The goal of this episode is to provide an overview of the things you should around owning mineral rights or royalties in the Appalachian Basin and to provide information about the Marcellus and Utica Shales. This is the fifth episode in our series about the major producing oil and gas basins and plays in the US. Please let us know if this is useful and if you have any requests on a particular area that you would like us to cover. We covered the Permian Basin, DJ Basin, Uinta Basin, and Powder River Basins in previous episodes.

Using the embedded player above, you can download the episode to your computer or listen to it here! Be sure to also subscribe on iTunes or wherever you get your podcasts and please leave us an honest rating and review. We read every one of them and sincerely appreciate any feedback you have. To ask us a question to be featured on an upcoming episode, please leave a comment below or send an email to feedback@mineralrightspodcast.com.

Now, let’s dive into our overview of the Appachian Basin.

Appalachian Basin Location

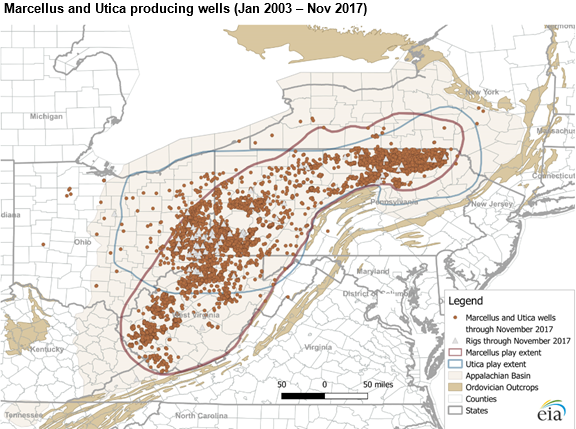

The basin covers most of New York, Pennsylvania, Eastern Ohio, West Virginia, Western Maryland on the north part of the basin and down to parts of Northwestern Georgia and Northeastern Alabama to the south.

The Appalachian Basin covers approximately 185,000 square miles and is around 1,000 miles long from the Northeast to the Southwest and is as much as over 300 miles wide at some parts

Appalachian Basin Geology

The primary producing formations in the Appalachian Basin today are the Marcellus Shale and the Utica and Point Pleasant formations. The initial focus of operators using horizontal drilling and hydraulic fracturing was in the Marcellus Shale in Pennsylvania around 2003.

Marcellus Shale

Because of this, when you say “Appalachian Basin” the first thing that usually comes to mind is the Marcellus Shale.

The Marcellus Shale is middle Devonian in age so that puts it around 393 to 382 million years ago. It got its name because it outcrops near Marcellus, New York. The Marcellus Shale extends through most of the Appalachian Basin but is really prevalent in Ohio, W. Va, PA, and NY. According to the USGS, the footprint of the Marcellus covers about 95,000 square miles with around 72,000 of that actually prospective for gas. Depth wise, it is pretty deep in parts of PA it is around 6000 ft deep and then shallower into Ohio where it is around 2000 ft deep (source: Geology.com)

The Marcellus Shale is one of the largest Natural gas plays in the United states. Some of the most prolific areas are in Northwestern Pennsylvania. According to the latest USGS assessment from October 2019, the Marcellus contains about 97 trillion cubic feet of undiscovered, technically recoverable natural gas and 1.5 billion barrels of undiscovered, technically recoverable natural gas liquids (e.g. propane, butane, ethane, etc.). This means that it could be produced using existing technology. Whether or not all of that it is actually profitable to produce is another question. These volumes don’t include what has already been discovered or produced.

The EIA provided an estimate in 2015 and at that time the proven reserves were 77.2 trillion cubic feet (TCF) of gas and oil reserves were 143 million barrels.

Utica Shale

Below the Marcellus is the other major producing formation called the Utica Shale. It is Sometimes referred to as Point Pleasant-Utica Shale formation which is older than the Marcellus Shale. It is another stacked play and is actually more geographically extensive than the Marcellus. Because it is deeper, it is also generally a bit more expensive to drill. Subsea depth ranges from 5,000 ft to 11,000 ft where most producing wells are.

Drilling and production began in Quebec Canada in 2006 and in Ohio around 2011.

