In this episode we provide an overview of the Williston Basin and the Bakken/Three Forks Shale. Learn about the history, geology, operators, and risks related to owning minerals and royalties in this prolific oil basin. Plus, we talk about exciting developments in managing stranded natural gas and future alternative energy opportunities in this energy rich area of Saskatchewan, Montana, North Dakota, and South Dakota.

This is the seventh episode in our series about the major producing oil and gas basins and plays in the US. Please let us know if you have any requests on a particular area that you would like us to cover. We covered the Permian Basin, DJ Basin, Uinta Basin, Powder River Basin, SCOOP/STACK/MERGE Plays , and Haynesville Shale in previous episodes.

Using the embedded player above, you can download the episode to your computer or listen to it here!

Be sure to also subscribe on Apple Podcasts via the link above (or wherever you get your podcasts) and please leave us an honest rating and review. We read every one of them and sincerely appreciate any feedback you have. To ask us a question to be featured on an upcoming episode, please leave a comment below or send an email to feedback@mineralrightspodcast.com.

Let’s dive in to our overview of the Williston Basin and the Three Forks / Bakken Shale.

Location

The Williston Basin is a large sedimentary basin in eastern Montana, western North Dakota, South Dakota, and southern Saskatchewan. The Williston Basin is known for its deposits of oil and gas as well as potash deposits. We talk about the importance of Potash in MRP 76: Leasing Mineral Rights for Mining Potash and Other Critical Minerals. The basin extends approximately 475 miles from the north to south and 300 miles east to west. It is roughly oval shaped and stretches from the Northwest to the Southeast.

Amerada Petroleum drilled the first commercial oil well, the Clarence Iverson No. 1 Well, approximately 50 miles from Williston, North Dakota on April 4, 1951 which launched the first drilling boom in the Williston Basin. In fact, within two months of this discovery over 30 million acres had been leased up by operators and speculators. The well ultimately produced more than 585,000 bbls of oil.

While the Bakken Formation is one of the primary targets today, operators have been drilling Bakken wells for almost 70 years. The formation was discovered to contain oil in 1953 and it was primarily seen as source rock which fed shallower conventional petroleum deposits.

Williston Basin Geology

The basin is a geologic structural basin which means that it is a structural formation of layers of rock that have been deformed by tectonic warping. Another way to put it is that it is a geologic depression and is the opposite of a dome.

Starting from the bottom, the Upper Cambrian Deadwood Formation is one of the deepest targets for drilling. Above that, the Winnipeg, Red River, and Stony Mountain Formations are stacked as part of the Ordovician System. These layers are generally shallow marine sandstone, shales, and carbonates.

Above this, is the Silurian Interlake Formation, and then the Devonian System. Notable Devonian Formations include the Dawson Bay, Duperow, and Birdbear.

All of these deeper formations pale in comparison to the potential of the shallower Bakken/Three Forks Formation which are part of the Late Devonian and Early Mississipian System.

All of these formations are part of the Paleozoic Era which lasted from around 541 to 251 million years ago. The Paleozoic Era is famous for the largest extinction event in the history of the eargth – the Permian – Triassic extinction event. This is different than the Cretaceous-Paleogene extinction event which killed off the dinosaurs approximately 66 million years ago due to the impact of a massive asteroid near what is now the Yucatan Peninsula.

Major Formations in the Williston Basin

The primary focus today is on the Bakken Shale and Three Forks Formation which underlies the Bakken. Another formation that you may hear mentioned is the Sanish sandstone that exists above the Three Forks in parts of the Williston Basin. There are many other producing formations in the Williston, inducing many of the formations we already mentioned. Many were the focus of conventional oil and gas development in the past, where oil and gas reservoirs were identified through seismic data and exploration drilling with a much lower success rate.

When it was determined that the Bakken/Three Forks could be economically developed using horizontal drilling and hydraulic fracturing, this changed the focus in the Williston Basin.

Some numbers to talk about the amount of oil that many of these Bakken wells have the potential to produce. Hess reported in their latest investor presentation that the per well Estimated Ultimate Recoveries are around 1.2 million barrels of oil equivalent, with initial production rates of between 100 – 150,000 bbls of oil in the first 180 days.

The USGS assessed undiscovered gas and natural-gas liquid resources within the Williston Basin Province, in North Dakota, Montana, and South Dakota and the totals are 2.4 trillion cubic feet and 100 million barrels of natural gas liquids.

Using a geology-based assessment methodology, the U.S. Geological Survey estimated mean undiscovered volumes of 7.4 billion barrels of oil as of 2013. I’m sure estimates are higher now but the thing to note is that it is the second largest oil play in the US, the first is the Permian Basin.

