In this episode we provide an overview of the Eagle Ford Shale play in South Texas. Learn about the history, geology, operators, and risks related to owning minerals and royalties in this prolific oil and gas basin. Plus, we talk about some exciting developments where operators are also targeting additional formations like the Austin Chalk and Buda Limestone in certain areas.

This is the eighth episode in our series about the major producing oil and gas basins and plays in the US. Please let us know if you have any requests on a particular area that you would like us to cover. We covered the Permian Basin, DJ Basin, Uinta Basin, Powder River Basin, SCOOP/STACK/MERGE Plays , Haynesville Shale, and Williston Basin and Bakken Shale in previous episodes.

Using the embedded player above, you can download the episode to your computer or listen to it here!

Be sure to also subscribe on Apple Podcasts via the link above (or wherever you get your podcasts) and please leave us an honest rating and review. We read every one of them and sincerely appreciate any feedback you have. To ask us a question to be featured on an upcoming episode, please leave a comment below or send an email to feedback@mineralrightspodcast.com.

Let’s dive in to our overview of the Eagle Ford Shale.

Location

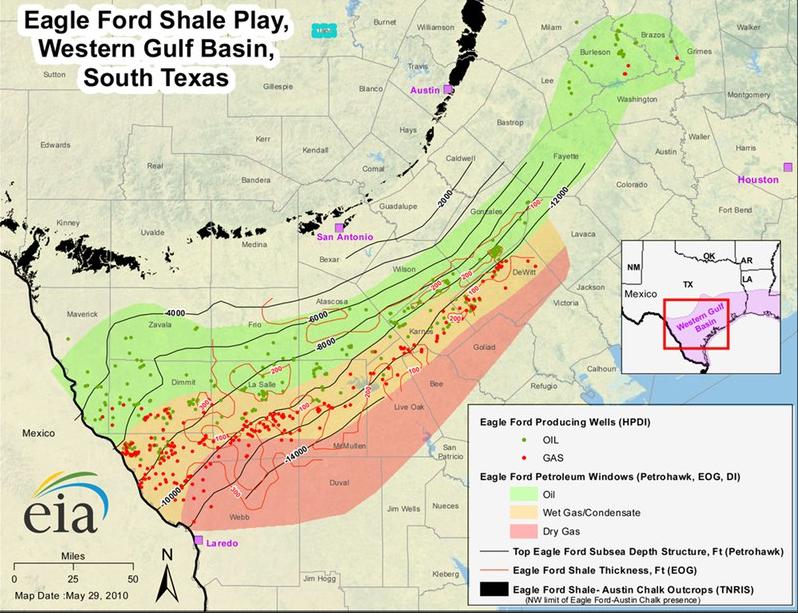

The Eagle Ford Shale is a hydrocarbon producing geologic formation that is one of the largest producers of oil and gas as compared to other shale plays. In fact, the Eagle Ford is somewhat unique in that certain parts of the formation produce primarily oil, other parts produce mostly gas and condensate (natural gas liquids), and other parts produce primarily natural gas. It is quite large, stretches across Texas all the way from the Mexican border to East Texas, some 400 miles long and 50 miles wide with an average thickness of 250 feet within the core parts of the play.

It contains a high carbonate shale percentage (up to 70% in South Texas) while it then becomes shallower and the shale content increases the further North and West you go. This unique property makes it more conducive to hydraulic fracturing and as a result, wells can have very large initial production rates.

Geology

It is Cretaceous in age resting between the Austin Chalk and the Buda Lime at a depth between 4,000 and 12,000 feet. It is the source rock for the Austin Chalk and the giant East Texas Field. The Austin Chalk is a conventional vertical play that has been around for quite some time. The shale is named for the town of Eagle Ford, Texas, approximately 6 miles west of Dallas, Texas, where it can be seen on the surface as clay soil. An outcrop of the Eagle Ford Shale can be seen near Dallas-Fort Worth.

The Eagle Ford Group (also called the Eagle Ford Shale) is “a sedimentary rock formation deposited during the Cenomanian and Turonian ages of the Late Cretaceous over much of the modern-day state of Texas. The Eagle Ford is predominantly composed of organic matter-rich fossiliferous marine shales and marls with interbedded thin limestones.”