The Point Pleasant-Utica Shale underlies most of NY, PA, OH, and West VA and up into Ontario and Quebec in Canada. The combined thickness exceeds 300 feet in northwest and central PA and in northeast and central Ohio.

The potential of the Utica is also impressive, around 117 trillion cubic feet of undiscovered, technically recoverable continuous resources of natural gas and 1.8 billion barrels of oil and 985 million barrels of NGL’s.

The EIA estimated the proven reserves for the Utica Shale play in 2017 at 6.4 trillion cubic feet (TCF) in Ohio.

According to the USGS, the combined potential of these two formations in the Appalachian Basin is around 214 trillion cubic feet of undiscovered, technically recoverable resources of natural gas.

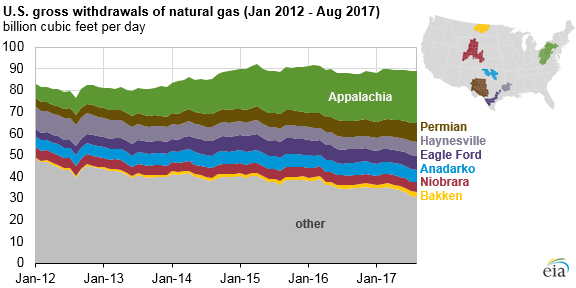

The EIA projects the Appalachian basin production to rise to 50 Bcf/day by 2050 which is more than many countries.

Appalachian Basin Operators

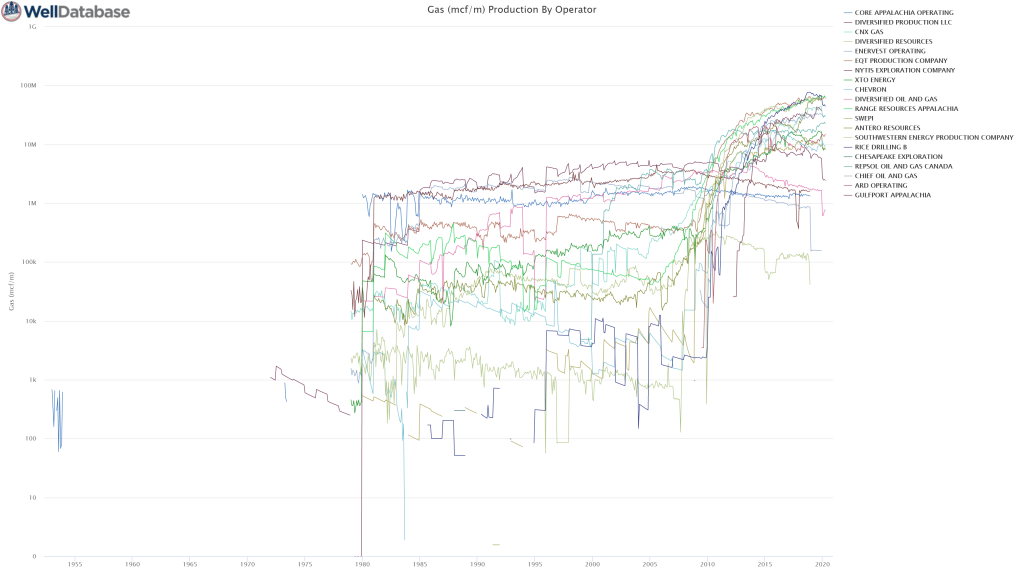

EQT, Chesapeake, Range Resources, Antero, Repsol, and Gulfport are just a few of the largest natural gas producers in the Appalachian Basin.

Here are a few interesting graphics I created using the production analytics tools that are available with the WellDatabase Essential Plan. If you haven’t used WellDatabase before, definately check it out.

