In this month’s episode, we answer a diverse set of listener questions submitted by Nathan, Darion, Holly, Richard, Julie, Joe, and Margaret. Questions range from valuing mineral rights portfolios across multiple states to verifying division orders, keeping mineral interests within families, researching active leases, buying minerals and royalties, and the complexities of Texas Relinquishment Act lands.

As before, many of the questions in this episode are covered in more depth in my Mineral Management Basics online course, including how to read a legal description, perform a title search, identify nearby oil and gas activity, and determine whether you should be getting paid on a well.

Thanks again to everyone who left a review or who submitted a listener question! If you have a question about your minerals or royalties, you can send it to feedback@mineralrightspodcast.com!

If this has been helpful, please take a moment and leave us an honest rating & review on Apple Podcasts. This feedback really helps keep us going and helps make sure that we are putting out content that is tailored to your needs.

Listener Question #1

Matt, I will try to keep this explanation short.

I am looking for a low-cost way to value 26 mineral rights located in TX, MS and OK.

Two or three of the parcels are producing; the remaining have never (to the best of my knowledge) ever had any exploration on them.

The valuation is needed to support the division of assets as part of an estate settlement. For IRS purposes, I understand that 3.5x is a good rule of thumb for producing assets. In this case, the LTM cash flows are just under $5,000 indicating an undivided interest for the entire trust of $17,500. The estate of the deceased owned 1/3 of this amount, or less than $6,000 So as you can see I do not wish to spend a lot of money on hiring a full-blown evaluation.

Another wrinkle is that in order to avoid dispersion of the ownership as each generation passes on, the Trust stipulates that only direct lineal descendants of my grandfather (who was the original owner) can be beneficiaries of the trust. This obviously diminishes the value of the mineral rights, since they cannot be freely transferred to just anyone.

I need an honest and fair way to value these properties so that the non-lineal descendants can be bought-out. They object to the 3.5x rule, and feel that even the non-producing assets have some value.

The non-producing assets have been in our family for over 100 years. In all that time, there has been little to no exploration or offers to drill. Hence, I consider them virtually worthless.

Do you have suggestions as to how we might proceed without spending a fortune?

Nathan

Listener Question #2

Hi, I’m Darion and I am fairly new to the industry. Just trying to learn and absorb as much knowledge as possible. I struggle with verifying if the division orders are correct.

Listener Question #3

Matt,

I am a totally clueless mineral owner.

But wait! There’s more!

I found myself thrown into the deep end of the World of Mineral Rights after inheriting shares based in southwest Texas in 2016. Until most recently, I allowed business to putz ahead as dictated by lease offers and the collaborative consent of my family group of heirs. However, several family members are tired of the paperwork and want to sell. I want to keep the mineral rights as a family legacy even more than as an investment. A speculator just sent letters to family members, offering to quickly buy their shares, but I want to seize the moment to increase my holdings. I am researching the industry at warp speed and am grateful to find your podcast!Holly

Listener Question #4

Hi Matt,

I have found your youtube videos to be very helpful. I just have two very quick questions:

1. Is there a source that you know of that will allow you to find the active lease on an associated well or property? Looked for about 5 hours for North Dakota to no avail.

2. If I were to reach out to the operator directly for information is that inappropriate? I imagine they are extremely busy and not sure how much help they could provide, but maybe they could get me the lease?

Imagine you are quite busy as well, appreciate any response you might be able to provide. I have been around the industry for years, but just now in a place where I am trying to acquire oil and gas interests.

Richard

Listener Question #5

Hi Matt,

Thank you for providing this resource! I own minerals in a small family business in Wyoming. My dad started the company and has managed the leases and minerals for 25 years. He will be 90 at the end of the year, and I want to learn as much from him as I can before he dies. I need to be taught like I’m a 10-year-old, and I listened to a couple of your podcast episodes and realized that you are a very good teacher. I want to learn the basics and how to tell what a good investment is. I want to have the confidence to talk to my siblings and have them trust my knowledge (they have no interest in learning about mineral rights). I look forward to diving into the material!

-Julie

PS: My dad worked for Shell for 34 years. My husband also worked for Shell for 15 years.