This shale formation was deposited as part of a large inland sea that covered much of present-day Texas. The Eagle Ford is interesting because the geologic and structural features in the formation creates sweet spots for production. There are also areas with natural fracturing that can cause operational issues during drilling and completions and so operators may use seismic data to pinpoint these locations so they can avoid them.

Major Formations

The Eagle Ford play primarily refers to the Eagle Ford shale formation which is part of the Cretaceous period like we mentioned earlier but other formations have also been targeted by oil and gas companies. The Austin Chalk which overlays the Eagle Ford had previously been the target of conventional oil and gas drilling but now it is seen as a potential secondary objective in many areas with active drilling in the Eagle Ford, especially in the deeper areas in the South part of the play. On the other hand, the formations below the Eagle Ford like the Buda can be targeted in the shallower areas to the North where it is still productive. This makes the Eagle Ford similar to other stacked plays like we see in the Delaware Basin where companies can target multiple formations from a single well pad and this is starting to happen in the Eagle Ford and Austin Chalk formations in South Texas.

Further to the East, the Woodbine Sand is being targeted and sometimes the East Eagle Ford Play is referred to as the “Eagle Bine” play.

As far as well productivity is concerned, the average well has an Estimated Ultimate Recovery of around 864,000 BOE with 75% of that being liquids. The breakeven price as of 2018 was seen as $34/bbl so it is a very attractive play in areas with significant oil %.

Operators

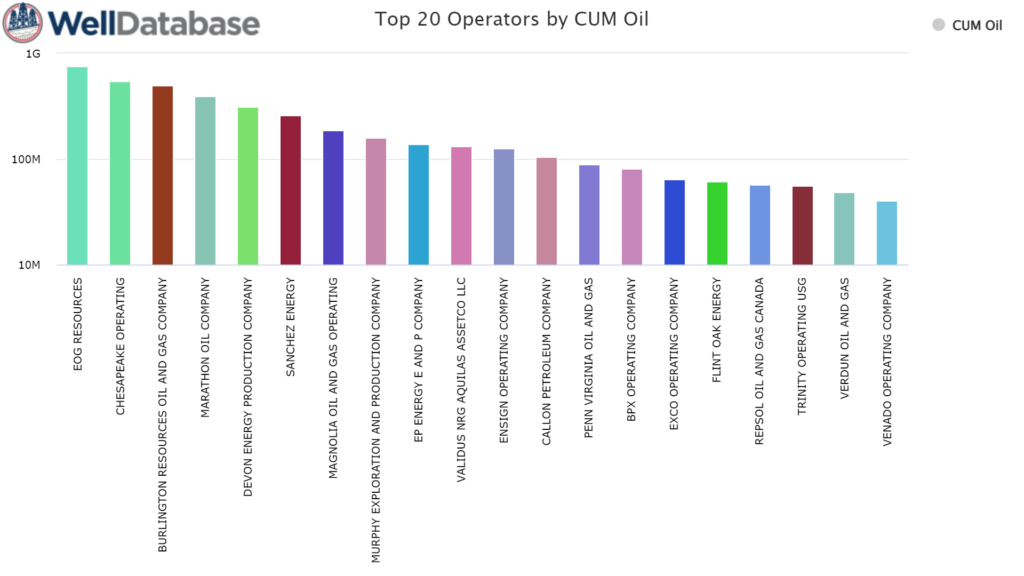

To take a look at the top operators by cumulative oil production, we went to WellDatabase (or you can view this information for free on the Texas Railroad Commission Website). As shown in the chart below,

The top 5 operators in terms of oil volumes in 2021 are:

- EOG Resources

- Burlington Resources (ConocoPhillips)

- Chesapeake

- Marathon Oil

- Callon Petroleum

Here is the full list of the top 20 operators by cumulative oil production according to WellDatabase. The relative ranking is slightly different than the Texas RRC list, possibly due to when the snapshot was taken and possibly the specific wells included:

