In this episode, we provide an overview of key facts about the Haynesville Shale natural gas play in Louisiana, Texas, and Arkansas. Learn what four companies have each produced more than 1 trillion cubic feet of gas since 2012 and where rigs are currently drilling. Also, this major oil and gas company is excited about the prospects for this important natural gas play and for good reason (you might be surprised who it is).

This is the sixth episode in our series about the major producing oil and gas basins and plays in the US. Please let us know if you have any requests on a particular area that you would like us to cover. We covered the Permian Basin, DJ Basin, Uinta Basin, Powder River Basin, and SCOOP/STACK/MERGE Plays in previous episodes.

Using the embedded player above, you can download the episode to your computer or listen to it here!

Be sure to also subscribe on Apple Podcasts via the link above (or wherever you get your podcasts) and please leave us an honest rating and review. We read every one of them and sincerely appreciate any feedback you have. To ask us a question to be featured on an upcoming episode, please leave a comment below or send an email to feedback@mineralrightspodcast.com.

Now, let’s dive into our overview of the Haynesville Shale.

Location

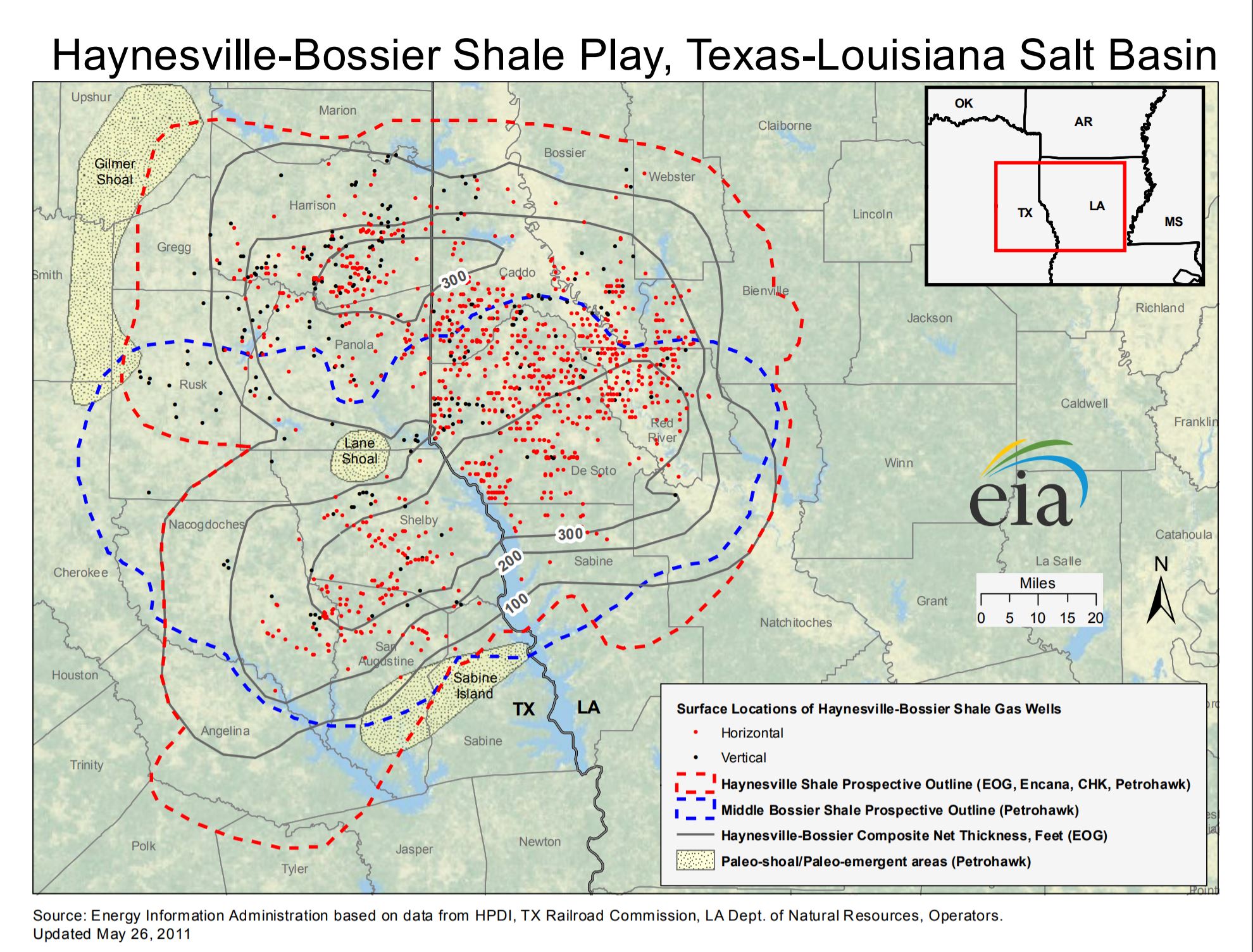

The Haynesville Shale is the common name of a Jurassic Period rock formation that underlies large parts of southwestern Arkansas, northwest Louisiana, and East Texas. It is one of the most important shale-gas plays in North America because resource estimates put recoverable natural gas in the hundreds of trillions of cubic feet. It is considered a dry gas play which means that there are not a lot of natural gas liquids produced with the gas.