Operators

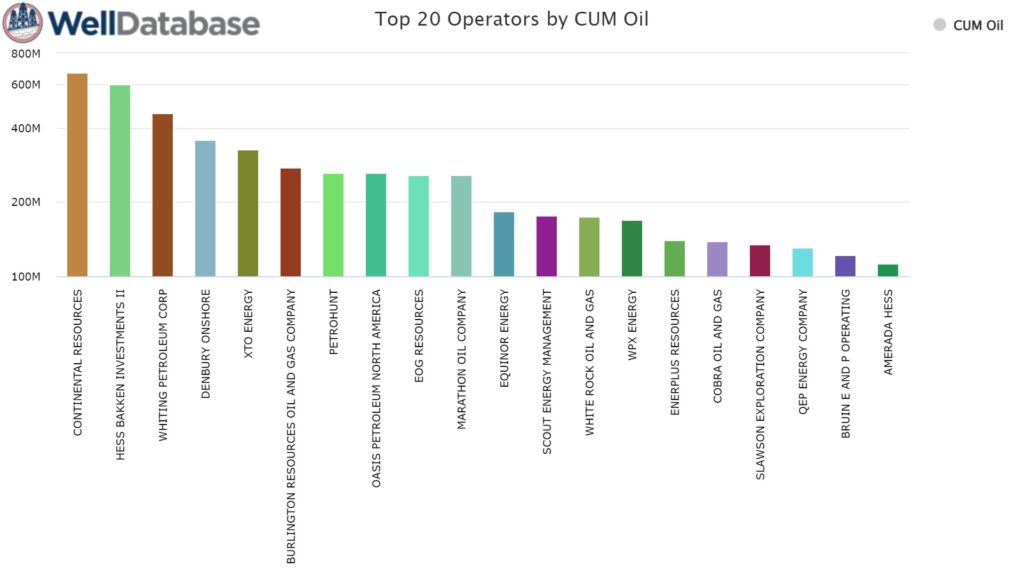

To take a look at the top operators by cumulative oil production, we went to WellDatabase. As shown in the chart below, Continental Resources, Hess, and Whiting Petroleum are the top oil producers. The theme for the Williston Basin is that large and medium size independent companies make up most of the production.

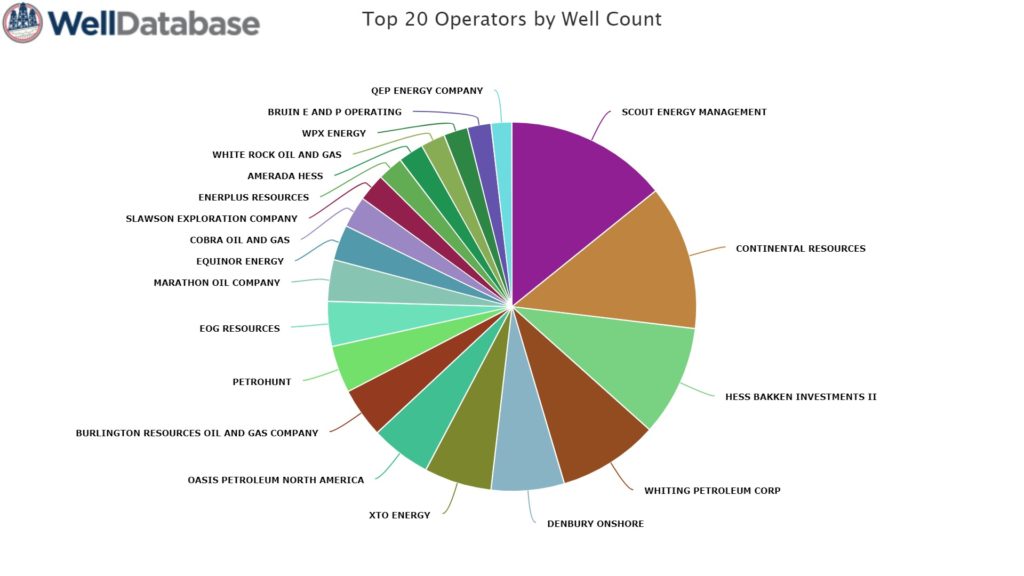

Taking a look at the top operators by well count yields similar results:

Production

The Bakken leads the other major oil producing basins and plays in terms of production efficiency. In other words, a new Bakken well has the highest initial crude oil production rate compared to any other new well drilled onshore in the U.S. The latest USGS Drilling Productivity Report for the Bakken Region breaks this down and shows just how many barrels per day each additional drilling rig adds to new oil production for this important play.