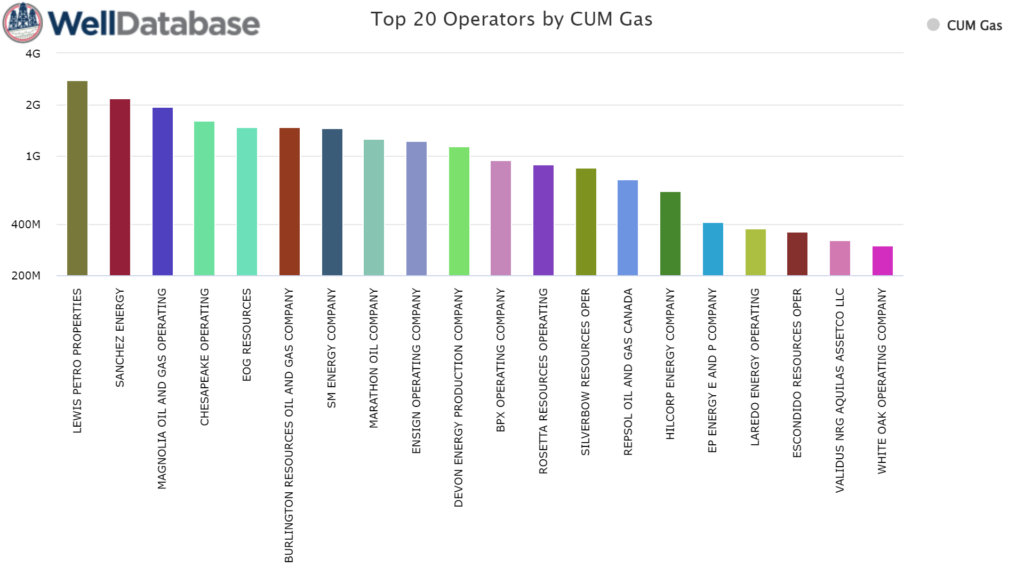

According to the Texas Railroad Commission, the top 5 operators in terms of gas volumes:

- Lewis Petro Properties

- SN EF Maverick

- Silverbow Resources

- BPX Operating Company

- SM Energy Company

Here is the full list of the top 20 operators by cumulative gas production according to WellDatabase. The relative ranking is slightly different than the Texas RRC list, possibly due to when the snapshot was taken and possibly the specific wells included:

Production

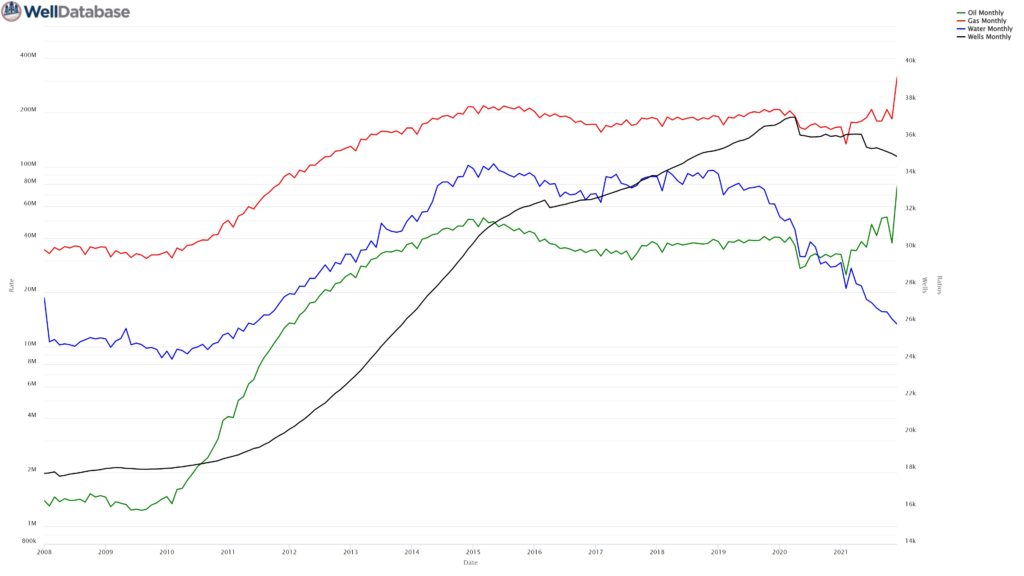

To illustrate just how prolific the Eagle Ford Shale Play is, here is the cumulative oil and natural gas production December 1, 2021 (data from WellDatabase.com):