Top Operators in the Appalachian Basin

Top Oil and Gas Operators in Pennsylvania (as of July 17, 2020)

| Name | Well Count | CUM Gas (Mcf) | CUM Oil (bbl) |

| CHESAPEAKE APPALACHIA | 3,218 | 6,170,518,500 | 0 |

| CABOT OIL AND GAS | 1,662 | 5,704,950,300 | 512 |

| RANGE RESOURCES APPALACHIA | 3,630 | 4,067,362,000 | 1,061,254 |

| EQT PRODUCTION COMPANY | 2,882 | 3,642,085,600 | 2,648 |

| SOUTHWESTERN ENERGY PRODUCTION COMPANY | 1,216 | 3,321,034,200 | 567,171 |

| RICE DRILLING B | 1,045 | 2,554,293,200 | 4,919 |

| CHIEF OIL AND GAS | 772 | 2,077,389,800 | 0 |

| REPSOL OIL AND GAS CANADA | 1,188 | 1,918,490,900 | 0 |

| CNX GAS | 1,563 | 1,633,289,000 | 6,246 |

| SENECA RESOURCES | 1,541 | 1,547,386,000 | 6,825 |

| ARD OPERATING | 438 | 1,323,134,700 | 32 |

| DIVERSIFIED PRODUCTION LLC | 12,152 | 1,196,665,700 | 154,037 |

| CHEVRON | 796 | 1,038,260,860 | 42,346 |

| SWEPI | 1,377 | 910,549,800 | 170,888 |

| PENNENERGY RESOURCES | 520 | 850,682,500 | 34,680 |

| BKV OPERATING | 163 | 723,227,840 | 0 |

| DIVERSIFIED OIL AND GAS | 8,125 | 678,406,460 | 1,267,401 |

| XTO ENERGY | 650 | 587,498,940 | 4,816 |

| PA GEN ENERGY | 552 | 481,330,400 | 114,126 |

| EXCO RESOURCES PA | 1,329 | 368,559,900 | 6,388 |

Top Oil and Gas Operators in Ohio (as of July 17, 2020)

| Name | Well Count | CUM Gas (Mcf) | CUM Oil (bbl) |

| ASCENT RESOURCESMARCELLUS | 668 | 2,059,386,400 | 31,318,136 |

| GULFPORT APPALACHIA | 405 | 1,838,790,800 | 6,062,878 |

| EAP OHIO LLC | 865 | 1,765,968,800 | 41,366,032 |

| ANTERO RESOURCES | 282 | 913,933,100 | 8,612,027 |

| RICE DRILLING B | 188 | 860,386,000 | 203 |

| ECLIPSE RESOURCES I | 356 | 593,218,000 | 20,040,020 |

| DIVERSIFIED PRODUCTION LLC | 7,057 | 551,324,600 | 20,516,438 |

| ENERVEST OPERATING | 6,336 | 498,618,180 | 37,023,620 |

| XTO ENERGY | 88 | 311,090,530 | 106,878 |

| CNX GAS | 95 | 268,029,790 | 24,578 |

| EQUINOR USA ONSHORE PROPERTIES INC | 54 | 166,990,220 | 418,783 |

| EVERFLOW EASTERN PTNS | 973 | 141,448,560 | 3,714,224 |

| ERIC PETROLEUM | 763 | 97,797,990 | 814,638 |

| PIN OAK ENERGY PARTNERS | 563 | 64,737,728 | 4,804,240 |

| NORTHWOOD ENERGY | 1,873 | 62,095,424 | 4,154,213 |

| TRIAD HUNTER | 300 | 61,039,148 | 712,739 |

| ARTEX OIL COMPANY | 456 | 57,519,632 | 2,264,680 |

| PETROX | 1,798 | 55,645,796 | 5,331,723 |

| PENNENERGY RESOURCES | 40 | 51,460,036 | 3,328,311 |

| HILCORP ENERGY COMPANY | 65 | 49,691,168 | 120 |

Top Oil and Gas Operators in West Virginia (as of July 17, 2020)

