This is the fourth episode in our series about the major producing oil and gas basins and plays in the US. The goal is to provide you an overview of the key facts and things you should know if you own minerals or royalties in the area. Please let us know if this is useful and if you have any requests on a particular area that you would like us to cover. We covered the Permian Basin, DJ Basin, and Powder River Basins in previous episodes.

Using the embedded player above, you can download the episode to your computer or listen to it here! Be sure to also subscribe on iTunes or wherever you get your podcasts and please leave us an honest rating and review. We read every one of them and sincerely appreciate any feedback you have. To ask us a question to be featured on an upcoming episode, please leave a comment below or send an email to feedback@mineralrightspodcast.com.

Now, let’s dive into our overview of the Uinta Basin

Uinta Basin Location:

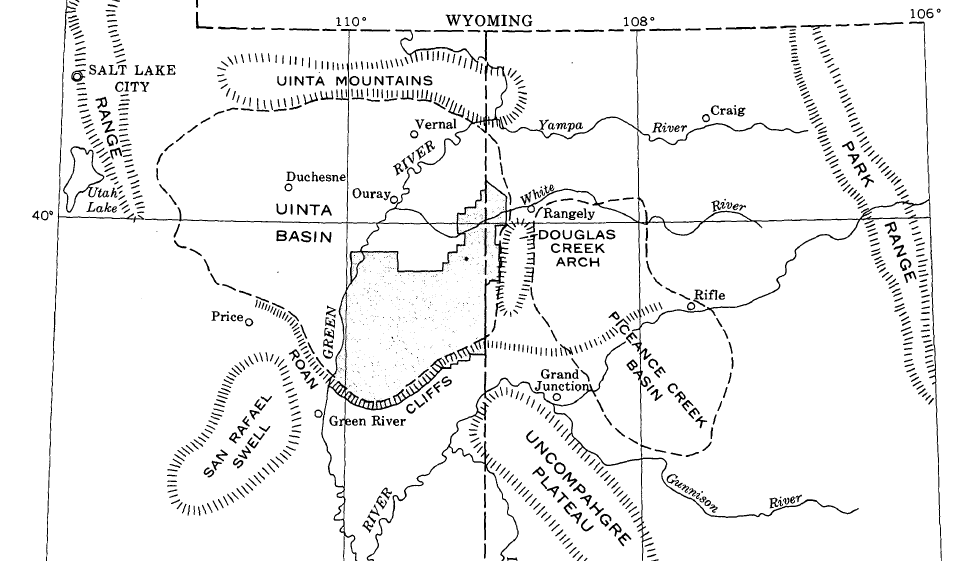

- Geologic structural basin located in Northeast Utah

- East of Wasatch Mountains and South of Uinta Mountains.

- First gas production was established in 1925 and oil was discovered in 1948 at Ashley Valley.

- Majority of production comes from Duchesne and Uintah counties but also includes Wasatch county, Carbon County, Emery, and Grand Counties.

- The largest population centers in the basin are Price, Utah in the SW part of basin and Vernal, Utah in the NE part of the basin.

- A large percentage of the surface and minerals in the Uinta are held by the federal government.

2018 Production Totals by County (Per Utah Department of Natural Resources – Oil and Gas Division):

Top 3 Counties in the Uinta Basin by Oil Production

| Year | County | Oil (BBLs) |

| 2018 | DUCHESNE (pronounced ‘do’-shAne) | 19,003,004 |

| 2018 | UINTAH | 12,147,869 |

| 2018 | SAN JUAN | 3,916,280 |

Top 3 Counties in the Uinta Basin by Natural Gas Production

| Year | County | Natural Gas (MCF) |

| 2018 | UINTAH | 187,997,746 |

| 2018 | DUCHESNE | 42,470,419 |

| 2018 | CARBON | 42,229,697 |

Uinta Basin Geology:

Looking at Map of the Uinta Basin you often see it shown with the Piceance Basin which is just across the border in Colorado. These two basins together are sometimes referred to as the Uinta-Piceance Province when talking about oil and gas potential. These two basins are both Laramide structures separated by the Douglas Creek arch. Another interesting feature is both basins are mostly bounded by major faults.

The Uinta Basin consists of both conventional oil and gas resources as well as unconventional (think tight sands, shales) oil and gas resources which are more continuous in nature.

Conventional oil and gas reservoirs have discrete geologic features which provide a structure for oil and gas to accumulate, more hit or miss, historically where oil and gas was found, usually vertical wells.

Unconventional formations are usually more continuous in nature and allow for horizontal drilling. Usually much lower permeabilities and lower porosity and don’t feature obvious seals and traps like conventional reservoirs.