It is near what is called Ark-La-Tex region. This is where the three states of Arkansas, Louisiana, and Texas meet. You’ve heard of the 4 corners, this is the 3 corners.

Geology

The Haynesville shale is the common name for a Jurassic period rock formation that is part of the Haynesville formation. The Haynesville formation contains two formal subdivisions – geologists call these members. They are the Gilmer limestone, also called the cotton valley limestone and Buckner anhydrite member.

Major Formations

Another formation often talked about along with the Haynesville is the Bossier shale. The Bossier actually lies directly above the Haynesville shale but lies under the Cotton Valley sandstones. Because of this some geologies consider the Haynesville and Bossier one in the same. The Haynesville is bounded on the bottom by the Smackover Formation.

The Haynesville is a heterogeneous mudstone which is a fine grained sedimentary rock that originally consisted of clays or muds. It lies at depths of 10,500 to 13,000 feet below ground so it is one of the deeper shale plays in North America. It averages about 200 to 300 feet thick and contains vast quantities of recoverable natural gas.

Like we’ve talked about before, shale formations like the Haynesville, were typically thought of as source rock as well as the cap and basement rock layers that trapped oil and gas in conventional reservoirs. This was the case here until around 2008 as operators suspected that there was a significant amount of gas in the Haynesville but there was not an economic way to produce it. In 2008 in conjunction with Henry Hub natural gas spot prices peaking at $12.69/MMBtu in June of that year, Chesapeake Energy figured out how to use horizontal drilling and hydraulic fracturing to extract the gas in a cost-effective manner in their successful exploration wells in the Haynesville. This kicked off a rush to lease up acreage and by 2010 the Haynesville had the most natural gas drilling rigs of any part of the country.

So while the price of natural gas dropped significantly in 2009 and as operator strategies shifted towards oil, assets have changed hands since then but it is back in focus in 2020 due to the bullish outlook for natural gas.

Haynesville Shale Well Results

Plus, the Haynesville has a lot going for it with the huge and repeatable well results (some 2-mile lateral wells have EUR’s up to 24 BCF PER WELL). To put this in perspective it is around 2x nearby Eagle Ford wells. Plus due to the overpressured nature of the reservoir, these wells produce more gas in the first year and then have a very steep decline after that.

By producing more in the first year, operators see a quicker payout and higher return for investors due to the time value of money. Haynesville Shale gas wells can be expensive to drill since they are so deep so there is a trade off. That said, Chesapeake claims that the breakeven prices are around $2.25/MCF but you have to take that with a grain of salt since they are currently going through bankruptcy.

Operators

Speaking of assets changing hands, here are a few of the notable transactions:

- BHP purchased Petrohawk’s Haynesville assets in 2011. BP acquired these assest in 2018 when they purchased BHP’s oil and gas interests.

- Encana (now Ovintiv) was one of the major players in the Haynesville but they sold these assets to GEP Haynesville, LLC

- Shell sold its Haynesville asset in 2014 to Vine Oil & Gas

- In 2016, Anadarko sold its East Texas Haynesville assets to Castleton Commodities International (CCI). Castleton also purchased the BG US Production Company assets from Shell at the end of 2019 (former British Gas interests in the Haynesville). Castleton Commodities is owned by Tokyo Gas America Ltd…

- Aethon Energy Management purchased QEP Resource’s interests in the Haynesville in 2019.

Cumulative Production

To take a look at the top operators by natural gas production, we went to WellDatabase. Here are a few highlights for cumulative gas production since 2012 when the play really started to boom.