| Name | Well Count | CUM Gas (Mcf) | CUM Oil (bbl) |

| ALLIANCE PETROLEUM CO LLC | 10,806 | 1,845,534,700 | 4,302,714 |

| ANTERO RESOURCES | 940 | 1,379,002,900 | 4,783,183 |

| NYTIS EXPLORATION COMPANY | 5,311 | 989,358,300 | 4,822,578 |

| EQT PRODUCTION COMPANY | 2,200 | 831,879,040 | 2,567,337 |

| SOUTHWESTERN ENERGY PRODUCTION COMPANY | 543 | 740,003,000 | 16,199,926 |

| CORE APPALACHIA OPERATING | 2,471 | 601,259,100 | 364,943 |

| GREYLOCK CONVENTIONAL | 2,008 | 329,961,900 | 1,097,241 |

| TUG HILL OPERATING | 296 | 173,183,500 | 3,530,897 |

| XTO ENERGY | 835 | 154,919,630 | 172,382 |

| SUMMIT APPALACHIA OPERATING COMPANY LLC | 325 | 137,481,780 | 0 |

| HG ENERGY II APPALACHIA | 127 | 132,043,150 | 427,049 |

| JAYBEE OIL AND GAS | 662 | 127,649,110 | 820,749 |

| DOMINION ENERGY TRANSMISSION | 2,150 | 127,045,710 | 434,342 |

| WESTMORELAND HARRY | 160 | 114,012,310 | 134 |

| MOUNTAIN V | 840 | 113,055,450 | 556,362 |

| PILLAR ENERGY | 1,325 | 108,162,880 | 2,359,660 |

| ARSENAL RESOURCES | 137 | 106,463,584 | 0 |

| TRIBUNE RESOURCES LLC | 281 | 101,641,120 | 5,027,228 |

| ENERVEST OPERATING | 599 | 89,204,944 | 414,200 |

| CNX GAS | 447 | 86,732,270 | 237,922 |

Economic Risk

Pros: one of the closest plays to the eastern seaboard and major markets of New York and New England.

Commodity price is the big risk. One of the main issues facing shale operators in the Appalachian basin is economics at current gas prices. At the time of this recording, Henry Hub gas price is $1.60. Natural gas futures for July 2020 were $1.637/mmbtu.

In Episode 50, we went into detail about how natural gas is priced.

Political Risk

This is probably the biggest headwind facing production in the Appalachian Basin. A hydraulic fracturing ban was instituted in New York in 2010. Some production from wells drilled prior to this but otherwise mostly in PA and OH and W. VA.

One of the biggest challenges facing operators are regulations prohibiting transportation of Marcellus and Utica natural gas to New York. Specifically, the Constitution pipeline which was approved by the Federal Energy Regulatory Commission in 2014 has been held up in New York. So the crazy thing is increased demand in New England is being partially met by Russian natural gas imports. The unintended consequences of limiting responsible energy development in the US is that it provides an opportunity for countries that may be not always on our side to take advantage of the situation.

Geologic Risk

The geology of the Appalachian Basin and the major producing formations are pretty well known at this point. Generally speaking, the geologic risk associated with the Marcellus and Utica Shale formations is pretty low. The issue is that a good portion of reserves are not economic at current prices.

Infrastructure

The big hurdle right now for Appalachia is midstream capacity. Plus, the political issues we already mentioned make it difficult to get approval for new export pipelines.

Shell is building a big ethane cracker in PA with Average peak annual production: 1.6 million tonnes of polyethylene once it comes online.

Outlook

The outlook for the Appalachian Basin (and for most natural gas plays) is generally positive as demand for natural gas is increasing. The move away from coal and towards natural gas for power generation is fueling some of this demand and LNG exports are expected to also help.

According to Forbes, natural gas is the only fossil fuel expected to grow in global demand through 2035. With the increase of LNG export capacity in the US, this should provide price relief for US producers. In fact the export capacity in the US is expected to grow to 34 BCF per day by 2027.

All this to say that prices should increase as export capacity comes online given the expectation that global gas prices are expected to average around $7/MCF in the future.

Side note, I watched the Michael Moore documentary “Planet of the Humans” and it was quite open in their assessment of current renewable energy alternatives requiring a significant amount of non-renewable resources. Not usually a big fan of his work but this was pretty well done. This just goes to show that we will still be dependent on fossil fuels like Natural Gas for a long time.

Thanks for Listening!

To share your thoughts:

- Leave a comment or question below (we read each one and your question may be featured in a future episode)!

- Ask a question or leave us feedback via email or voicemail: (720) 580-2088.

To help out the show:

- Subscribe and leave a review on iTunes or wherever you get your podcasts – we read each one and greatly appreciate it. Plus, you can get a shout out on a future episode!

Thanks again – until next time!