According to the USGS, nearly all the undiscovered gas is estimated to be in continuous unconventional reservoirs. (Link: USGS Report on the Uinta Basin)

Here’s the Breakdown:

- 21 trillion cubic feet of gas and about 59 million bbls of oil, and 43 million barrels of NGL’s estimated in this province. Here’s the breakdown:

Natural Gas Potential:

- Of 21 TCF gas, 13 TCF estimated in Mesaverde formation,

- 7 TCF estimated in the Mancos/Mowry system,

- Others make up the rest

Crude Oil Potential:

- 65% of the estimated oil potential is in the Green River total petroleum system in the deep Uinta Basin; the remainder is estimated to be in conventional oil and gas reservoirs in the Green River and Phosphoria total petroleum systems.

- Overpressured layers exist in the deeper Northern and eastern areas of the Uinta Basin, especially around the Altamont-Bluebell field in the North part of the Uinta basin.

- Most of oil and gas fields and production is within Tertiary rocks in the Uinta Basin. What makes this interesting is this is from some of the youngest rock. This is made possible by both vertical and lateral migration of oil and gas from the original source rock in the deeper part of the basin. Some evidence of this is provided by the extensive occurrence of tar sands (solid bitumen) in outcrops around the center part of the basin.

As mentioned, the current focus is on the Deep Uinta Overpressured area that is part of the Green River Total Production system (Formations here are typically deeper than around 8,500 ft.).

Like other oil and gas plays, there are multiple stacked horizons in the Uinta. That said, the horizontal well activity is still at very early stages.

Potential Oil and Gas Formations in the Uinta Basin:

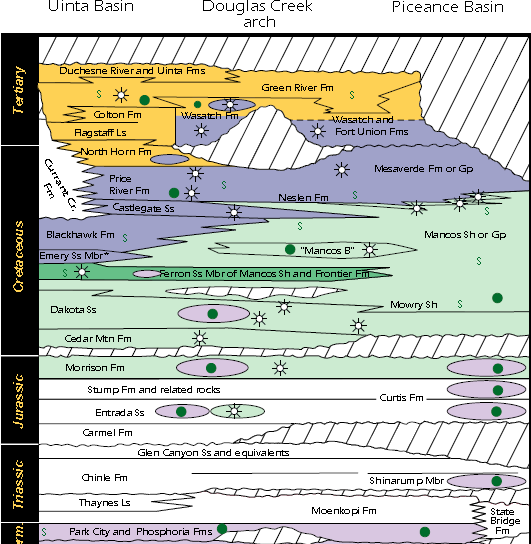

Here is an overview of the key formations in the Uinta Basin. See the stratigraphic column below for more information:

Fun Facts:

An interesting fact about this area is the Green River Formation contains the world’s largest oil-shale deposit with around 1.2 trillion bbls of oil in place in shale and marlstone. Most of these deposits were not buried deep enough to have generated hydrocarbons.

One of the most well known deposits is in the Mahogany oil-shale zone in the Piceance Basin in Colorado. Oil shale is immature source rock that is mainly consists of kerogen which has not been exposed to high enough pressures and temperatures to break it down into oil and gas.

When the price of oil was above $100/bbl there was a lot of interest from companies in trying to crack the code in accelerating this process by heating the oil shale both through traditional mining methods and then processing it in surface retort furnaces to try to get hydrocarbons out of the rock (used mainly in the early 1980’s). Then technology was developed by Shell and others to insert a heater down into the ground to basically generate synthetic crude oil, like refining the kerogen below ground and then producing the oil and gas that is created. Shell did a demonstration project that proved that this works but it is just not economic to do at current oil prices.

Key Formations:

- Green River Formation: a few of the major intervals include the Green River, Mahogany Oil Shale, Douglas Creek, Black Shale, Castle Peak, and Uteland Butte. Green river oil production is mostly black waxy crude.

- Below that there is the Wasatch formation. Oil production here is mostly yellow waxy crude.

- Then there is the Mesaverde Formation , mostly gas play. Depending on where you are in the basin can be dry gas or liquids rich (with NGL’s).

- Then the Deep Uinta, including the Blackhawk and Mancos/Dakota intervals

Current horizontal drilling is currently focused on the Lower Green River and Wasatch formations.

Major Operators:

- There used to be 3 major players – EP Energy, Newfield, and Crescent Point Energy.

- Several of the operators with largest positions in the basin have recently sold their interests.

- Crescent Point energy sold their Uinta asset in 2019 to unnamed private operator

- Encana acquired Newfield and their Uinta asset but it has been a footnote on investor presentations ever since with Encana focusing on their Anadarko and Permian acreage.