- Cumulative Oil: 5,505,209,011 bbl

- Cumulative Gas: 32,091,845,417 mcf

- Cumulative Barrrels of Oil Equivalent (BOE): 10,853,849,914 boe

Despite the slowdown over the past few years, the Eagle Ford is still a major contributor to oil and natural gas production in the US as shown in the chart below which focuses on production rates from 2008 through 2021:

Activity levels

While the activity level in the Eagle Ford is down significantly from the peak in 2014 when operators permitted 5,613 wells, 2020 and 2021 saw 981 and 1066 new permits issued each year, respectively. 2022 is on track for similar permit numbers. The Eagle Ford remains an important shale play even more than 10 years into development. There is still plenty of undeveloped acreage and companies that have driven well and operating costs down see this as a premium play in terms of the return on investment.

The Eagle Ford remains one of the top 10 oil and gas plays in the United States in terms of the rig count with 56 rigs currently operating. This is up from 34 rigs in 2021 so it has seen a big increase on a percentage basis over last year (the rig count is up almost 65%).

Drilling down on the rig report for the Eagle Ford, the top counties where drilling is occurring is Webb County with 15 rigs, Karnes County with 13 rigs, Dimmit County with 5, and La Salle County with 5, the remaining 7 counties each have between 2 and 4 rigs operating. Most of that drilling (80+%) is occurring in the oil window of the Eagle Ford which is no surprise given $100 oil prices.

The Eagle Ford’s position as a top oil plays is also demonstrated by an estimated 3,246 million barrels of proved reserves as of 2020 which was down from 4,297 million barrels in 2019. Proved reserves are the oil and gas reserves that are classified as economic to develop at a given price so the drop in reserves doesn’t mean anything changed underground, just that the low oil prices that we saw in 2020 resulted in less oil and gas being economic to develop. These reserves numbers are from the EIA report as of early 2022 which features data through 2020. I expect we’ll see a large uptick in proved reserves in the next report due to the rebound in oil and gas prices. The exact number isn’t that important other than as a point of comparison as there are only two other unconventional basins that have larger oil reserves – the Permian Basin (Wolfcamp/Bone Spring plays) and Williston Basin (Bakken/Three Forks plays). Interestingly, the Eagle Ford has more rigs operating right now than the Williston Basin / Bakken which only has 33 currently vs 56. To put these in perspective, however, the Permian has 323 rigs turning.

https://shaleprofile.com/blog/eagle-ford/eagle-ford-update-through-august-2021/

Economic Risk

There is a lot to like about the Eagle Ford, if you are in the right areas. Operators with good acreage rightfully claim that this play competes head to head with other top shale plays. One of the biggest “risks” to wells getting drilled in the Eagle Ford is access to capital. If oil and gas prices stay elevated, I expect that Eagle Ford operators will reinvest cash into drilling new wells given the attractive economics in the core areas within the play. Especially in the areas that are prospective for both the Eagle Ford and Austin Chalk formations.

If you have interests in those areas it will be worth keeping an eye on what operators are doing in terms of drilling Austin Chalk wells in areas that might have been previously thought to be fully developed (at least in terms of the Eagle Ford). I’ve evaluated several properties in Wilson and Karnes County where operators are drilling Austin Chalk wells that are in some cases even better performing than their Eagle Ford counterparts.

Like in other plays, operators have also been optimizing well spacing and completions design all with a focus on higher asset value per drilling spacing unit and how much they can ultimately produce from that lease vs. focusing on higher initial production rates as they may have done in the past.

This is especially important since the horizontal Eagle Ford has been drilled since 2008 so you have 14 years of production in some cases draining the formation and coming in later to drill infill wells results in lower child well performance. What this means is if you own acreage with a well that was drilled several years ago and is holding your lease, even though you might have plenty of space to drill additional wells, it is likely that the operator would rather go to a completely undeveloped location to drill additional wells first because the well performance will be better and therefore the economics will also be better, all things being equal. That said, in the good parts of the play, there aren’t many virgin areas that haven’t already had some horizontal drilling activity on or nearby.