Listener Question #6

I’m a semi-retired landman and owner of minerals, royalty, overriding royalty and non-operator working interests. Main question is [how to address] negative gas royalties showing up on production from earlier this year. Thanks for your help.

Joe

Listener Question #7

Hi There.

My name is Margaret, and I’m an underwriter for a title company in Texas. We deal with property all over the US, but a lot of it happens to be located in the State of Texas. I just finished listening to your podcast related to the Relinquishment Act of 1919 and have a couple of questions for you. I’m new to underwriting land in TX, having spent most of my career examining land in another state. So, mineral rights are not something I’m terribly familiar with.

Here are my questions:

- Does the Act only pertain to land deeded out of the state during the 1895-1931 period? Does the Act apply even if the mineral rights were not reserved by the state, or only to land where the mineral rights were expressly reserved when property was deeded out of the state during that period?

- How do I determine whether or not the land falls under the Act? Is there a map to refer to, or is there something in the county records for the property that would tell me it is classified as “mineral land”?

- Is the current rule that if land within the relinquishment area was not retained by the state but instead was sold to individuals during the 1895-1931 period, that the individual leases out the rights to minerals and gives the state a royalty on the profits?

- What if the state sold “mineral land” after the 1895-1931 period? Does the Act apply and does the state hold any interest in the mineral rights? Or does the state only hold those rights if they were expressly reserved when the property was deeded out?

Thank you, I appreciate any guidance you can provide!

Margaret

Resources Mentioned in this Episode:

Mineral Rights Education

- Mineral Management Basics Online Course

- National Association of Royalty Owners

- 1-on-1 Coaching with Matt

How Mineral Rights are Valued

- MRP 84: The Top 6 Things That Affect The Value of Mineral Rights and Royalties

- MRP 194: How Do You Calculate Mineral Rights Value?

- MRP 4: How Mineral Rights are Valued

Buying Mineral Rights

- MRP 200: Mineral Rights Investing Q&A

- MRP 160: Strategies for Investing in Mineral Rights

- MRP 126: Deep Dive on Investing in Mineral Rights, Royalties, and Working Interests

- MRP 26: Investing in Mineral Rights and Royalties

Books

- Never Split the Difference by former FBI Hostage Negotiator Chris Voss is THE book on negotiation.

How to Make Sure You are Getting Paid Correctly

- MRP 3: How to Calculate your Net Revenue Interest in 3 Simple Steps

- Download my the Free NRI Calculation Worksheet HERE

- MRP 97: How to Audit Your Oil and Gas Royalty Statements

- MRP 103: How to Find Out if You Have Unclaimed Royalties

- MRP 166: How to Read and Manage Your Royalty Statements

- MRP 224: What to do About Late Royalty Payments

Mineral Rights Research

- MRP 10: How to Perform a Title Search

- Download my Free Runsheet Template to help you get started with your mineral rights title search.

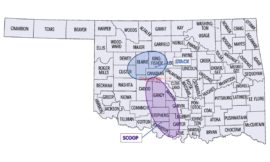

- MRP 227: How to Find Oil and Gas Info for Oklahoma

- MRP 226: How to Use the Texas Railroad Commission Website

- MRP 238: How to Find Oil and Gas Info for North Dakota

- WellDatabase.com

Negative Royalties

- MRP 162: Understanding Prior Period Adjustments

- MRP 53: Negative Royalties and What to Do When Your Well Gets Shut-in

- MRP 13: Royalty Audits and Litigation with Attorney Spencer Cox

Division Orders

- MRP 3: How to Calculate your Net Revenue Interest in 3 Simple Steps

- MRP 16: What You Need to Know about Oil & Gas Division Orders

- MRP 135: Listener Questions for 2021

Texas Relinquishment Act

Thanks for Listening!

To share your thoughts:

- Leave a comment or listener question below (we read each one and your question may be featured in a future episode)!

- Ask a question or leave us feedback via email.

To help out the show:

- Subscribe and leave an honest review on Apple Podcasts or wherever you get your podcasts – we read each one and greatly appreciate it. Plus, you can get a shout-out in a future episode!

Thanks again – until next time!