- EP Energy is seemingly the only major player that is touting their Uinta Basin position. Reporting some interesting horizontal well results from long lateral horizontal wells.

- Word is that Oxy is shopping their Uinta asset that they acquired in the recent Anadarko deal.

Economic Risk:

Like we’ve mentioned before, there is always a level of Economic Risk due to fluctuating commodity prices. For example, wells currently economic to drill at oil prices around $55-60/bbl oil $2.50/mcf natural gas might not be economic if prices drop. This would likely cause a stoppage in drilling new wells in this area due to the marginal nature of the play.

To find out more about the economics and outlook for horizontal drilling in the Uinta Basin, check out the article linked below.

Uinta Basin Economic Considerations:

- High paraffin content of Uinta crude oil contributes to higher transportation and refining costs. This is because it has to be kept hot in order for it to flow (around 100-120F).

- Well breakeven prices are marginal in the current $55-60 WTI price environment. Because of the focus on capital efficiency and companies living within their cash flow, marginal plays like the Uinta are likely to see a reduction in investments vs. other options that companies have.

- Example: Encana (Newfield) and Crescent Point, which are two of the largest operators in the basin have indicated that they are spending most of their capital budget on other plays like the Permian basin.

- What this means is that production will likely remain flat or even decline slightly going forward unless oil prices rise above $60/bbl or unless operators can get drilling & completions costs down.

Political Risk:

- Utah is a pretty conservative state, mostly favorable to extractive industries. All that could change if out of state special interest groups decide to come in to influence legislation.

- That said, risk of this is pretty low since Utah isn’t a major oil and gas producer and level of activity is relatively small compared to other parts of the country so if environmental groups are going to spend energy it will likely be where they feel they can get the biggest ‘bang for their buck’.

- Quote from John R. Baza – Utah Director of Division of Oil Gas and Mining: “The mining of coal, minerals, oil and natural gas production play an important part in Utah’s economy, and without these natural resources we would not enjoy the standard of living we do in our modern society. The Division of Oil, Gas and Mining ensures our access to these natural resources in an environmentally responsible manner, while our Abandoned Mine Program works to protect the public from the dangers of unregulated past mining practices. . .”

Geologic Risk:

- The Uinta Basin is a higher risk area from a geologic perspective because it is a relatively immature horizontal oil and gas play

- The wax content in crude oil that is produced here can be problematic to handle.

- Success will likely be isolated to thermally mature parts of the basin where oil and gas reservoirs are overpressured.

- One of the issues is that that many of the wells are deep so this can present issues when drilling; in other words, there may be more opportunities for operational issues.

Infrastructure Constraints:

Also, because oil produced in Uinta has a high paraffin content, it is harder to transport since it has to remain hot (100-120F) otherwise it solidifies into wax. Because of this, most of Uinta Basin crude oil is trucked via insulated trucks to local refineries in Salt Lake City. Because of high paraffin content, only certain refineries are setup to process this so there is a bit of a refining constraint.

Utah Refining Capacity:

- Marathon operates largest refinery in Utah with total crude oil refining capacity of 61,000 barrels per day.

- Chevron refinery around 55,000 barrels per day

- HollyFrontier Woods Cross Refining LLC (North Salt Lake) around 39,000 bbl/day

- Big West Oil Co – around 30,500 bbl/day

Total Refining capacity in Salt Lake City is around 185,500 bbl/day which is relatively small. Of that, only around 88,000 bbl/day is wax crude refining capacity. So there is somewhat a cap on local refining capacity.

Rail terminals would likely be the way that operators would look to expand to get their product to market. Around 60,000 bbl/day capacity of rail capacity today. Link to EIA data on refining capacity. To put that in perspective, the Motiva refinery in Port Arthur, TX is the largest in North America with around 600,000 bbl/day capacity.

Thanks for Listening!

To share your thoughts:

- Leave a comment or question below (we read each one and your question may be featured in a future episode)!

- Ask a question or leave us feedback via email or voicemail: (720) 580-2088.

To help out the show:

- Subscribe and leave a review on iTunes or wherever you get your podcasts – we read each one and greatly appreciate it. Plus, you can get a shout out on a future episode!

Thanks again – until next time!

Great overview Matt and Justin, thanks. I believe the private operator that bought Crescent Point’s assets was Finley Resources. They have been active on drilling permit requests with the State and their web site has Utah as a focus area. Their corporate office is located in Fort Worth and they have a field office in Roosevelt, UT. They recently signed a lease with us.