like gathering fees, processing fees, marketing fees, etc. typically for natural gas.

- Another thing that is often listed is the interest type. Examples are RI for Royalty Interest, WI for working interest, ORRI for overriding royalty, and NPRI for Non-Participating Royalty Interest. The bottom of the check statement will have more information on the meaning of things like Interest type or Product codes.

What Should I Look For When Reviewing My Royalty Statement?

- It is pretty simple, you want to make sure they are using the correct sales volumes, prices, and post-production deductions and that your decimal interest (also called the “Net Revenue Interest”) in each well is correct. It is not uncommon to see small subtractions to your royalties for adjustments that are made for previous months. These are called Prior Period Adjustments and we talk more about this topic in MRP 162: Understanding Prior Period Adjustments.

- You generally want to make sure they are deducting anything they aren’t supposed to. For example, if the operator doesn’t have a W-9 on file with your taxpayer information they may be required to withhold income tax from your royalty check. This is sometimes referred to as “backup withholding.” If you see this it is a good idea to contact the operator’s owner relations department to find out how you can get this removed. In any case you need to be ready to pay taxes on this income at the end of the year when you file your taxes if you don’t have any tax withheld.

Why Are Some Royalties Paid Two Months in Arrears?

The main reason is that it takes time for them to get statements from the midstream company for a natural gas for example, and so it’s not something they have available a few days after the end of the previous month. In the meantime they’re having to issue checks to royalty owners sometimes before they have all of that information and so that’s sometimes why you’ll see prior period adjustments as well. We talk about that in MRP 162: Understanding Prior Period Adjustments.

What Are Other Things I Should Know About?

Other things to find on some royalty check stub is the heating value of the gas. The heating value may be shown in terms of the number of British Thermal Units (BTU’s) per cubic feet (MCF) of gas. The average heat content of natural gas in your home is around 1.037 MMBtu (million Btu’s) per MCF (thousand cubic feet). This is useful because you can use this number to get a rough approximation of how much you should at least be getting paid for the sale of natural gas and natural gas liquids (NGL’s). Specifically, if you multiply the gas volume by the BTU factor (for example 1.3) and then by the price that was paid that provides a rough rule-of-thumb that should be less than what you are actually paid for dry gas and the sale of NGL’s or plant products separately.

Another less common scenario is where you might have different ownership decimal amounts shown on the check stub. Specifically, a different division of interest decimal and a payment decimal or marketing decimal. If you run into this situation you need to get a copy of your oil and gas lease and likely help from an attorney as there may be provisions in the lease or the title to your interests that are the reason for this.

Finally, severance taxes are something that all royalty owners should be aware of, even if you have a lease that does not allow post-production deductions.

What is a Royalty Audit?

A royalty audit refers to the process of comparing the production volumes, prices paid, the decimal interest for each well, and the post-production deductions on your royalty statement to known amounts and the terms of your oil and gas lease to make sure they match. If you receive royalties on a lot of wells this can be a very time consuming process and if you are getting paid a significant amount of money it may be worth hiring someone to get help with this. We talk in more detail about how to perform a royalty audit in MRP 97: How to Audit Your Oil and Gas Royalty Statements.

That said, it can be fairly simple for royalty owners to perform a mini royalty audit whether on all of your wells or on a few wells to spot check that everything looks correctly. This involves a few steps:

- Compare the oil, gas, and NGL (sometimes called “plant products”) volumes on your royalty statements to data reported to public sources (e.g. your state oil and gas commission website). You want to make sure you are reporting the “sales” or “disposition” volumes from the state website because these will be the numbers that will match what was sold by the operator (and what you were paid on). For some leases, wells may produce more than what was sold and the remainder is left in the storage tanks onsite at the end of the month and that is why the produced volumes might not match the sales volumes. Most companies pay based on what is sold not what is produced so you need to compare the disposition value to the value shown on your check stub.

- If getting paid by multiple operators in an area, can compare prices paid by month and by operator. Sometimes these prices can vary because each operator will have a separate contract with the midstream company or they might hedge production by buying futures contracts to sell production at a certain price in the future which might be higher or lower than the spot price that you see reported in the news.

- The price that you are paid will likely not match the average price of West Texas Intermediate (WTI) Crude Oil or Henry Hub natural gas and this is to be expected. This is because it costs money to transport oil to the marketplace so this expense may be reflected as a lower price paid for oil at the wellhead. This does not necessarily mean that your operator is doing anything funny with regards to paying you a lower price for oil or natural gas vs. deducting post-production costs from your check. These price differences in a specific basin or area compared to the benchmark crude oil & natural gas prices are what is called a “price differential”. And while the price differential may change over time it is usually a gradual change related to takeaway capacity and characteristics of the oil and gas, the thing to look for here are significant changes over the course of a couple of months. That might signal something worth looking into.

What Should I do if I Find an Issue?

If you find an issue with your royalty payments or if you have a question you should first contact the operator. A simple question might be answered by contact the operator’s owner relations department whereas a significant discrepancy might require contacting an oil & gas attorney for help. We discussed what to do if the operator might have made an error or if you otherwise feel they have not paid you correctly in MRP 13: Royalty Audits and Litigation with Attorney Spencer Cox.

Resources Mentioned in This Episode

- To help you calculate if you are getting paid correctly, I’ve created this free Royalty Audit Worksheet. Keep track of your wells, perform a quick end of year royalty audit against your 1099’s, or do a full audit, all using this helpful tool!

- Understanding the Prior Period Adjustment

- MRP 13: Royalty Audits and Litigation with Attorney Spencer Cox

- MRP 97: How to Audit Your Oil and Gas Royalty Statements

- MRP 162: Understanding Prior Period Adjustments

- MRP 72: What You Should Know About Post-Production Costs

- MineraliQ is a free online platform for mineral owners which will automatically connect to your well data – helping to track all your royalty check payments and portfolio value. Activate your free account today by clicking the link here: MineraliQ.com

Thanks for Listening!

To share your thoughts:

- Leave a comment or question below (we read each one and your question may be featured in a future episode)!

- Ask a question or leave us feedback via email.

To help out the show:

Click the Apple Podcasts Logo Above to leave us a rating & review. It really helps us reach those that need to hear this information and only takes a minute. We greatly appreciate it! Plus, you can get a shout out on a future episode!

Thanks again – until next time!

Awesome thank you. The mineral IQ is great-get see our active wells on a map with API#, dates of production, well operator… You all make this so much easier and less stressful. Thanks for the great info for learning how to care for mineral rights.