Political Risk

Because the Eagle Ford is in Texas, this is one of the areas with the lowest political risk in the US because that state is probably the most friendly states to oil and gas activity because such a big part of the economy is dependant on the industry. Like anywhere though, the ESG movement is putting pressure on the industry by influencing more restrictive regulations like decreasing the amount of natural gas that operators can flare and limiting approval of permits or pipelines. The good thing is there is not much federal land in the Eagle Ford where the federal government could stop activity unlike in other areas.

Infrastructure

The Eagle Ford does not have the takeaway capacity issues that we have seen in the Permian since it has already seen peak production from the area whereas the Permian is still growing. This is good for Eagle Ford operators as it means there is a smaller price differential compared to WTI oil prices or Henry Hub gas prices.

Interestingly, many of the pipelines under construction to transport Permian Basin oil and gas to refineries and NGL terminals go right through the Eagle Ford so they also can benefit from this midstream infrastructure development.

Outlook

The Eagle Ford still has a lot of potential with thousands of wells left to be drilled, especially at current oil prices. There are also future upside opportunities as we enter the energy transition. Carbon Capture and Sequestration could be interesting here and operators are testing innovative practices like EOG’s injection of produced gas into their wells as gas lift to increase oil production in times where there is an operational issue on the gas pipeline that would otherwise require that they shut-in production. By doing things like this, operators can eliminate methane emissions and flaring while also increasing oil production.

Other operators like ConocoPhillips are refracing early Eagle Ford wells with newer completion designs. They claim a 60% increase in resource from these refracs so this adds even more opportunity to increase production without having the full capital expenditure of having to drill a new well. It will be interesting to see if operators turn to these types of ideas to make the most of their limited capital to grow production to meet current demand.

Thanks for Listening!

To share your thoughts:

- Leave a comment or question below (we read each one and your question may be featured in a future episode)!

- Ask a question or leave us feedback via email or voicemail: (720) 580-2088.

To help out the show:

- Subscribe and leave a review on Apple Podcasts or wherever you get your podcasts – we read each one and greatly appreciate it. Plus, you can get a shout out on a future episode!

Thanks again – until next time!

Excellent overview !

Thanks Lynn!

Hi, Matt,

I was so thrilled to see that you were discussing the Eagle Ford Shale Formation on MRP 153 !! I am a native West Texan, born (1955) and grew up in Crane, Crane County, TX in the Permian Basin, where “oil and gas” was the principle economic activity. My parents did not work in the oil field, (teachers) but I absorbed some knowledge of the oil and gas business, just living there. Fast forward to 2012. I inherited mineral interests in Eagle Ford in Dimmit County, being operated by Chesapeake. (By the way, I am not 100% certain, but I believe it is pronounced like Ford Motor Company, not ferd as in waterford. Two separate words. Eagle. Ford. That is what I have always heard from Chesapeake personnel I have talked to. We Texans pronounce and drag out every vowel and consonant LOL)

Anyway, thanks for all the great information. I am so appreciative that you share your knowledge and expertise freely with those of us who are “accidental royalty owners” ! (I enjoyed listening to MRP 39. ) I am still struggling to verify my division orders and ownership percentages. Chesapeake laid off quite a few people, and it has been difficult to keep hounding them to get back to me with help. If you want to do another podcast of that aspect of ownership (verifying division orders) , it would be much appreciated!

Thanks again for all your great info!

Sincerely,

Jonna Craft

Jonna,

Thanks for your comment and for your suggestions. Verifying Division Orders is certainly a common challenge faced by royalty owners so we’ll be sure to do an update on this important topic! Regarding the pronunciation of Eagle Ford and having lived in Texas, I certainly can relate to what you are saying. Since I’ve been back in Colorado for more than 14 years I suppose I’ve adopted more of a Colorado accent (we do have a tendency to pronounce a’s and o’s as “ee’s”) so my apologies if we are mispronouncing it. When working for Shell I helped out the Eagle Ford team at the beginning and to be honest I don’t remember how we pronounced it back then!

Thanks,

Matt