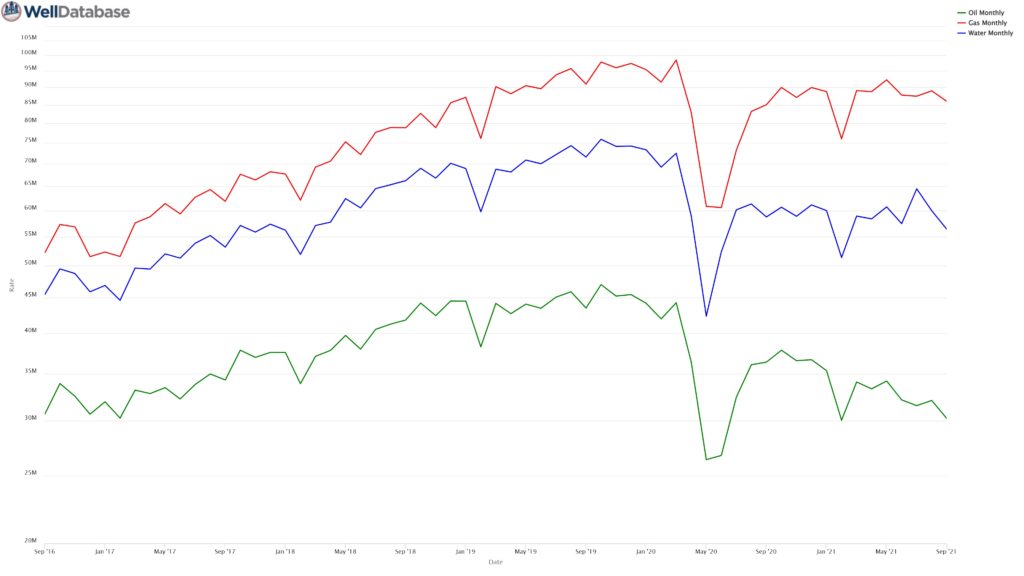

To illustrate just how prolific the Williston Basin and the Bakken is, we took a look at the cumulative oil and natural gas production in the basin through September 1, 2021 (data from WellDatabase.com):

Oil: 6,606,600,739 bbl

Gas: 10,642,438,886 mcf

This results in a total of 8,380,340,553 Barrels of Oil Equivalent (BOE)!

Despite the slowdown over the past few years, the Williston Basin still contributes a significant portion of US Crude Oil Production as seen in the chart below.

Economic Risk

The core of the Bakken play is generally seen to have already reached maximum infill development. In other words, the average well production from more recent wells tend to under-perform older wells after the first year of production.

Operators have been optimizing well spacing and completions design all with a focus on higher asset value per drilling spacing unit and how much they can ultimately produce from that lease vs. focusing on higher initial production rates as they may have done in the past.

This is helping to mitigate some of these parent-child well issues as the basin gets drilled out and the economics appear to still be strong even at $50/bbl oil prices (Hess presentation).

Political Risk

North Dakota and Montana where much of the activity is located has generally been favorable to the oil and gas industry but the macro trends are adding additional requirements for operators. This includes things like decreasing the amount of natural gas that operators can flare and ensuring

Infrastructure

Historically, takeaway capacity has been a challenge for operators and has been a bottleneck to increasing production. A lot of Bakken crude is transported by rail. This limited takeaway capacity caused Bakken crude to trade at a discount to West Texas Intermediate due to the higher transportation costs.

One of the challenges that operators in North Dakota are facing is the limited natural gas takeaway capacity. Many Bakken wells have associated natural gas that is tied to the production of crude oil and with increasingly stricter flaring regulations, many operators are often faced with the decision to shut in wells to meet these requirements.

One of the trends that we are seeing in the Williston Basin where operators are faced with this problem is looking at ways to capture as much gas as possible vs. flaring or venting. One flare mitigation tactic that many are using is installing mobile data centers and natural gas generators to burn the gas to generate electricity and then using this electricity to power these computers to do things like mine bitcoin. In fact, Kraken Oil & Gas LLC has mentioned this has allowed them to monetize their stranded natural gas while decreasing its flaring emissions. We talk more about using stranded natural gas for bitcoin mining in MRP 113: Mineral Rights News July 2021.

To put in perspective how big of an opportunity this is, around 92% of produced natural gas is currently captured and sold or used for things like electricity generation. This means that we still have around 8% of the gas that is flared. So there is a big opportunity to either leverage the current high gas prices to expand the gas gathering and processing capacity in the basin or to bring in mobile gas generators to tie into the grid or to do things like mine bitcoin at the wellsite.

Outlook

In addition to the rich petroleum deposits which will continue to be extracted for many years, the williston basin will likely be part of the future of energy as we transition to a lower carbon future. For example, there is the potential to leverage CO2 sequestration and Enhanced Oil Recovery to reduce carbon emissions while maximizing production of oil, production of other products like helium, hydrogen, and potash, as well as leveraging geothermal energy for heat and power generation.

Thanks for Listening!

To share your thoughts:

- Leave a comment or question below (we read each one and your question may be featured in a future episode)!

- Ask a question or leave us feedback via email or voicemail: (720) 580-2088.

To help out the show:

- Subscribe and leave a review on Apple Podcasts or wherever you get your podcasts – we read each one and greatly appreciate it. Plus, you can get a shout out on a future episode!

Thanks again – until next time!