Chesapeake, BP, Comstock, and Vine each have produced more than a Trillion Cubic Feet (TCF) of gas from the Haynesville since 2012!:

| Name | Well Count | CUM Gas (Mcf) | CUM Oil (bbl) | CUM Water (bbl) |

| CHESAPEAKE OPERATING | 243 | 1,517,842,400 | 9,360 | 112,736 |

| COMSTOCK OIL AND GAS | 218 | 1,092,851,000 | 10,725 | 0 |

| VINE OIL AND GAS (assets purchased from Shell) | 185 | 1,061,994,430 | 0 | 0 |

| INDIGO MINERALS | 256 | 836,973,630 | 931,023 | 0 |

| EXCO OPERATING COMPANY (purchased some of Chesapeake’s interests in Haynesville in 2015) | 173 | 724,790,660 | 0 | 3,649,901 |

| XTO ENERGY | 185 | 702,889,150 | 239,050 | 19,642,760 |

| CCI EAST TEXAS UPSTREAM (formerly Anadarko’s assets) | 222 | 656,238,140 | 634,019 | 78,615,024 |

| BPX OPERATING COMPANY (BHP’s assets purchased by BP) | 100 | 611,916,350 | 1,423 | 1,423 |

| AETHON ENERGY OPERATING (Formerly QEP’s assets) | 225 | 536,149,400 | 221,894 | 1,663,898 |

| BP AMERICA PRODUCTION COMPANY | 90 | 510,552,320 | 19,427 | 4,573,921 |

| GEP HAYNESVILLE (Encana’s old assets) | 114 | 507,901,820 | 0 | 0 |

| ROCKCLIFF ENERGY OPERATING | 161 | 485,012,860 | 1,670,348 | 34,893,076 |

| SABINE OIL AND GAS | 132 | 314,010,020 | 2,793,591 | 27,094,536 |

| COMSTOCK OIL AND GASLA | 72 | 291,639,000 | 239,582 | 5,767,912 |

| AMPLIFY ENERGY OPERATING | 76 | 211,092,020 | 1,748,426 | 28,601,934 |

| BPX KCS RESOURCES LLC | 32 | 189,980,300 | 0 | 0 |

| GOODRICH PETROLEUM COMPANY | 19 | 109,454,456 | 12 | 0 |

| TANOS EXPLORATION II | 48 | 101,804,704 | 510,950 | 6,311,927 |

| MERIT ENERGY COMPANY | 40 | 92,405,410 | 942,769 | 18,744,714 |

| PETROQUEST ENERGY | 27 | 80,326,056 | 485,588 | 10,984,452 |

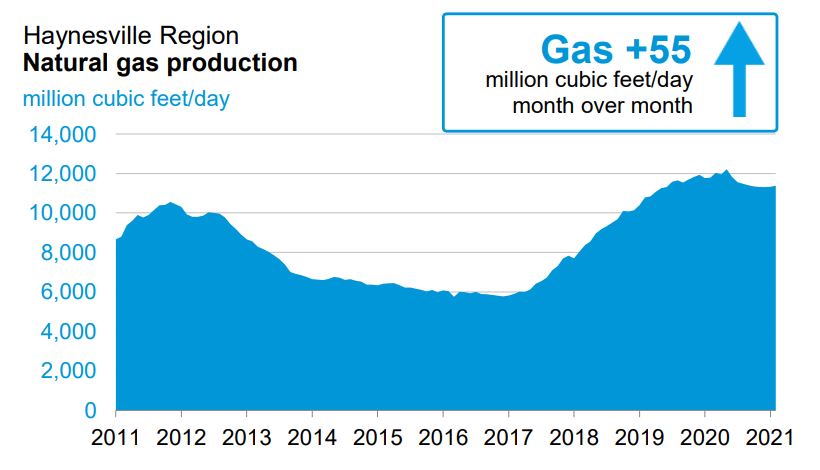

And to compare how the natural gas production has fared over time, this graph from the EIA shows that production is down slightly in 2020 but not by much. In fact, natural gas production was up by 55 MMcf/day month over month in January 2021.

Haynesville Shale Rig Count

The Haynesville is one play that has received more attention as of late with the positive outlook for natural gas prices. In fact, there were 40 drilling rigs running in the area as of November 17, 2020. Here are a few of the top operators still drilling:

| Operator | Number of Rigs |

| ROCKCLIFF ENERGY OPERATING | 4 |

| AETHON ENERGY OPERATING | 4 |

| BURLINGTON RESOURCES OIL AND GAS COMPANY | 4 |

| EOG RESOURCES | 3 |

| SABINE OIL AND GAS | 3 |

| MARATHON OIL COMPANY | 3 |

| COMSTOCK OIL AND GASLA | 2 |

| DEVON ENERGY PRODUCTION COMPANY | 1 |

| CALLON PETROLEUM COMPANY | 1 |

| CHESAPEAKE OPERATING | 1 |

| SM ENERGY COMPANY | 1 |

| SPONTE OPERATING | 1 |

| SANCHEZ ENERGY | 1 |

| LEWIS PETRO PROPERTIES | 1 |

| INEOS USA OIL AND GAS LLC | 1 |

| STRAND ENERGY LC | 1 |

| EXXON MOBIL | 1 |

| SILVERBOW RESOURCES OPER | 1 |

| AGERON ENERGY | 1 |

| DOMINION EXPLORATION AND PRODUCTION | 1 |

| SPEEDWELL OIL AND GAS COMPANY | 1 |

| ESCONDIDO RESOURCES OPER | 1 |

| MAGNOLIA OIL AND GAS OPERATING | 1 |

| GULFTEX ENERGY III | 1 |

| PENN VIRGINIA OIL AND GAS | 1 |

| MANTI OPERATING COMPANY | 1 |

| CHAMPLIN PETROLEUM COMPANY | 1 |

| PETROHAWK OPERATING COMPANY | 1 |

As far as where the drilling is occurring, really in three main counties:

Caddo and De Soto Parishes in Louisiana and Panola County Texas – each have 6 or more rigs running right now. Several other counties have a few rigs running as well but this seems to be where most of the activity is centered.

We were curious to see how the recent uptick in natural gas prices has affected natural gas prices over the past year or so. Interestingly, the rig count is back to where it was prior to the COVID-19 pandemic. I imagine that a lot of this has to do with the increase in natural gas prices and the bullish outlook for this commodity over the next several years.

In closing, one of the most notable things about the Haynesville in looking at the names of the companies that are currently drilling, is how many smaller private companies are active in this gas play. When you look at a lot of the other major basins and plays that we’ve talked about there are a lot of larger publicly traded companies. There are definitely quite a few large public companies in the Haynesville as well but a lot of the public companies sold their Haynesville assets to private companies as we mentioned earlier.

Economic Risk

Economic risk refers to the risk associated with commodity prices going down in the future. One of the silver linings of the drop in drilling activity for crude oil is that there is less associated natural gas being produced. Associated gas is the natural gas that is produced as a by-product of crude oil in predominately oil plays. This has brought supply and demand for natural gas back into more of a balance and as a result, natural gas prices have been increasing steadily in 2020.

This, coupled with a stronger macro-economic outlook as the global economy recovers from the COVID-19 pandemic should bode well for natural gas prices.

Another benefit that the Haynesville Shale enjoys is the proximity to Liquefied Natural Gas (LNG) export terminals along the gulf coast of the United States. These LNG export terminals allow operators to choose to sell their gas domestically via the Henry Hub prices or to export the gas as LNG for sale to markets that will pay more than Henry Hub.

Political Risk

As far as political risk goes, Texas and Louisiana are relatively friendly to the oil and gas industry (certainly when compared to other states like California or Colorado).

In the big picture, the Environmental, Social, Governance (ESG) risk is relatively low in the Haynesville Shale. From a social standpoint, there is a high level of local employment in the oil & gas industry in this area and many residents are also mineral owners. A thriving natural gas industry means the local economy is likely to thrive as well.

Nationally, federal regulation of greenhouse gas emissions, climate change rhetoric, and a focus on the “green” energy transition is a headwind facing the entire industry. The resistance to fossil fuels is likely to grow as there is increased pressure to transition to a carbon neutral energy future. This is evidenced by recent laws passed in California that bans new natural gas appliances in new homes. (So much for freedom of choice, eh?)

Infrastructure

The Haynesville shale is ideally located with respect to the Henry Hub marketplace for natural gas with ample pipeline takeaway capacity to transport gas domestically or to nearby Liquefied Natural Gas (LNG) export terminals along the gulf coast. There aren’t really many negatives when it comes to the Haynesville Shale infrastructure.

Outlook for the Haynesville Shale

As long as the outlook for natural gas remains bullish, the Haynesville Shale should benefit. Hart Energy had an interesting outlook as to how natural gas prices might affect drilling in the Haynesville. Not surprisingly, they forecast that LNG exports would decline 20% if Henry Hub Natural Gas prices stay in the $1.80 to $1.90/mcf range through 2023. I don’t think that is likely but only time will tell.

I tend to agree with BP’s bullish outlook on the Haynesville Shale as mentioned in this article:

Thanks for Listening!

To share your thoughts:

- Leave a comment or question below (we read each one and your question may be featured in a future episode)!

- Ask a question or leave us feedback via email or voicemail: (720) 580-2088.

To help out the show:

- Subscribe and leave a review on Apple Podcasts or wherever you get your podcasts – we read each one and greatly appreciate it. Plus, you can get a shout out on a future episode!

Thanks again – until next time!